Roth IRAs 2025 Key Points

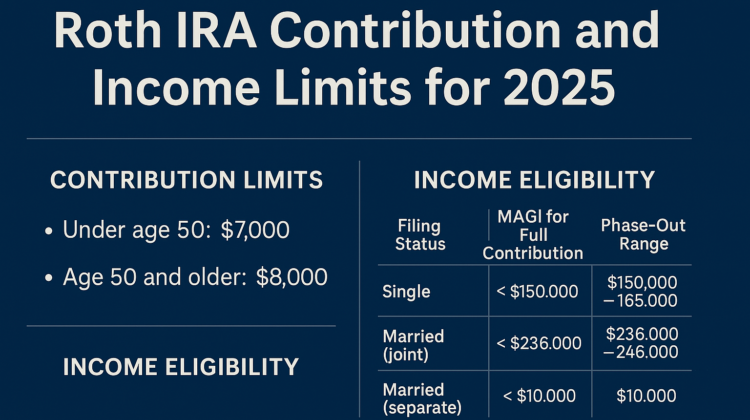

- For 2025, Roth IRA contribution limits are $7,000 for those under 50 and $8,000 for those 50 and older (includes a $1,000 catch-up contribution).

- Eligibility depends on income: singles can contribute fully with MAGI under $150,000, and married couples filing jointly under $236,000.

- Income phase-outs apply for partial contributions, with limits varying by filing status.

Contribution Limits

Contribution Limits for 2025

The Roth IRA allows contributions of up to $7,000 for individuals under 50 in 2025, with an additional $1,000 catch-up contribution for those 50 and older, totaling $8,000. These limits remain unchanged from 2024, as confirmed by recent IRS announcements.

This stability reflects the IRS’s approach to maintaining predictability in retirement planning. The deadline to make contributions for the 2025 tax year is April 15, 2026, aligning with the tax filing deadline.

Income Eligibility

Income Limits and Eligibility

Eligibility to contribute to a Roth IRA in 2025 is determined by your Modified Adjusted Gross Income (MAGI) and tax filing status. Here’s a breakdown:

| Filing Status | MAGI for Full Contribution | MAGI Phase-Out Range | MAGI for No Contribution |

|---|---|---|---|

| Single individuals | < $150,000 | $150,000–$165,000 | ≥ $165,000 |

| Married (filing jointly) | < $236,000 | $236,000–$246,000 | ≥ $246,000 |

| Married (filing separately) | < $10,000 | $0–$10,000 | ≥ $10,000 |

For example, a single filer with a MAGI of $155,000 can still contribute partially, with the amount prorated based on their income within the phase-out range. Tools like Fidelity’s IRA calculator can help estimate the allowed contribution.

Recent Changes to Limits

These income limits increased slightly from 2024, reflecting cost-of-living adjustments:

- Singles: from $146,000 → $150,000

- Joint filers: from $230,000 → $236,000

Unexpected Detail: Phase-Out Ranges

Partial contributions are allowed within the phase-out ranges:

- Single filers: $150,000–$165,000

- Married filing jointly: $236,000–$246,000

- Married filing separately: Partial contributions only if MAGI is below $10,000

These ranges provide flexibility for middle-to-higher earners and are an important planning tool for maximizing retirement savings.

Additional Considerations

Calculation of MAGI

MAGI is generally your Adjusted Gross Income (AGI) with certain deductions added back (e.g., IRA contributions, student loan interest). For accurate calculation, refer to IRS Publication 550 Worksheet 2-1.

SECURE 2.0 and Other Policy Notes

While Roth IRA limits remain unchanged, other retirement plan policies (like 401(k)s) may be impacted by SECURE 2.0 changes. Roth IRAs, however, continue to offer tax-free growth and withdrawals, making them an appealing option for eligible individuals.

Historical Context and Trends

According to Fidelity’s Q2 2023 Retirement Analysis, Roth IRAs have grown in popularity due to:

- Tax-free growth

- No required minimum distributions (RMDs)

- Greater flexibility than traditional IRAs

The 2025 income threshold adjustments aim to balance accessibility with contribution restrictions for high earners.

Practical Implications

Planning Tools and Resources

Resources like NerdWallet’s guide and Fidelity’s calculator can assist individuals in determining their contribution eligibility and amount.

Because Roth IRAs use after-tax dollars, there’s no immediate tax deduction—but the long-term benefit is tax-free income, which can significantly grow over time.

Key Citations

- IRS – IRA Contribution Limits

- IRS – 401(k) and IRA Limits for 2025

- Fidelity – Roth IRA Income Limits

- CNBC – 2025 Roth IRA Income Limits

- Vanguard – Roth IRA Income Limits 2025

- NerdWallet – Contribution Limits 2024 & 2025

- IRS Pub. 550 Worksheet 2-1

Let me know if you’d like this exported as a PDF, Markdown, or in a presentation format!