Introducing Traditional IRAs and 401(k) Plans When it comes to retirement savings, two popular options are Traditional IRAs and 401(k) plans. In this section, we introduce both types of retirement accounts, explaining their features, benefits, and eligibility criteria. By understanding the basics, individuals can make informed decisions about which option suits their … [Read more...] about Traditional IRA vs 401(k): Understanding the Differences and Making Informed Retirement Choices

401K

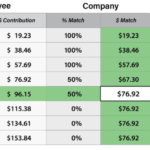

What is the max an employer can contribute to 401k?

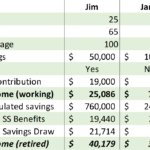

The maximum salary deferral amount you can contribute in 2019 to a 401 (k) is the less than 100% of salary or $ 19,000. However, some 401 (k) plans may limit your contributions to a lower amount, and in such cases, IRS rules may limit the contribution for highly paid employees. What does the IRS consider a highly compensated employee? For the previous year, he received … [Read more...] about What is the max an employer can contribute to 401k?

What happens if you go over 19500 to 401k?

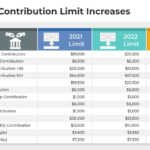

Does 401k Contribution stop at limit? For 2021, the maximum allowable 401(k) contribution is $19,500 per year (rising to $20,500 in 2022). If you've contributed too much to your 401(k) plan—that is, you've contributed more than the annual maximum set by the IRS—you should notify your employer or plan administrator immediately. Do 401k contributions automatically stop when … [Read more...] about What happens if you go over 19500 to 401k?

How much can I contribute to my 401k and Roth 401k in 2022?

You can split your annual elective deferrals between certain Roth contributions and traditional pre-tax contributions, but your combined contributions cannot exceed the deferral limit - $20,500 in 2022; $19,500 in 2021 ($27,000 in 2022; $26,000 in 2021 if eligible for catch-up contributions). What is a good 401K balance by age? AgeAverage 401k balanceMedian 401k … [Read more...] about How much can I contribute to my 401k and Roth 401k in 2022?

Can I max out 401k and IRA in same year?

Can I contribute to a Roth IRA if I have maxed out my 401k? Contribution Limits For example, if you max out your 401(k) plan, including employer contributions, you can still contribute the full amount to a Roth IRA without worrying about overcontribution penalties. Can I contribute to a Roth IRA if I reach the limit on my Roth 401k? Yes. You can contribute to both plans … [Read more...] about Can I max out 401k and IRA in same year?

Can I contribute 100% of my 2022 salary to my 401k?

What happens if I put too much in my 401k? If you go over your 401k contribution limit, you have to pay a 10% early withdrawal penalty, because you have to withdraw the money. The money will count as income, and those extra contributions will cost you at tax time. Can you put more than 19500 in your 401k? For 2020 and 2021, the IRS limits employee 401(k) contributions to … [Read more...] about Can I contribute 100% of my 2022 salary to my 401k?

How much can I contribute to my 401k and IRA in 2022?

How much of my paycheck should I put in 401k? Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401(k), but this may not be feasible for everyone. Plus, we often think of other ways to use that money now. How much should I put into my 401k per week? Save enough to provide enough income If you earn $400 per week, save 10 percent to … [Read more...] about How much can I contribute to my 401k and IRA in 2022?

401k 2022

What is the max retirement contribution for 2022? For 2021, your individual 401(k) contribution limit is $19,500, or $26,000 if you're 50 or older. In 2022, 401(k) contribution limits for individuals are $20,500, or $27,000 if you're 50 or older. These individual limits are cumulative for 401(k) plans. How much can a high-paid employee contribute to a 401k in 2022? 401(k) … [Read more...] about 401k 2022

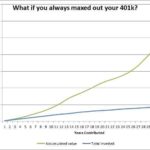

401k Tips 2021 — Things to Do to Your 401k If You Wanna Be Rich

For most of us, including the early 20s version of me, an introduction to retirement savings happens like this: You get your first big job, HR tells you that you’ll be enrolled in a 401(k) program, you say “Great!” and then…you never think about it again. (Okay, fine, you might, but probs not until you’re 35.)Honestly, I do get it—there are few terms less sexy than “retirement … [Read more...] about 401k Tips 2021 — Things to Do to Your 401k If You Wanna Be Rich

Dollars & Sense: Do 401k accounts really work? – KMPH Fox 26

Dollars & Sense: Do 401k accounts really work? KMPH Fox 26 … [Read more...] about Dollars & Sense: Do 401k accounts really work? – KMPH Fox 26