Here we have another cautionary tale.

My friend, Micah Shilanski, from the great state of Alaska, shared with me a story that I’ve titled, “You’ll be a rich woman.”

Micah’s Story

Like me, Micah is a CERTIFIED FINANCIAL PLANNER™ practitioner. Micah is also an expert on the Federal Benefits System that government employees use. As you would imagine, the Federal Benefits System is complex.

Micah relayed a story to me about a widow who had come to see him for help after her spouse had passed away. Before he died, her husband had always told her that if he died before she did, “she would be a rich woman”. She assumed he had adequate life insurance when, in fact, he had very little. After he died, she found out that he only had $100,000 of life insurance. To him, that sounded like a lot of money. In their case, it was not close to being enough to keep her in a similar standard of living. To make matters worse, they had saved next to nothing for retirement.

She was in her early 50s when he passed away. Their joint income, which previously had them living comfortably, was now cut drastically, and as previously mentioned, retirement savings were severely underfunded. Micah and I both hate telling a widow that they do not have enough, and now they need to plan to work for probably much longer than regular retirement age. Unfortunately, it is a conversation we must have from time to time.

This same couple had made other critical mistakes in their planning (or lack thereof). The deceased spouse was a federal employee who had a Thrift Savings Plan or TSP—a government employee plan somewhat similar to 401(k).

After her husband passed away, but before seeing Micah, someone told her to transfer his TSP into her IRA. Because of IRA rules, we know well, this was a bad move. Until she reaches age 59½, she will no longer have penalty-free access to those funds.

Since her income had been reduced dramatically, this became a big problem. IRA planning wasn’t her only problem. She had a health insurance problem, too. Her husband was a federal employee, and she was working part-time in the private sector. She was not under his health insurance because one of her so-called “wise” co-workers said, “Why pay for Federal Employee Health Benefits (FEHB) when the private sector health insurance costs less per month?”

While her health insurance was cheaper per month, it stopped when she stopped working. With FEHB, if you meet specific requirements, you can keep FEHB even into retirement, which is one of the most valuable benefits that federal employees have. Because she didn’t understand how her husband’s benefits worked, she was not on his FEHB plan before he died and therefore lost out on an invaluable benefit.

Now, not only was she dealing with the incredible pain of the loss of her spouse, but she also had to downsize, go back to work full-time to make ends meet, and live with losing out on some of his best benefits that widowed spouses of a federal employee could have received.

These massive pain points could have been avoided if this couple had seen a competent professional.

Determining how much life insurance to buy is a simple task that any CERTIFIED FINANCIAL PLANNER™ practitioner can handle. However, knowing how to receive your deceased spouse’s IRA properly takes a little more advanced training. Knowing the ins and outs of the Federal Benefits System requires a specialist like Micah.

If you are a widow, a competent financial advisor is essential to help you navigate through these difficult times. While CPAs and attorneys are valuable advisors, they still need to be well-versed in the rules regarding IRAs. IRAs can be the black hole of estate planning. Just ask Charlotte Gee; the lack of good advice cost her a penalty of nearly $100,000.

IRAs are different from all other assets, and estate planning is different for IRAs.

Here are a few—among many—reasons:

- IRAs pass by contract law (generally not by will).

- Unlike other inherited assets, IRAs receive no step-up in basis.

- IRAs cannot be gifted or transferred during one’s lifetime.

- Exception: a direct gift to a charity (a Qualified Charitable Distribution, or QCD).

- Exception: a court-ordered transfer that is part of a divorce agreement.

- IRAs cannot be owned jointly, as other property can, even in community property states.

In summary, IRAs require their own estate plans, which must then be integrated within the overall estate plan that includes all other assets.

How to Find a Qualified Advisor

When looking for a qualified advisor, general credentials matter. At a minimum, your advisor should be a CERTIFIED FINANCIAL PLANNER™ or CFP®. The designation is a professional certification mark for financial planners conferred by the CERTIFIED FINANCIAL PLANNER™ Board of Standards (CFP® Board) in the United States. To receive authorization to use the designation, the candidate must meet education, examination, experience, and ethics requirements. The candidate must have a bachelor’s degree (or higher) or its equivalent in any discipline from an accredited college or university.

