Contributions to a Roth IRA can be made at any time, and after the account owner turns 59 ½ the earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if the employer's plan allows it. Can I use my Roth 401k to buy a house? Roth IRA Withdrawal Rules "As long as … [Read more...] about Can I withdraw Roth 401k anytime?

Roth 401k

How does a Roth 401k work?

Can I max out 401k and Roth 401k in same year? (Note: If you invest in both a Roth 401(k) and a traditional 401(k), the total amount of money you can contribute to both plans cannot exceed the annual maximum for your age, $19,500 or $26,000 for 2021. If you exceed it , the IRS could fine you a 6% overcontribution penalty.) Does the 401k contribution limit include a Roth … [Read more...] about How does a Roth 401k work?

Is a Roth 401k the same as a Roth IRA?

Can you have 2 Roth IRAs? Can you have more than one Roth IRA? You can have more than one Roth IRA and can open more than one Roth IRA at any time. There is no limit to the number of Roth IRA accounts. No matter how many Roth IRAs you have, your total contributions cannot exceed the limits set by the government. How Many Roth IRAs Can I Have? Although there is no limit to … [Read more...] about Is a Roth 401k the same as a Roth IRA?

Should I split 401k and Roth?

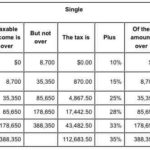

How much should I have in my 401k at 45? At 45: Save four times your salary. At 50: Save six times your salary. At 55: Saved seven times your salary. At 60: Eightfold salary saved. How much should you have in 401K times 46? According to Fidelity, this is how much Americans should save at any age: By age 30, you should have saved your salary. By 40 you should have saved … [Read more...] about Should I split 401k and Roth?

How much can I contribute to my Roth 401k?

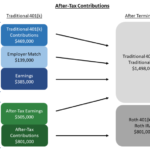

For 2022, workers under the age of 50 can defer up to $20,500 of their salary into their company's regular pre-tax or Roth (after-tax) 401(k) account. However, you can make additional after-tax contributions to your traditional 401(k), allowing you to save more than the $20,500 cap. Is there a salary limit to contribute to a Roth 401 K? There is no income limit for a Roth … [Read more...] about How much can I contribute to my Roth 401k?

Is it better to max out 401k or Roth IRA?

If your employer makes matching contributions, their payments will automatically stop when yours do. So, if you reach your $18,500 before the last paycheck of the year, your employer matching payments will stop before the end of the year and you may not get your full match. Which retirement account should I use first? Key Takeaways Managing cash flows and withdrawals in … [Read more...] about Is it better to max out 401k or Roth IRA?

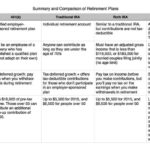

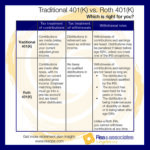

What is the main difference between a 401k and a Roth 401k?

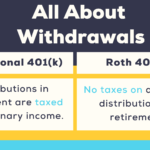

Can I withdraw Roth 401k anytime? Early withdrawals. If you've owned a Roth IRA for at least five years, you can withdraw contributions tax-free before age 59½ (but not earnings, in most cases you'll pay a 10% tax penalty). Can I withdraw my contributions from a Roth 401 K without penalty? Contributions to a Roth IRA can be withdrawn at any time, and after the account … [Read more...] about What is the main difference between a 401k and a Roth 401k?

Is Roth 401k better than 401k?

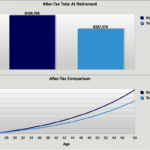

A Roth IRA is good for taxpayers who expect to be in a higher tax bracket during retirement. You can pay taxes today when your tax rate is low, then enjoy tax-free withdrawals when your tax rate is high in retirement. Should I split my 401k contribution between Roth and traditional? In most cases, your tax situation should dictate which type of 401(k) you should choose. … [Read more...] about Is Roth 401k better than 401k?

Roth 401k

What should you do with your 401k when you retire? In general, retirees with a 401(k) have the following options – leave your money in the plan until you reach the required minimum distribution (RMD) age, convert the account to an Individual Retirement Account (IRA), or start payouts through lump sum distributions, installment payments, or. .. What does the average person … [Read more...] about Roth 401k