What is the max retirement contribution for 2022?

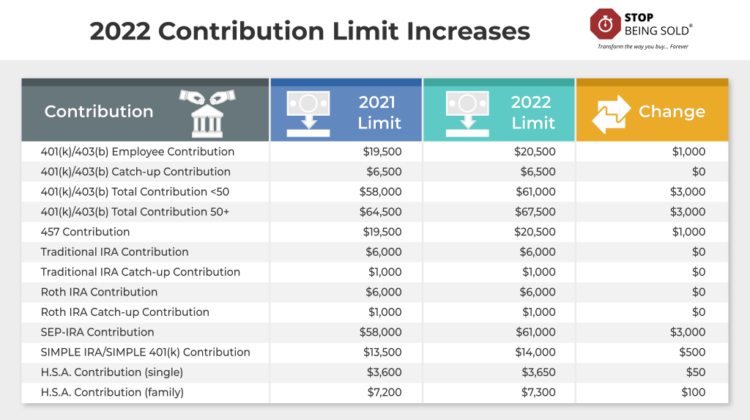

For 2021, your individual 401(k) contribution limit is $19,500, or $26,000 if you’re 50 or older. In 2022, 401(k) contribution limits for individuals are $20,500, or $27,000 if you’re 50 or older. These individual limits are cumulative for 401(k) plans.

How much can a high-paid employee contribute to a 401k in 2022? 401(k) Contribution Limits for High-Wage Employees For 2021, a single 401(k) participant can contribute up to $19,500. For 2022, a self-depositing 401(k) participant can make up to $20,500 in contributions.

How much can I contribute to my 401k and IRA in 2022?

The contribution limit for employees participating in a 401(k), 403(b), most 457 plans, and the federal savings plan increases to $20,500. Contribution limits for traditional and Roth IRAs remain unchanged at $6,000.

What is the max 401k contribution for 2022 over 50?

401(k) Plans The annual elective deferral limit for employee 401(k) plan contributions increases to $20,500 in 2022. Employees age 50 or older can contribute up to an additional $6,500 for a total of $27,000.

How much can I contribute to an IRA if I also have a 401k?

If you participate in an employer retirement plan, such as a 401(k), and your adjusted gross income (AGI) is equal to or less than the number in the first column for your tax filing status, you can make and deduct a traditional IRA contribution up to a maximum of $6,000 or $7,000 $ if you’re 50 or older, in…

What is the maximum 401k contribution for 2022 for over 55?

If you’re 50 or older, you can add an additional $6,500 per year in catch-up contributions, bringing your total 401(k) contributions to $27,000 for 2022.

Will 401k limits increase in 2022 over 50?

401(k) Plans The annual elective deferral limit for employee 401(k) plan contributions increases to $20,500 in 2022. Employees age 50 or older can contribute up to an additional $6,500 for a total of $27,000.

What is the maximum allowable 401k contribution for 2022?

401(k) Contribution Limits For 2022, these elective contributions are limited to $20,500. Workers age 50 and older can contribute an additional $6,500 in income contributions. Many employers also match employee pension contributions, either dollar for dollar or in part.

What is the average 401k balance for a 65 year old?

| age | The average 401(k) balance. | Median 401(k) balance |

|---|---|---|

| 65+ | $279,997 | 87,725 dollars |

How much should I have in my 401K at 67? By age 40, you should have three times your salary saved. By age 50, you should have six times your salary saved. By age 60, you should have eight times your salary saved. By age 67, you should have ten times your salary saved.

How much should a 65 year old have in retirement savings?

Because higher earners will receive a smaller portion of their Social Security income in retirement, they generally need more assets relative to their income. We estimated that most people looking to retire around age 65 should aim for assets totaling between seven and 13.5 times their pre-retirement gross income.

What does the average 65 year old have saved for retirement?

Those who had retirement accounts did not have enough money in them. According to our research, 56- to 61-year-olds have an average of $163,577. Those aged 65 to 74 have even less. If you turned that money into an annuity for life, it would only be a few hundred dollars a month.

How much does the average person have in a 401K when they retire?

Many workers in the U.S. retire when they reach age 65. Vanguard data shows that the average 401(k) balance at retirement is $255,151, while the median balance is $82,297.

How much should you have in 401k by 55?

Experts say that by age 55 you should be saving at least seven times your salary. This means that if you earn $55,000 a year, you should have at least $385,000 saved for retirement. Remember that life is unpredictable – economic factors, health care and life expectancy will also affect your retirement costs.

What is a good 401k balance at retirement?

If you earn $50,000 by age 30, you should have $50,000 in the bank for retirement. By age 40, you should have three times your annual salary. Until the age of 50, six times your salary; by the age of 60 eight times; and by the age of 67, 10 times. 8 If you are 67 years old and earn $75,000 a year, you should have $750,000 saved.

What happens if I put too much in my 401k?

If you go over the 401k contribution limit, you’ll have to pay a 10% early withdrawal penalty since you have to remove the funds. The funds will count as income, and those extra contributions will cost you at tax time.

