Editor’s Note: This article is a part of a series on investing advice for recent college graduates, drawing on expertise from financial professionals, university faculty and of course, InvestorPlace’s very own analysts and writers. Read more “Money Moves for Recent Grads” here and check out Top Grad Stocks 2021 for our best stocks to buy for new graduates.

Source: InvestorPlace unless otherwise noted

Odds are, someone has already pulled you aside to give you “the talk.” You know what I mean: “It’s time to start saving for retirement.”

The end of your career is probably the last thing on your mind, especially when it’s barely begun. But it’s never too early to start investing in yourself.

What Are Retirement Funds?

You can get an employee benefit through a 401(k) plan at work, putting that money toward tax-deferred investments.

Okay, let’s back it up. In plain English, that just means that you don’t have to pay as much income toward your taxes for that particular year. Let’s say you earn $55,000 in your first job and contribute $5,000 toward your workplace 401(k). You’d only pay taxes on $50,000, rather than the full $55,000 you earned.

Here are the three biggest things to know about retirement funds:

- Investment gains grow tax-deferred until you withdraw the money in retirement.

- Do you like free money? If so, take advantage of your employer’s match. Your employer may give you money for your retirement funds. However, it might take a number of years for you to become fully vested in your retirement plan. You can’t keep the funds your employer contributes if you leave your job before you become fully vested. You can keep your own contributions, however.

- Financial experts recommend contributing the absolute maximum you can manage for your retirement plan. You might have heard the term “max it out” at your employee orientation. Take it to heart.

I’m Poor… Why Should I Worry About This Now?

It’s as simple as this: the sooner you get started, the sooner you’ll finish. And you’ll more likely retire a millionaire if you get started early. But do you know the difference between investing and saving?

Grandma may have said, “Save your money, honey,” but she really should have said, “Invest like crazy!” So what’s the difference?

- Saving: Saving (stuffing your money under the mattress, or more commonly, into a savings account) doesn’t involve risk and comes with lower growth potential. Saving works well for short-term goals like a vacation, so you can easily access your money.

- Investing: Investing involves purchasing assets you expect to earn a profit from in the future. That could refer to putting your money in stocks or other types of investments that you believe will rise in value.

As you get out into the real world and begin paying more of your own bills, you might feel like you don’t have the money to spare for investing. That’s especially true for those of us staring down a mountain of student loan debt. But you still should focus on your financial future as soon as you can because of compounding.

The longer you let interest compound on your investments, the sooner you’ll become a millionaire. As University of Maryland Professor Elinda Kiss told InvestorPlace last year, “By saving early, you can save less in later years and still have more upon retirement.”

401(k) 101: Understanding the Basics

A 401(k) is an employer-sponsored retirement account. You can dedicate a portion of your pre-tax salary toward stocks, bonds, mutual funds and cash.

What you choose for your investments depends on your risk tolerance. In other words, are you okay with risking a large portion of your money? Or will you sleep better knowing your money is safe, even if it nets less profit overall.

- Setting up your 401(k). You choose a percentage you want taken out of each paycheck and also choose the investments you want — typically a combination of stocks, bonds and mutual funds.

- The plan administrator can help you choose the right retirement fund. Many graduates don’t know what to invest in, so they simply don’t invest. Don’t let that be a stumbling block for you!

- You can contribute up to $19,500 to your 401(k) in 2021. Does that seem like a lot of money? You may not be able to contribute that much in your first years of work. But a good rule of thumb is to contribute at least 10% to 15% of your income toward your retirement and ratchet that up incrementally every year thereafter. If you have a company match, contributing less than that match is akin to leaving money on the table.

Roth IRAs: Tax-Free Growth And Tax-Free Withdrawals

A Roth IRA serves as an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. In other words, a Roth IRA offers the best of both worlds. You already pay taxes on this money so can withdraw your money after age 59 ½ and you won’t have to pay any federal taxes. Note: You can also open a Roth 401(k), which offers you the option of tax-free withdrawals in retirement as well.

- You can leave the money in your account as long as you want, unlike with a 401(k) or IRA, which requires you to make withdrawals after age 70 ½ in most cases, you don’t have to make minimum distributions (RMDs) by a certain age. You can decide to finally withdraw from your Roth at 90 if you want!

- As long as you have earned income, you can put money in your account for as many years as you want. Even if you’re teetering into work on your cane at 90, you can put money in a Roth IRA.

- As long as you don’t exceed IRS income limits, you can still contribute the maximum annual amount to a Roth IRA. For the 2020 and 2021 tax years, the cap is $6,000 for Roth IRA investors under 50.