As a first step to the present CFP® certification criteria, students must master a curriculum of approximately 100 topics on financial planning. The curriculum taught must be the equivalent of 18 semester credit hours (e.g., six courses). The topics cover major planning areas such as:

- General principles of finance and financial planning

- Insurance planning

- Employee benefits planning

- Investment and securities planning

- State and federal income tax planning

- Estate tax, gift tax, and transfer tax planning

- Asset protection planning

- Retirement planning

- Estate planning

- Financial planning and consulting

The CFP® Designation

The CFP® designation is a base-line minimum. You want to know that your advisor has advanced knowledge on this subject, other designations such as the Retirement Management Advisor® (RMA®) and/or Retirement Income Certified Professional® (RICP®).

These designations demonstrate a focus on building customized retirement income plans to mitigate clients’ risks and to master retirement planning. The programs tap the nation’s top retirement planning experts to provide the best insights and trends on retirement income planning.

Designations are significant, but is your advisor staying up to date? Here are some questions you will want to ask:

- Do you have expertise in IRA distribution planning?

- What books have you read on the topic?

- What professional training have you taken on the subject of IRA distribution planning?

- How do you stay current on crucial IRA tax laws?

- What will happen to my IRA after I die?

- Who do you consult with when you have a very technical question regarding IRA distribution planning?

I had previously mentioned my affiliation with Ed Slott. Ed Slott and Company is the nation’s leading source of accurate, timely IRA expertise and analysis to financial advisors, institutions, consumers, and media across the country. (When I have a technical question, I call Ed Slott.)

As a member of Ed Slott’s Elite IRA Advisor Group, I train—along with other advisors—with Ed Slott and his team of IRA Experts continuously. These advisors have passed a background check, completed requisite training, attended semiannual workshops and webinars, and completed mandatory exams. They are immediately notified of changes to the tax code and updates on retirement planning.

Now, once you know your financial planner has met all the above requirements, there is one major question you will want to ask yourself:

“Do I like and trust this person?”

Remember, if your spouse has just passed away, this will be an unfathomably vulnerable time for you. The topic of IRAs may not feel like one you want to tackle at the moment, but it is one that could have an overwhelming impact on what resources you have to support you throughout the rest of your life. We hope this guide has been helpful in that process.

Determining How Much You Can Spend

Another area where a CERTIFIED FINANCIAL PLANNER™ practitioner can help is in determining how much you can spend in your new financial situation. It’s strongly recommended that you craft a budget. Bank statements and credit card statements (assuming you use them) will help you determine what you historically spend.

Lingering Expenses

Keep a close eye out for lingering expense accumulation from your deceased spouse: gym memberships, country club memberships, magazine subscriptions. It’s obviously wise to trim back what you can.

Most expenses can be controlled and, in any case, decreased. Income, however, is much more challenging to manage. Potentially, you could have several sources of income, and they may vary from month to month. We’ll touch on a few in a moment. Keep in mind, each of these corresponding categories could be a separate book unto themselves. We’ll just be scratching the surface.

Social Security

First off, countless books have been written on the subject of Social Security and Social Security claiming strategies. It is a vast topic. In this book, we only highlight the basics. As a widow, if you had been married for at least nine months before your spouse passed, you may be eligible for Social Security. This would be based on your deceased spouse’s record of earnings. As a widow, assuming you were married to a covered worker for at least nine months, you can claim Social Security at age 60 (age 50 if disabled).

If you do draw early, at 60, the benefit will be reduced. If you are eligible for Social Security based on your own work history, you may be eligible to switch to your own benefit at a later date. It may be a higher amount than your spouse’s. If you and your spouse were both receiving Social Security benefits at the time of his death, you would not continue to receive both benefits. You will only receive one benefit, the higher of the two.

Annuity and Pension Payments

These payments may continue, possibly at a decreased rate. Most likely, when the payout commenced, an irrevocable decision was made to determine if payments would be based on joint life or single life. If the decision were joint life, survivor payments would continue. If single life, payments will stop. Joint life payments can be 50% to 100% (or somewhere in between).

Example:

Let’s assume Jim and Kelly had a 66% joint and survivor payment of $1,000 a month. When Jim dies, the payment will decrease to 66% of the original amount, or $660.

Let’s assume Jim also had a single-life annuity with a $500-a-month payment from the ABC Insurance Company. When Jim dies, that payment will stop.

Rent and Dividend Income

Assuming assets were jointly held, you will continue to receive this income.

Other Income

There may be other income sources that are not as common (business ownership, payout of a business sale, structured settlements, etc.). These will most likely continue.

IRAs

IRAs are often referred to as a deferred savings plan. However, my friend and fellow advisor, Jim Saulnier from Colorado, often refers to IRAs as “deferred spending plans.” He contends that you need to learn how to spend your money from an IRA. People spend a lifetime saving but knowing how to spend wisely is just as vital.

