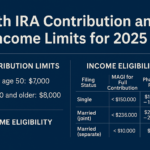

Roth IRAs 2025 Key Points For 2025, Roth IRA contribution limits are $7,000 for those under 50 and $8,000 for those 50 and older (includes a $1,000 catch-up contribution). Eligibility depends on income: singles can contribute fully with MAGI under $150,000, and married couples filing jointly under $236,000. Income phase-outs apply for partial contributions, with … [Read more...] about Roth IRA Contribution and Income Limits for 2025

Roth IRA

Maximizing Your 401k at 55 | Retirement Strategies for Growth

Maximizing Your 401k At 55 | Retirement Strategies For Growth | Maximizing Your 401k at 55 with Effective Retirement Strategies for Growth Key Takeaways Importance of a 401k at age 55 and its role in retirement planning Approaches to enhance your 401k at 55 for better outcomes Distribution of assets for retirement enhancement Tax considerations and advantages for … [Read more...] about Maximizing Your 401k at 55 | Retirement Strategies for Growth

Financial Focus: Is Roth IRA better for young workers? | Features

If you’re in the early stages of your career, you’re probably not thinking much about retirement. Nonetheless, it’s never too soon to start preparing for it, as time may be your most valuable asset. So, you may want to consider retirement savings vehicles, one of which is an IRA. Depending on your income, you might have the choice between a traditional IRA and a Roth IRA. Which … [Read more...] about Financial Focus: Is Roth IRA better for young workers? | Features

Read this, college athletes: What to do with your new NIL money

The NCAA will no longer prohibit its athletes from making money off their name, image and likeness (NIL), and some are already cashing in. For example, incoming Tennessee State freshman basketball player Hercy Miller signed a deal with web design and coding company Web Apps America for $2 million over four years. It has long been a problem that college athletes — in fact almost … [Read more...] about Read this, college athletes: What to do with your new NIL money

Episode 3: Then The Pandemic Happened

In the third episode of Fair Shares, a podcast from the Washington Post Creative Group and MassMutual about helping smart women plan a better financial future, host Bola Sokunbi — a financial education instructor and the CEO of Clever Girl Finance — joins a mother getting back on her feet while also prioritizing her family. Sokunbi talks with Asia, who was shaken emotionally … [Read more...] about Episode 3: Then The Pandemic Happened

Episode 1: Then I Was The Caregiver

In the first episode of Fair Shares, a podcast from the Washington Post Creative Group and MassMutual about helping smart women plan a better financial future, host Bola Sokunbi — a financial education instructor and the CEO of Clever Girl Finance — joins a mother trying to balance work, parenting and money. Sokunbi talks candidly with Ariana, who found out her son had special … [Read more...] about Episode 1: Then I Was The Caregiver

Episode 5: Then I Planned For The Future

In the fifth and final episode of Fair Shares, a podcast from the Washington Post Creative Group and MassMutual about helping smart women plan a better financial future, host Bola Sokunbi — a financial education instructor and the CEO of Clever Girl Finance — joins two business owners taking charge of their financial fates. Donna identifies as a self-made, lifelong … [Read more...] about Episode 5: Then I Planned For The Future

Understanding Annuities and Taxes: Mistakes People Make

When it comes to taxes, we all have to pay the piper. In this case, the piper is Uncle Sam. So, even though you’ve seemingly already paid your fair share, your taxes aren’t going to necessarily be any lower in retirement. And, this also applies to annuity owners.Annuity Taxation 101Annuities are taxed by the IRS based. And, the tax is almost entirely calculated on how they were … [Read more...] about Understanding Annuities and Taxes: Mistakes People Make

Are IRA Contributions Pre-Tax?

Pre Tax IRAThere are many ways to save for retirement, but one of the best is to get an individual retirement account (IRA). These are especially useful if you don’t have access to a workplace retirement account, like a 401(k) or 403(b). An IRA is essentially a shell into which you deposit and invest money for the purpose of growing your retirement savings. Workplace retirement … [Read more...] about Are IRA Contributions Pre-Tax?

Even if you aren’t working, you may be able to open an IRA. Here’s how

Westend61 | Westend61 | Getty ImagesIf you are not working and married, you may be leaving tax-deductible money on the table — money that could go towards your retirement savings.While you typically need to have income to open an individual retirement account, there is an exception for married spouses who file their taxes jointly. It's known as a spousal IRA, but it is simply a … [Read more...] about Even if you aren’t working, you may be able to open an IRA. Here’s how