Table Of Contents The Importance of Retirement Planning Types of Retirement Accounts Maximizing Your Retirement Savings: Expert Insights on IRAs and 401(k)s What is an IRA? What is a 401(k)? Strategies to Maximize Your Retirement Savings Contributing to Your IRA Employer Matching in 401(k) Plans Tips for Managing Your Retirement Savings … [Read more...] about Maximizing Your Retirement Savings: Expert Insights on IRAs and 401(k)s

Roth 401k

IRA vs 401(k): Key Differences to Help You Choose the Best Retirement Plan for 2024

Table Of Contents IRA vs 401(k): Key Differences to Help You Choose the Best Retirement Plan for 2024 | What is an IRA? What is a 401(k)? Key Differences Between IRA and 401(k) Contribution Limits in 2024 Tax Treatment and Benefits Pros and Cons of Each Retirement Plan Advantages of an IRA Advantages of a 401(k) Choosing the Right Option for Your … [Read more...] about IRA vs 401(k): Key Differences to Help You Choose the Best Retirement Plan for 2024

IRA vs 401(k) Retirement Planning: Making the Best Choice for Your Future

Navigating the world of retirement planning can often feel like trying to find your way through a dense forest without a map. However, understanding the difference between an IRA (Individual Retirement Account) and a 401(k) plan can be the compass that guides you to a secure and prosperous retirement. So, grab a seat, and let's demystify these options together in a way that's … [Read more...] about IRA vs 401(k) Retirement Planning: Making the Best Choice for Your Future

IRA vs 401

Understanding Individual Retirement Accounts The concept of an Individual Retirement Account (IRA) is but a singular type of tax-favorable vessel, crafted with the intention to aid individuals in their quest to amass savings for their twilight years. The methodology behind this fiscal strategy revolves around allocating a segment of one's earnings into said account, which … [Read more...] about IRA vs 401

Choosing Between IRA and 401(k): Making the Right Retirement Savings Decision

Understanding Individual Retirement Accounts (IRAs) In this section, we'll explore Individual Retirement Accounts (IRAs), a popular retirement savings option. We'll cover the different types of IRAs, contribution limits, tax benefits, and investment options. Understanding the features of IRAs is essential for making an informed decision when choosing between an IRA and a … [Read more...] about Choosing Between IRA and 401(k): Making the Right Retirement Savings Decision

Exploring the Tax Advantages of IRA and 401(k) Accounts

Understanding Individual Retirement Accounts (IRA) Tax Benefits Individual Retirement Accounts (IRAs) offer several tax advantages that can help individuals grow their retirement savings. In this section, we'll explore the tax benefits of IRAs, including tax-deferred growth, tax-deductible contributions, and tax-free withdrawals in retirement. Understanding these advantages is … [Read more...] about Exploring the Tax Advantages of IRA and 401(k) Accounts

Understanding the Differences Between IRAs and 401(k) Plans

What is an Individual Retirement Account (IRA)? An Individual Retirement Account (IRA) is a retirement savings account that offers individuals various tax advantages. In this section, we will explore the key features of IRAs, including eligibility criteria, contribution limits, and the types of IRAs available (traditional IRA and Roth IRA). Understanding the basics of IRAs is … [Read more...] about Understanding the Differences Between IRAs and 401(k) Plans

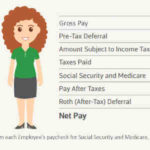

How much should I put in my 401k per paycheck?

For example, if a 50-year-old buys a $500,000 annuity with lifetime income and wants to retire in 10 years at age 60, that person would receive about $53,110 a year for the rest of their life. If you live for 30 years in retirement, you will receive $1.6 million in payments. How much savings does the average person have when they retire? On average, Americans have about … [Read more...] about How much should I put in my 401k per paycheck?

Who should use Roth 401k?

Who is a highly paid employee? The IRS defines a highly compensated employee as an employee who meets one of the following two criteria: An employee who received $130,000 or more in compensation from his or her 401(k) plan sponsor employer in 2021. In 2022, this limit will increase to $135,000. Should high earners use Roth 401k? Is there any other reason why a high income … [Read more...] about Who should use Roth 401k?

Is a Roth 401k a good idea?

Is Roth 401k better than Roth IRA? The Roth 401(k) has higher contribution limits and allows employers to make matching contributions. A Roth IRA allows your investments to grow over a longer period of time, offers more investment options, and makes early withdrawals easier. Why is a Roth 401k better? With a Roth 401(k), it's basically the other way around. You make your … [Read more...] about Is a Roth 401k a good idea?