Here’s how changing a few numbers might spell big tax hikes.

getty

There are some significant tax increases proposed by the Biden Administration (and Congress as well). It’s incredible the way changing a number or two increases taxes dramatically, and also changes policy setting off a chain reaction of cascading outcomes. Caveat emptor: Draw your own conclusions about whether tax increases are good or evil. This discussion is focused only on possible outcomes.

Change an ‘8’ to a ‘1’ and Raise Over $1 trillion. One piece of the tax proposal is to raise the corporate income tax from 21% to 28% on ‘C’ corporations. At first blush this would seem to affect big companies, and it will. Estimates vary, but a tax increase to 28% will affect S&P 500 earnings negatively, possibly by as much as -6%. Lower profits mean investors will pay less for a stock.

Big companies with profits pay more taxes, but there are only about 3,671 publicly traded companies (in 2020) versus about 23 million private businesses. According to Ashley Wilson, chief tax lobbyist of the US Chamber of Commerce “Raising the corporate rate will cascade to almost all small businesses as well.” Part of the reason is the particular method by which businesses are taxed. A corporation is a separate legal entity and pays taxes as a taxpayer. This is the typical type of corporation, known as a ‘C’ corporation, named after the associated Internal Revenue Code subchapter. There are about 1.4 million small businesses (under 500 employees) that are C-corps. However, the vast majority (about 95 %) of American businesses are pass-through entities. Pass-through means that the profits and losses flow to the owner’s tax return. Pass-through entities include sole proprietors, Limited Liability Companies (LLCs), and Subchapter-S corporations (also named for an Internal Revenue Code subchapter). Do a quick survey on a drive and tally how many small businesses (LLC, PLLC, Inc.) you see. Most of them are pass-through, and virtually all would likely be affected by a tax increase.

The Tax Code needs to put both kinds of entities on parity, and therein lies the rub. If we tax C-corps at 28%, we need to allow pass-through owners to deduct 20% of their business income (called Qualified Business Income, or QBI). Otherwise, C-corps would have a lower tax rate. If we raise the corporate rate, the drafters of legislation would have to change the pass-through rules and lower the deduction. Hence, raising the corporate rate affects most small businesses.

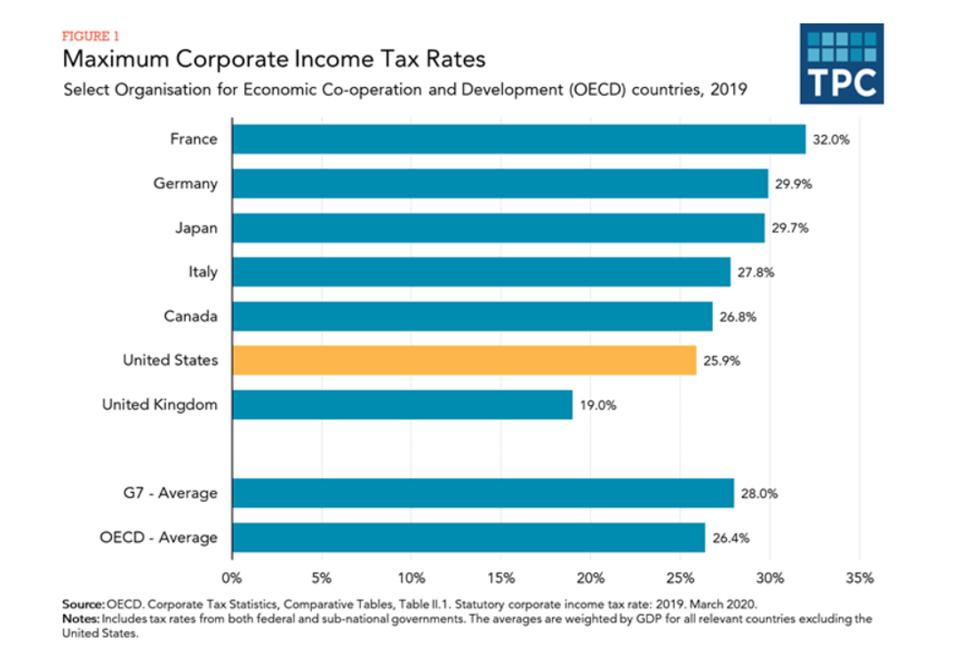

The third level effect relates to competition. Of the G7 developed nations, the US has the 2nd lowest corporate tax rate.

Here’s a comparison of maximum corporate tax rates in G7 countries.

OECD, Corporate Tax Statistics, Comparative Tables

If corporate rates increase to 28%, the U.S. moves up two spots to number four, on par with the current G7 average and higher than the average of the G20 (26.4%)

Change a ‘5’ to a ‘1’ and Upend Estate Planning. Of all the possible tax increases available, the easiest (and most obvious, probably) would be to change the expiration date of the Tax Cuts and Jobs Act (TCJA). The TCJA has multiple provisions that expire on 12/31/2025, due to the reconciliation process. Two notable pieces in the tax crosshairs are the maximum tax rate on ordinary income, going from 37% to 39.6% and the estate tax exclusion dropping from $11.7 million to $5.85 million. Change the expiration date to 12/31/21 and you raise taxes on high income and high asset families. The income tax increase is significant but not particularly consequential. The 37% rate starts at $523,601 for single and $628,301 for married, so it is hitting a rarefied group of taxpayers.

The estate tax change is more binary. If you tax $5.85 million dollars at 40% (45% is proposed), the family of the decedent would be on the hook for about $2.34 million. Married couples each get an exclusion, so they can pass $23.4 million now and $11.7 million after expiration. The issue presents itself for couples worth more than $11.7 million or single people worth more than $5.85 million, their heirs will pay more in taxes. $5.8 million sounds like a lot and depending on your point of view, it is. However, a single person in California might have a house worth $1.2 million (your basic CA starter home), a 401(k) or IRA worth $1 million, $1 million of investments and $1 million of life insurance. They have about $4.2 million, but if the assets grow by a modest 5%, in 20 years they’d be worth $9.2 million and a portion of the estate would be taxable. Also, there is the small matter of California death taxes. Estate planning attorneys and advisors are seeing a huge rush in planning moves ahead of the change. Wayne Roberts, co-chief tax counsel of the Bodman law firm in Michigan observes “The reduction in the exclusion will create many more taxable estates, and an increase in the tax rate to 45% will exacerbate the economic effect for those who do not engage in strategic planning early. Clients are well advised to monitor legislative action regularly and begin to revise estate plans now. Even a minor delay could have a materially negative impact.”

Bottom Line. Simple changes in tax law can have very big consequences. We don’t know what tax increases, if any, may actually be enacted. We should note that the U.S. took on trillions in debt during the pandemic. Somebody always pays for it, and the simplest way for the government to increase revenue is through taxes. The correlation is difficult to ignore.

As always, I’ll try to respond to e-mailed questions at llabrecque@sequoia-financial.com.