Why You Need to Stock Up On Stocks

As you probably know, a stock is a share of ownership in a company. When a company goes public, it sells its stock through an exchange like Nasdaq or the New York Stock Exchange. You can consider yourself an official shareholder as soon you own even just one share of a company stock.

Though stocks involve more risk than say, bonds, you’ll typically get higher returns for taking on that risk.

- Avoiding inflation. This is the primary reason people buy stocks. Over longer periods of time, your savings in a bank account will actually decline in purchasing power as inflation outpaces the interest rate on your saving account. Buying stocks allows investors to grow their money and outpace inflation over the long haul.

- Buy low, sell high. Not to be confused with the surprisingly popular strategy of buying high and selling low. When the value of a stock goes up, you can sell your shares for a profit. Investors who buy and hold stocks for the long term usually do the best in the stock market because the stock market rises over time and losses from bearish cycles are smoothed over. From 2011 through 2020, the average stock market return ticked up 13.9% annually for the S&P 500 Index.

- Don’t forget the dividends. Some stocks pay dividends. This just means that the company pays out a portion of the company’s earnings for every share of a dividend stock that you own, typically on a quarterly basis. In other words, you earn money just for holding shares. You can choose to pocket the dividend or reinvest it.

Making Sense and Dollars of Mutual Funds

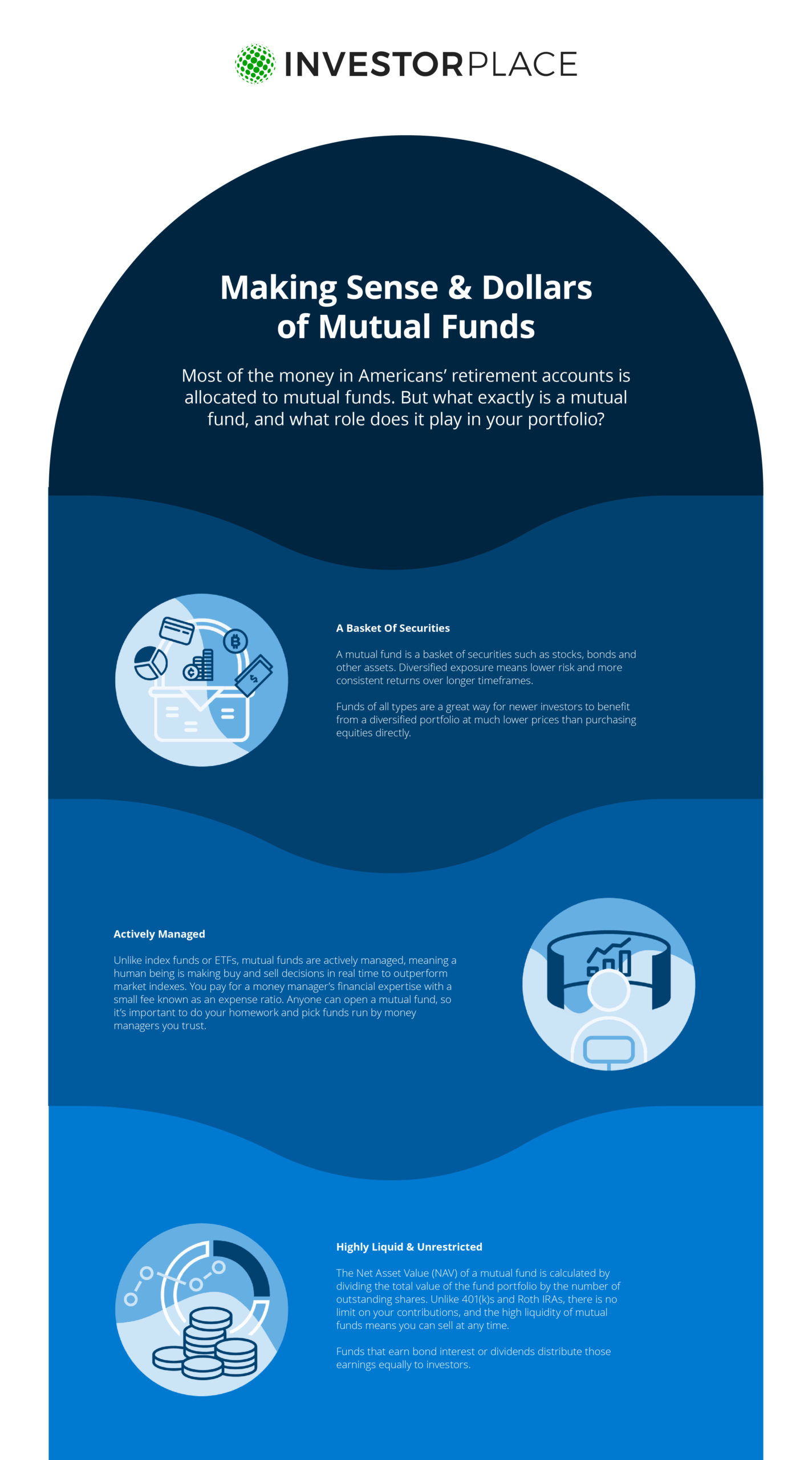

Source: InvestorPlace (Dreama Stafford/Vivian Medithi)

Think of mutual funds as bundles of stocks or as pools of investments, complete with a professional manager whose job is investing your money in stocks, bonds or other assets. You’ll pay an expense ratio for the privilege of investing in a mutual fund, which can get kind of pricey.

Mutual funds can seem like snoozers compared to the excitement of day trading stocks or cryptocurrency. But if you want guidance on your funds and really want to have someone watch over your money with you, a mutual fund offers a great solution.

- Risk is determined by the type of assets in the fund. If your mutual fund contains more stocks than bonds, for example, you face more risk in your portfolio. That’s usually a good thing when you’re young, FYI!

- Buy low, sell high. You can sell your mutual funds for a profit once you make more money than you originally invested. And unlike 401(k)s and Roth IRAs, which limit the amount you contribute, you can invest as much as you want in a mutual fund. Some funds earn stock dividends or bond interest; these earnings are distributed to investors.

- Anyone can open a mutual fund. So make sure to do your research and pick a money manager whose investing outlook aligns with your goals and risk-tolerance.

Balancing Risk-Reward Ratios With Bonds

When you buy a bond, you’re lending money to a company or government. The bond issuer pays you back later with interest. The government does this all the time, as do local municipalities (via municipal bonds) and other entities.