Portfolio Withdrawals and Safe Withdrawal Rates

An entire book could be written on Safe Withdrawal Rate (SWR) strategies.

The SWR is a rate at which you can withdraw from your portfolio every year without cutting into your investment principal. That gives you a high probability of never running out of money. Put another way, an SWR has a high probability of leaving more than the original starting principal.

Both academia and the financial services industry are actively researching the subject of SWR. The baby-boom generation is really the first to retire with IRAs and defined contribution retirement plans such as 401(k)s. We anticipate evolving strategies concerning retirement decisions and SWRs.

The 4-Percent Rule

The SWR of 4% per year (inflation-adjusted) is a “rule of thumb” rate that is most often quoted and is commonly referred to as “the 4-percent rule.” You would withdraw 4% of available funds in the first year the rule is implemented. The following year you would withdraw the same dollar amount, adjusted for inflation, and do the same each year after that.

How the 4-Percent Rule Was Created

The 4-percent rule was created using historical data on stock and bond returns over the 50 years from 1926 to 1976. A financial advisor named William Bengen conducted an exhaustive study of historical returns in the early 1990s, focusing heavily on the severe market downturns of the 1930s and early 1970s.

Bengen concluded that, even during shaky markets, no historical case existed in which a 4% annual withdrawal exhausted a retirement portfolio in less than 33 years.

Example:

As the name implies, you would withdraw 4% of your available funds in year one. If you have $500,000, the first year, you will withdraw $20,000 ($500,000 x 0.04). The next year you will withdraw the same amount ($20,000) but adjusted for inflation. If inflation is 3%, you will withdraw $20,600 ($20,000 x 1.03). Depending on what the market has done to your portfolio in that period, $20,600 might be more than 4% of your remaining funds.

Working with a CERTIFIED FINANCIAL PLANNER™ Practitioner.

First, you would determine if 4% is the right factor. If younger, a percentage of less than 4% should be considered. Also, the composition of your portfolio (stocks, bonds, taxable vs. non-taxable accounts, etc.) needs to be examined. The goal is for the SWR to protect your assets so you don’t run out of money.

Note:

The 4-percent rule has come under attack because of the historically low-interest rate environment in which capital markets have existed. Other “refined” 4-percent-rule-like methods may be more appropriate.

The RMD-Based rule

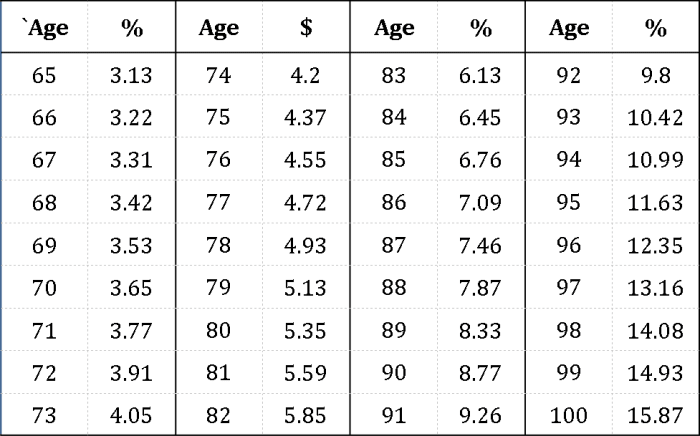

Another SWR strategy has been developed by researchers at Boston College’s Center for Retirement Research. Withdrawals are based on the Required Minimum Distribution (RMD) tables published each year by the IRS, based on life expectancy. The balance of your funds is multiplied by the percentage related to your age each year. The percentages are shown in the table on the following page (below).

Following our earlier example:

Using the RMD-table method, if you have $500,000 at age 65, in year one, you will withdraw $15,650 ($500,000 x 0.0313). The next year, you will multiply the remaining balance of your funds by the factor alongside your age that year. The percentage rises each year since you have a lower life expectancy left. (At age 65, it’s 3.13%. At age 66, it’s 3.22%. By age 95, it’s 11.63%.)

The best part of a strategy like this is that it is simple and easy to implement. This strategy also allows you to withdraw more money each year as your life expectancy decreases, which is beneficial because healthcare costs may rise as you age.

What is the main downside?

Lower income when you are younger and when you might need more money. Most retirees spend more in the early years (on travel and such) when they are healthy. Retirement spending is usually higher when you first retire, then tapers with age. Depending on your spending, this may or may not be a workable withdrawal strategy.

