By Patrick Kuster, AIF

When deciding to convert traditional IRA funds to a Roth IRA, we generally start by thinking in terms of taxes. I mean, if it wasn’t for taxes, why would we consider converting in the first place? But we don’t want to convert too much in any given year, as we don’t want to put ourselves in too high of a tax bracket or pay more taxes than we can stomach. While we may start our analysis in terms of our tax bracket or tax bill, for those currently or within two years of receiving Medicare Part B, it’s also important to understand that converting an amount that results in income even $1 over the threshold could mean thousands of dollars in increased Medicare Part B costs.

Gross Income, AGI, MAGI and Taxable Income

Before diving into an explanation and its planning implications, let’s first revisit some key tax return terms that will be important for our discussion:

Gross Income includes all earned and unearned income including wages, dividends, capital gains (short-term and long-term), business income and retirement distributions.

Adjusted Gross Income (AGI) is gross income minus allowed adjustments, most commonly for individual retirement account (IRA) and self-employed retirement plan contributions, half of self-employment taxes paid and self-employed health insurance premiums, student loan interest and alimony payments.

Modified Adjusted Gross Income (MAGI) is AGI but without certain adjustments and includes tax-exempt interest income. In other words, MAGI is the AGI with the addition of some of the items that were used to reduce gross income when calculating AGI (or that maybe weren’t counted in the first place). Some of the items include IRA contributions, half of self-employment taxes, non-taxable Social Security income, student loan interest and rental losses. MAGI is most significant in determining whether you are eligible for certain deductions and whether you can make Roth IRA contributions, and it also impacts potential government program costs or benefits.

Taxable Income is your AGI minus either the standard deduction or total itemized deductions, generally whichever gives the most benefit. Taxable income can be thought of as the amount of income that Uncle Sam taxes and it is used in determining your tax bracket. Tax brackets for 2021 can be found at the IRS website.

Taxable Income and Roth Conversions

When converting traditional IRA funds to a Roth IRA, many retirement savers generally think in terms of taxable income; the more we convert, the more we ultimately increase our taxable income, and therefore the amount of income taxes we owe. As such, the intention is often to set a goal for “filling up” whatever room is left in a tax bracket with Roth conversions while avoiding the next tax bracket. A common example would be to convert “through” the 24% bracket but avoid the jump up to the 32% bracket. For 2021, that would mean converting with a taxable income target of $329,850.

Let’s look at an example using these figures as a starting point. Also assume we’re talking about a retired, married couple that files a joint tax return. Both spouses turned 65 in January, both enrolled in Medicare Part A and B, and they usually take a standard deduction. They decided two years ago (in 2019) to fill up the 24% bracket with the help of Roth conversions, which means they wanted to generate an AGI of $345,850 ($321,450 of taxable income after the $24,400 standard deduction). To get there, they converted a whopping $195,850.

MAGI Matters for Medicare Premiums

When our couple from above enrolled in Medicare Part B, they discovered they have a Medicare Part B premium of $475.20 per month, each, and had to pay an additional $70.70 per month for Part D drug coverage on top of the drug card costs. Had they converted just $15,850 less, their Part B premium would “only” have been $386.10 each, meaning that they would have saved $2,138.40 in Part B premiums for 2021 by converting a slightly smaller amount (at least comparatively). Their Part D premiums would have been reduced to $51.20 per month each, saving an additional $468 annually.

Medicare Part B and Part D premiums are broken into two parts: 1) the “standard” premiums and drug coverage cost and 2) the Income Related Monthly Adjustment Amount (IRMAA). In simple terms, everyone starts off by paying a standard amount, but those over certain MAGI limits pay more for the same coverages. To make things a little more confusing, the MAGI used in the calculation is from two years prior, leaving 2021 thresholds based on 2019 MAGI, 2022 thresholds based on 2020 MAGI, etc.

For 2021, the standard premium for Medicare Part B is $148.50 per month and the total premium including IRMAA goes as high as $504.90 per month. For Part D, it starts at the stated drug insurance premium (the amount you pay the insurance company for drug coverage) and goes as high as an additional $77.10 per month. Notably, this is per person, so for a married couple with both spouses enrolled, these figures generally double.

This complicates Roth conversion planning for those expecting to enroll in Medicare within two years or for those already receiving benefits, as Medicare IRMAA is based on MAGI while federal tax brackets are based on taxable income.