Bonds offer lower returns, but do come with the risk that the bond issuer could default on its payments.

- How bonds work. Bond issuers pay investors in regular installments until the total principal is paid off at the bond’s maturity date.

- Bonds are generally lower-risk. You may want to temper some of your high-risk stocks with bonds in your portfolio for diversification. When you invest in lots of different asset types at once, if one investment falters, you have others that will make money in its place.

- Uncle Sam has your back. U.S. government bonds are backed by the “full faith and credit” of the United States, so they’re the least risky type of bond.

Keeping Up With Cryptocurrency

Caught up in the cryptocurrency craze? Far from being the “newest” thing on the market, crypto has gone fully mainstream over recent months, helped by the tweets of Elon

You can choose from all sorts of altcoins when you want to invest in blockchain. But with more than 7,000 cryptocurrencies out there, how do you know which to buy? Keep these rules in mind, and don’t forget that cryptocurrencies are generally high-risk investments. If you’re uncomfortable with volatility, these might not be the assets for you.

- Don’t follow the crowd. Case in point: Dogecoin mania. If everyone you know is talking about a coin, it’s probably already overbought. You never want to buy something just because your college buddies have encouraged you to.

- FOMO has lost more money than caution. In fact, fear of missing out could get you involved in a scam pretty quickly, encouraging you to panic sell or buy “great deals” in tokens that tank. Make sure to do your research on absolutely anything you buy ahead of time.

- How to invest in crypto. You simply purchase coins or tokens using a trading platform. You may be surprised to note how similar a cryptocurrency broker is to traditional stock brokerage platforms.

Call It Quits And Retire Like a Champ

Okay, so now that we’ve presented all those options, you might feel more confused than ever.

In short:

- Get started with your employer’s 401(k) NOW. Run, don’t walk, to your human resources office at your new company. Note that some companies won’t let you open a retirement account on your first day; they want to know you’ll stick around for six months or so first. Never mind. Put the date on your calendar and open your account the first day you become eligible.

- Open a Roth IRA. They offer so much benefit, tax-wise.

- Cover your bases, but don’t stop there. You can do much, much more than the above — but only after you do the above. What feels right to you? Investing in stocks? Trying your hand at day trading or scalping (Yikes)? More conservative investing, like bonds? Take your risk appetite into consideration before you invest, and make sure to keep up with the news that affects your holdings.

No matter what, remember one thing: more risk generally equals more reward when you’re young.

Well, two things: always keep your portfolio diversified. Having a diversified portfolio keeps you from relying too much on any given company or asset class and seriously reduces the chance of losing money.