Will my 401k automatically stop at the limit? If your employer pays matching contributions, their payments will automatically stop when yours does. So if you reach your $18,500 before your last paycheck of the year, your employer matching payments will stop before the end of the year and you may not receive the full amount.

How do I correct an excess 401k contribution?

Get a new W-2 and pay your taxes. The excess contribution returned will be added to your total taxable wages for the previous year, so an amended W-2 will be issued. Your tax bill will increase (or your refund will decrease) by the amount of the excess 401(k) contribution.

What happens if I accidentally contributed too much to my 401k?

Dealing With Excess 401(k) Contributions After Tax Day The bad news. You’ll end up paying tax twice on the amount over the limit if the excess 401(k) contributions aren’t returned to you by April 15th. You’ll be taxed first in the year you contributed too much and again in the year the correction occurs, Appleby says.

How do you fix excess deferrals?

Under Tax Procedure 2021-30, Appendix A, Section . 04 is a permitted method of correction to distribute excess deferral to the employee and report the amount as taxable in both the year of deferral and the year of distribution. These amounts are reported on Forms 1099-R.

Can you put more than 19500 in your 401k?

For 2020 and 2021, the IRS limits employee 401(k) contributions to $19,500. If you are 50 or older, you can contribute an additional $6,500 as a catch-up contribution. Excess contributions most often occur when a person contributes to more than one 401(k) plan per year.

Can you contribute more than 19500 to 401k with employer match?

Employer match does not count against the 401(k) limit For tax year 2022 (for which you will file in 2023), this limit is $20,500, which is $1,000 more than in 2021.

Can I save more than 19500 for retirement?

In 2021, 401(k) savers can contribute up to $19,500 pre-tax per person (or $26,000 for those age 50 or older). Those who contribute to a Roth or traditional IRA can contribute up to $6,000 (or $7,000 for those age 50 or older). If you want to save more than these limits, it is entirely possible.

Is there a maximum income limit for a traditional IRA?

There are no income limits for traditional IRAs1, but there are income limits for tax-deductible contributions. There are income limits for Roth IRAs. As a single filer, you can make a full Roth IRA contribution if your 2021 modified adjusted gross income is less than $125,000.

Can I contribute to a traditional IRA if I earn over 200k? Earned income is a requirement to contribute to a traditional IRA, and your annual IRA contributions cannot exceed the amount you earned that year. Otherwise, the annual contribution limit in 2022 is $6,000 ($7,000 if you’re 50 or older).

What are income limits for traditional IRA 2021?

For 2021 IRA contributions, the amount of income you can have and still get a full or partial deduction increases starting in 2020. Singles with a modified adjusted gross income of $66,000 or less and joint filers with income up to $105,000 can deduct their full contribution for the 2021 tax year.

Are there income limits for traditional IRA 2021?

Here are the traditional IRA phaseout ranges for 2021: $66,000 to $76,000 â Individual taxpayers covered by a workplace retirement plan. $105,000 to $125,000 â Married couples file jointly.

Who can contribute to a traditional IRA in 2021?

Traditional IRA Contribution Rules Earnings are a requirement to contribute to a traditional IRA, and your annual IRA contributions cannot exceed what you earned that year. Otherwise, the annual contribution limit in 2022 is $6,000 ($7,000 if you’re 50 or older).

What income is too high for IRA?

The IRS limits tax deductions for traditional IRA contributions to those individuals earning $69,000 or less and married couples earning $115,000 or less. Roth IRA contributions are limited to individuals earning less than $127,000 and married couples earning less than $188,000.

What happens if I contribute to a traditional IRA and my income is too high?

The IRS will charge you 6% tax on the excess for each year that you do not take action to correct the error. For example, if you contributed $1,000 more than you were allowed to, you would owe $60 each year until you correct the mistake.

Can you contribute to IRA with high-income?

If a high earner chooses to contribute to an IRA, the contribution cannot be rolled over to a Roth IRA. Instead, it must be designed for a traditional IRA. Let’s assume that in this case of earnings, the contribution is not tax-deductible. Once the funds are in the IRA, they will grow tax-deferred until withdrawal.

Can a high earner open a traditional IRA?

If a high earner chooses to contribute to an IRA, the contribution cannot be rolled over to a Roth IRA. Instead, it must be designed for a traditional IRA. Let’s assume that in this case of earnings, the contribution is not tax-deductible. Once the funds are in the IRA, they will grow tax-deferred until withdrawal.

Can I open a traditional IRA if my income is too high?

No, there is no maximum traditional IRA income limit. Anyone can contribute to a traditional IRA. While a Roth IRA has a strict income limit and those with earnings above it cannot contribute at all, a traditional IRA has no such rule. But that doesn’t mean your income isn’t important at all.

Who Cannot open a traditional IRA?

To open a traditional IRA and make contributions, you must not reach age 70½ by the end of the year. If you are older than that, you should not open a traditional IRA because you are prohibited from making deposits. This age limit also applies if you are still working and not retired.

Sources :