I’m what you might call a “Roth activist.”

Here’s what that means: I would love for you to open a Roth IRA account and invest as much as you can to maximize it.

Did you know that investing with a Roth IRA will enable you to keep more of your money, because it’s tax-advantaged? See, taxes are the number one wealth killers. Many people pay up to 30% of their income in taxes annually. That’s like giving up two hours of your eight-hour workday. That’s 10 hours a week, or five days a month. Two months a year.

So if you’re ever thinking of making an investment, make sure you’ve considered all tax-advantageous accounts available to you first. That begins with a Roth IRA.

You might even become a millionaire.

What’s a Roth IRA?

A Roth IRA is an investment account that’s free to open and lets you contribute up to $6,000 a year if you’re under 50, or $7,000 for those 50 and over. (Once you make over $124,000 for single households or $196,000 for those married filing jointly, you’re technically unable to contribute up to the maximum. Check out this link to see your maximum eligibility. But there’s a maneuver called the “back-door Roth” that will let you get around that.)

Basically, anyone who has earned income within a given year is eligible. That includes children under 18, which would mean opening a custodial Roth IRA. But certain sources of income don’t count, such as unemployment, alimony, child support and income from rental property. More information can be found directly on the IRS website.

Because you’re investing your income, which you’ve already paid taxes on, the dollars you invest in a Roth IRA—plus the thousands of dollars in earnings they will generate over time—grow completely tax-free, forever. That’s very different from a traditional 401(k) or a brokerage account, in which you must pay taxes on your investments when you withdraw them.

Simply put: in a Roth IRA account, what you see is what you get.

The How-To Plan

All right, hopefully by now you’re convinced to become a Roth Millionaire.

So let’s talk about capital deployment strategy. In plain English, this means how fast you can get your money into the market and get it working for you.

To give yourself the best chances of success, aim to make enough room in your budget to contribute the maximum amount you can each month. For those under the age of 50, that means you should aim to contribute $500 per month, or $6,000 a year. (You may want to build a small emergency fund before you get started, but it’s OK to invest in a Roth IRA even when you’re in debt.)

Next, you have two options: invest all your money at once (the “lump-sum” strategy) or divide it up into 12 monthly installments (the “dollar-cost averaging” strategy).

There’s a lot of debate about which is better. Based on my research, I typically recommend the lump-sum strategy. But during times of uncertainty—or if you simply don’t have a $6,000 lump sum available all at once—it’s totally fine to go for dollar-cost averaging. That means you’ll be depositing $500 every month to max out your Roth IRA.

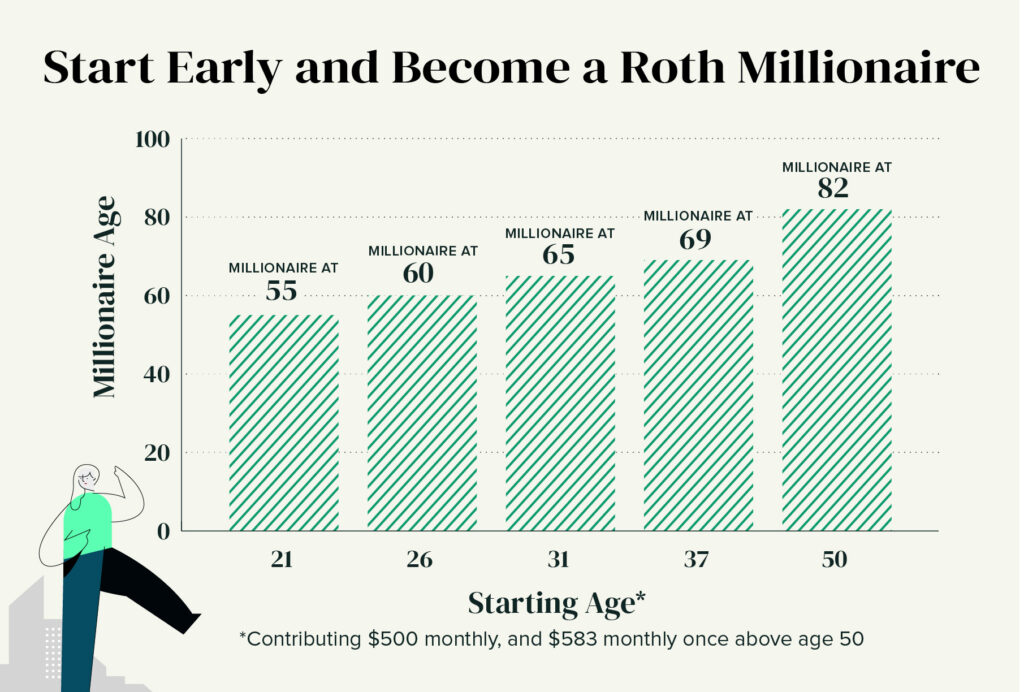

It takes decades of consistent investing to reach millionaire status in your Roth IRA. Here’s your guide:

As you can see in the chart, timing is everything.

For example, for those who start saving $500 a month in their 20s have a shot at becoming Roth IRA millionaires before they hit the age of 60. If you’re not able to start until your 30s, or unable to contribute the maximum amount each year, millionaire status will have to wait.

For the purposes of this chart, it assumes you begin making full contributions at the starting age and earn an average rate of return of 7%. Past performance is not an indicator of future success, but 7% is a commonly used baseline based on historical data.

Performance will vary depending on which assets you decide to invest in. Based on treasure troves of data, the best recommendation is to invest in index funds and ETFS, which are mutual funds that track a broad group of stocks, as they outperform fund managers over time. These estimates also do not include reinvesting dividends.

The Best Part

And guess what’s the best part? All of the growth and compound interest earned in your Roth accounts are 100% yours to keep. Meaning the tax system can’t come knocking on your door for it.

Another bonus: let’s say you end up having some life emergencies where you need to pay for medical bills or school, or some other sudden expense. You can use your Roth IRA. Unlike a 401(k), a Roth IRA allows you to withdraw your own contributions at any time, for any reason, without penalty. You’ll miss out on any further compound interest—and potentially derail your plan to becoming a millionaire—but the money will be there if you truly need it.

So please, as a Roth activist, I strongly recommend you open a Roth IRA and invest as much as you can afford to maximize it with assets or index funds that fit your comfort levels.

Hope the math convinces you.