The ERISA consultants at the Retirement Learning Center Resource regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings plans. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with a financial advisor from Minnesota is representative of a common inquiry involving a taxpayer’s ability to make a deductible IRA contribution. The advisor asked:

“Active participation in an employer’s retirement plan can affect whether an IRA contribution made by the participant is deductible on the tax return. What does ‘active participation’ mean?”

Highlights of Discussion

This is an important tax question that can only be answered definitively by a person’s own tax advisor. Generally speaking, for purposes of the IRA deduction rules, an individual shall be an “active participant” for a taxable year if either the individual or the individual’s spouse actively participates during any part of the year in:[1]

- a qualified plan described in Code Section [IRC §401(a)], such as a defined benefit, profit sharing, 401(k) or stock bonus plan;

- a qualified annuity plan described in IRC §403(a);

- a simplified employee pension (SEP) plan under IRC §408(k);

- a savings incentive match plan for employees (SIMPLE) IRA under IRC §408(p);

- a governmental plan established for its employees by the federal, state or local government, or by an agency or instrumentality thereof (other than a plan described in IRC §457);

- an IRC §403(b) plan, either annuity or custodial account; or

- a trust created before June 25, 1959, as described in IRC §501(c)(18).

When an individual is considered active depends on the type of employer-sponsored plan.

- Profit Sharing or Stock Bonus Plan: During the participant’s taxable year, if he or she receives a contribution or forfeiture allocation, he or she is an active participant for the taxable year.

- Voluntary or Mandatory Employee Contributions: During the participant’s taxable year, if he or she makes voluntary or mandatory employee contributions to a plan, he or she is an active participant for the taxable year.

- Defined Benefit Plan: For the plan year ending with or within the individual’s taxable year, if an individual is not excluded under the eligibility provisions of the plan, he or she is an active participant for that taxable year.

- Money Purchase Pension Plan: For the plan year ending with or within the individual’s taxable year, if the plan must allocate an employer contribution to an individual’s account he or she is an active participant for the taxable year.

Refer to IRS Notice 87-16 for specific examples of active participation.

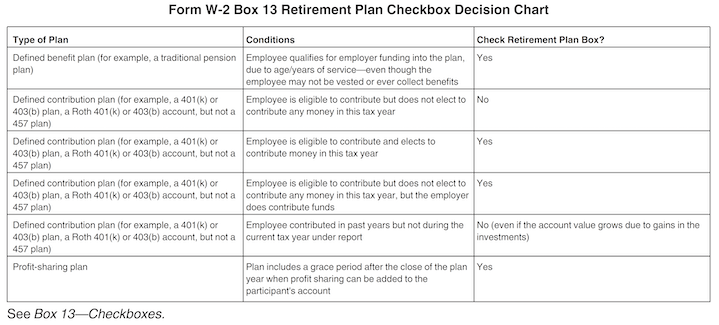

As a quick check, Box 13 on an individual’s IRS Form W-2 should contain a check in the “Retirement plan” box if the person is an active participant for the taxable year.

If an individual is an active participant, then the following applies for IRA contribution deductibility.

|

IF your filing |

AND your modified adjusted gross income (modified AGI) |

THEN you can take … |

|

single or |

$65,000 or less |

a full deduction |

|

more than $65,000 |

a partial deduction |

|

|

$75,000 or more |

no deduction |

|

|

married filing jointly or |

$104,000 or less |

a full deduction |

|

more than $104,000 |

a partial deduction |

|

|

$124,000 or more |

no deduction |

|

|

married filing separately2 |

less than $10,000 |

a partial deduction |

|

$10,000 or more |

no deduction |

|

|

Not covered by a plan, but married filing jointly with a spouse who is covered by a plan |

$196,000 or less |

a full deduction |

|

|

more than $196,000 |

a partial deduction |

|

Source: IRS 2020 IRA Deduction Limits

|

$206,000 or more |

no deduction |

|

*$66,000-$76,000 for 2021; **$105,000-$125,000 for 2021; and ***$198,000-$208,000 for 2021 |

||

Conclusion

Participating in certain employer-sponsored retirement plans can affect an individual’s ability to deduct a traditional IRA contribution on an individual’s tax return for the year. The IRS Form W-2 should indicate active participation in an employer-sponsored retirement plan. When in doubt, taxpayers should check with their employers.

Any information provided is for informational purposes only. It cannot be used for the purposes of avoiding penalties and taxes. Consumers should consult with their tax advisor or attorney regarding their specific situation.

©2021, Retirement Learning Center, LLC. Used with permission.