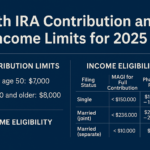

Roth IRAs 2025 Key Points For 2025, Roth IRA contribution limits are $7,000 for those under 50 and $8,000 for those 50 and older (includes a $1,000 catch-up contribution). Eligibility depends on income: singles can contribute fully with MAGI under $150,000, and married couples filing jointly under $236,000. Income phase-outs apply for partial contributions, with … [Read more...] about Roth IRA Contribution and Income Limits for 2025

Real Estate Syndication in Indianapolis: Unlocking Investment Potential

Real Estate Syndication in Indianapolis When it comes to building wealth through property investment, few strategies are as dynamic and accessible as real estate syndication. In Indianapolis, this approach has become a game-changer for both seasoned investors and newcomers. Whether you’re eyeing a lucrative multi-family property or a bustling commercial space, understanding … [Read more...] about Real Estate Syndication in Indianapolis: Unlocking Investment Potential

Best Retirement Investment Strategies: Navigating Your Golden Years

When it comes to retirement, the goal isn't just to save; it's to thrive. You've worked hard your entire life, and now it's time to ensure your golden years are as golden as they can be. As your financial advisor, I'm here to guide you through the best retirement investment strategies that will not only secure your future but also allow you to enjoy the fruits of your labor. … [Read more...] about Best Retirement Investment Strategies: Navigating Your Golden Years

IRA vs 401(k) Retirement Planning: Making the Best Choice for Your Future

Navigating the world of retirement planning can often feel like trying to find your way through a dense forest without a map. However, understanding the difference between an IRA (Individual Retirement Account) and a 401(k) plan can be the compass that guides you to a secure and prosperous retirement. So, grab a seat, and let's demystify these options together in a way that's … [Read more...] about IRA vs 401(k) Retirement Planning: Making the Best Choice for Your Future

Retirement Planning: Securing Your Financial Future

When it comes to securing your financial future, retirement planning is a term that often invokes a mix of emotions, from excitement about your golden years to anxiety about the unknown. It's about more than just saving money; it's about creating a comprehensive plan that ensures you can enjoy your retirement years without financial worry. Let's dive into the essentials of … [Read more...] about Retirement Planning: Securing Your Financial Future

IRA vs 401(k): Choosing the Right Retirement Plan

When it comes to planning for retirement, you've likely encountered two popular options: the Individual Retirement Account (IRA) and the 401(k) plan. Both offer valuable benefits for saving towards your golden years, but understanding their differences is crucial to making the best decision for your financial future. Let's break down the key aspects of IRAs and 401(k)s, … [Read more...] about IRA vs 401(k): Choosing the Right Retirement Plan

IRA vs 401

Understanding Individual Retirement Accounts The concept of an Individual Retirement Account (IRA) is but a singular type of tax-favorable vessel, crafted with the intention to aid individuals in their quest to amass savings for their twilight years. The methodology behind this fiscal strategy revolves around allocating a segment of one's earnings into said account, which … [Read more...] about IRA vs 401

The Roth IRA

A Roth IRA is a type of individual retirement account (IRA) that offers tax-free growth and tax-free withdrawals in retirement. Unlike a traditional IRA, contributions to a Roth IRA are not tax-deductible. However, all earnings and withdrawals are tax-free. Roth IRAs are named after Senator William Roth of Delaware, who was a key sponsor of the legislation that created them in … [Read more...] about The Roth IRA

Financial Focus: Is Roth IRA better for young workers? | Features

If you’re in the early stages of your career, you’re probably not thinking much about retirement. Nonetheless, it’s never too soon to start preparing for it, as time may be your most valuable asset. So, you may want to consider retirement savings vehicles, one of which is an IRA. Depending on your income, you might have the choice between a traditional IRA and a Roth IRA. Which … [Read more...] about Financial Focus: Is Roth IRA better for young workers? | Features

401k Tips 2021 — Things to Do to Your 401k If You Wanna Be Rich

For most of us, including the early 20s version of me, an introduction to retirement savings happens like this: You get your first big job, HR tells you that you’ll be enrolled in a 401(k) program, you say “Great!” and then…you never think about it again. (Okay, fine, you might, but probs not until you’re 35.)Honestly, I do get it—there are few terms less sexy than “retirement … [Read more...] about 401k Tips 2021 — Things to Do to Your 401k If You Wanna Be Rich