Monitoring Your Withdrawals

Neither SWR strategy is a “set and done” solution. You will want to take a new look at the situation each year for two reasons:

- Extreme market behavior may call for a realignment of the composition of your assets to avoid future problems in your drawdown strategy.

- Based on overall income each year, you may want to strategize which accounts (taxable, tax-deferred, or tax-free) to tap first to minimize taxes.

The first situation calls for a review with your financial planner to be sure you are still on track for the long term.

For the second situation, to minimize taxes, as mentioned in the previous section of this book, one strategy is to withdraw enough from your tax-deferred accounts to “fill up your tax bracket.” Say your income of $24,000 puts you in the 12% tax bracket. (For 2020, this bracket goes up to $40,125 for single filers; above this, you move into the 22% tax bracket.) You would take no more than $16,125 more out of taxable accounts.

With this strategy, your ordinary income stays within the 12% bracket. This strategy will work in higher tax brackets as well.

If you need more income, you will look to non-taxable or low-taxed sources of cash. These might be a Roth IRA, a money market or savings account, or the sale of taxable investments where the market value is lower than their cost basis.

Another Tax-Reducing Strategy

Another strategy may be to convert traditional IRAs to Roth IRAs if you have some lower-income years. By doing so before age 72 (when you would have to start taking RMDs), you could reduce the level of future RMDs. Roth conversions have the added benefit of giving you a way to pass money to your heirs tax-free.

Conferring with your CERTIFIED FINANCIAL PLANNER™ practitioner will tell you if this strategy makes sense, as it depends on your level of taxable income in a given year, along with other factors.

As previously mentioned, an entire book could be written on Safe Withdrawal Rate strategies. Keep in mind that the massive baby-boom generation is the first group to retire with IRAs and defined contribution plans. Previous generations received old-fashioned pensions (for example, 80% of your pay for the rest of your life).

SWRs are a relatively new concept and, as mentioned, are being researched by academia and industry. They are looking for optimal strategies. The bottom line, you should have a plan, as well as the criterion that guides your distributions

One Last Tax-Reducing Strategy

Like most of us, Maria despised paying taxes. She always made significant charitable contributions to her alma mater and her church. When the Tax Cuts and Jobs Act of 2017 doubled the size of the standard deduction, Maria no longer had to itemize, and instead, took the standard deduction. Unbeknownst to Maria, she lost the possibility of getting her charitable deduction directly. Maria was livid and decided to get some professional help.

With help from her newly hired CERTIFIED FINANCIAL PLANNER® professional, Maria learned about Qualified Charitable Distributions (QCDs). QCDs are available only to taxpayers over age 70½. (While the SECURE Act changed most trigger dates to age 72, they left QCDs at 70½.) How do QCDs work? They allow for a direct transfer from an IRA to a qualified charity. Because the funds come directly from the IRA, the income is not recognized for tax purposes.

Maria was now ecstatic.

While she could not get the charitable deduction because she no longer itemized, she now had the opportunity to still lower her income for tax purposes.

Wrapping Up

We have gone through a lot of content in this book, all of which somehow affects the finances of a surviving spouse.

As we have seen, spousal beneficiaries enjoy different rules!

Here’s a big-picture recap on IRAs:

- A spouse beneficiary can move an IRA that she inherited to an IRA in her name or combine it with an IRA she already owns.

- A spouse beneficiary can establish an inherited IRA from the IRA she inherited. If she does, she has no RMD requirement until the deceased account owner would have reached age 72.

A younger spouse (below age 59½) who inherits an IRA should consider establishing the IRA as an inherited IRA. As a beneficiary of that inherited IRA, she can take distributions at any time, in any amount, without being subjected to the 10% early-distribution penalty.

Once the spouse reaches age 59½, when the 10% penalty disappears, the inherited IRA should be moved to an IRA in her name. IRAs are often built up over many years and represent a lot of effort and good intentions.

It makes no sense to allow any missteps to eat away at funds, which can be so crucial to the well-being of the spouse who is left behind. It is our hope that having read this book, you have gained a level of comfort with the ideas we have shared and feel secure that you can have a financial future that will bring you peace of mind.

The above article originally appeared as a chapter in Inheriting Your Spouse’s IRA and is reprinted with permission from the author Bill Harris, RMA®, CFP®. No parts of this article may be reproduced without correct attribution to the author of this book.

You can find the full book here.