MEMPHIS, Tenn. — Starting next month, about 36 million American families will start receiving monthly checks from the IRS.

It’s part of the expanded Child Tax Credit. WREG-TV talked with several tax experts about how you should spend the money, and why it could create headaches for some families.

If you’re a parent, but somehow didn’t get the memo, Monday is the Biden-Harris Administration has selected as Child Tax Credit Awareness day

But what exactly is the child tax credit? Tawni Rayman is a Certified Public Account in Southaven, and she gave insight as to what the credit is and the best way to spend the money.

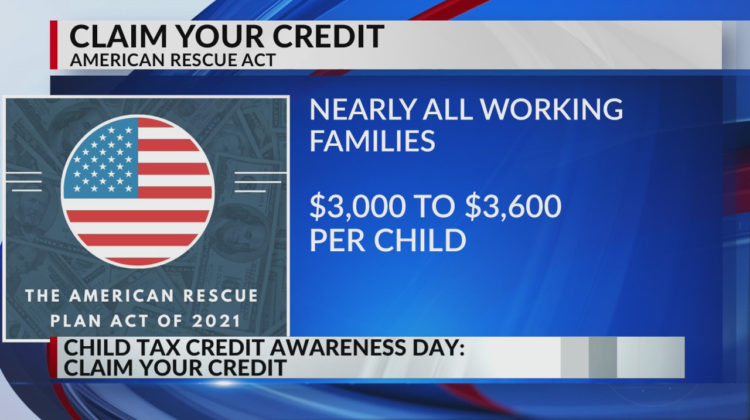

“It’s a new thing that the IRS has been working on and rolling out as part of the American Rescue Plan Act of 2021,” said Rayman of Griffith CPA in Southaven.

It means families making less than $150,000 a year would get $300 per month for each child, zero to five years old and $250 for each kid between six and 17 years old, and nearly all working families will receive $3,000 to $3,600 per child credit.

“They are also making it available for taxpayers to get some of that child tax credit for the rest of the year in monthly payments for 2021 tax year, this year and starting like next month,” said Rayman.

The goal is to lift more than five million children and their families out of poverty this year.

“A lot of parents will be using it for childcare, so they can go back to work. Others it’ll help with the car insurance for their teenagers, groceries, or gas,” said Rayman.

Some financial experts like, Miles Mason who is a certified public accountant and a divorce attorney in Memphis, say plan for the future.

“Don’t spend it. Start a 529 college account with the money, or if you already got one, start a Roth IRA,” Mason said.

Mason also says the tax credit could create challenges for divorced couples.

“And there is a divorce, it could easily go to the custodial parent who claimed the children in the prior year, and everything gets messy if both parents claim the children,” Mason said.

Mason added, “Don’t spend the money, talk to your tax advisor, be smart because you may have to owe the money back.”

The enhanced Child Tax Credit and the stimulus checks are only available to eligible lower and middle class families and families can always opt out of the plan.

The IRS will deposit the payments directly into bank accounts.