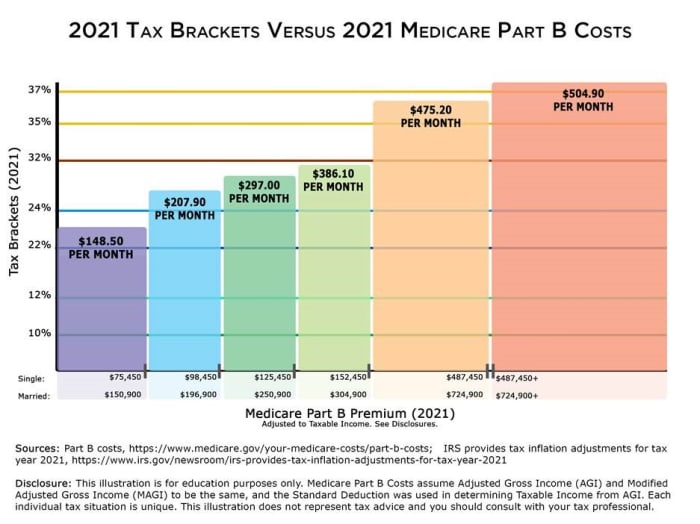

Let’s look at a hypothetical illustration comparing federal tax brackets to monthly Medicare Part B premiums, assuming an adjustment of the standard deduction from taxable income to MAGI. It’s worth noting that, especially for those collecting Social Security benefits, taxable income may be further away from MAGI than the standard deduction, which would result in shifting Medicare Part B premiums (not the tax brackets) downward.

To stress this point, when accidentally going over a tax bracket, the higher tax bracket only impacts the taxable income within the bracket itself. If someone accidentally converted $1 over into the 32% bracket, they would only pay 32% on $1 with the rest of their taxable income at lower brackets. With Medicare IRMAA, and as seen in the graphic above, going into that same new IRMAA “bracket” by $1 of MAGI could cost up to $1,069.20 per person, per year in additional premiums in 2021. The good news is that IRMAA amounts are adjusted for inflation and look back two years, so if you go slightly over today’s threshold when converting this year, there is a chance that two years from now you may be back under with inflation adjustments.

In real-world application, conversions are generally not to-the-penny of MAGI or taxable income targets, and many leave some margin for error when converting. In other words, you may want to convert a bit less than you need to reach your target income in case your total income ends up a little higher for the year than you projected. This is because conversions cannot be “undone” through recharacterization, pursuant to the Tax Cuts and Jobs Act.

Imagine executing a Roth conversion that put you a few thousand dollars or less over the IRMAA threshold and then having to pay the “penalty” of an increased IRMAA for such a relatively small “extra” conversion amount. This outcome merits consideration, especially when planning to convert “through” the 22%, 24% or 35% bracket. In other words, if you plan on converting up to the 24%, 32% or 37% tax bracket, keep an eye on Medicare IRMAA MAGI amounts.

Form SSA-44

If you are in a higher IRMAA when enrolling in Medicare Part B, or are already a beneficiary, a triggering life event may help provide some relief from IRMAA premiums if you anticipate that your AGI for the tax year after the event (that is, for the year in which the event occurred or the following year) will fall from where it was before the event. A simple example would involve a 63-year-old who converts through the 24% bracket and retires at 65 (and assuming they enroll in Medicare Part B). With a two-year lookback, IRMAA would kick in. But let’s say this same retiree anticipated AGI below this IRMAA threshold. They can then submit form SSA-44 (Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event) to essentially say, “Hey, I just retired, and my income has changed. Please take my expected income into consideration and not use my previous income to determine my IRMAA.” Of course, if the retiree from this example didn’t project a change in AGI, this wouldn’t apply.

Form SSA-44 can be submitted if there is a life changing event, defined as marriage, divorce, death of a spouse, work stoppage (retirement or termination), work reduction (such as going to part-time), loss of income-producing property, loss of pension income or employer settlement payment.

Impact

When executing a Roth conversion, consider not only tax brackets but also Medicare IRMAA and other potential impacts related to the increase in MAGI. Fine-tuning how much to convert should be evaluated and calculated year to year, and it’s a good idea to involve your financial planner and tax professional in the process.

About the author: Patrick Kuster, AIF®

As a Wealth Advisor with Buckingham Strategic Wealth, knows that even the most thorough and well-conceived financial life plan is only as good as its implementation. He works closely with clients to help them solve their financial puzzle – pulling apart plans, rebuilding them, then seeing them through – and achieve their most important retirement goals.

Important Disclosure: The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Individuals should speak with qualified professionals based upon their individual circumstances. The analysis contained in this article may be based upon third-party information and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. IRN-21-2410

The University of Maryland Global Campus (UMGC) invites you to their open-to-the-public, free, no-strings-attached UMGC Virtual Financial Wellness Day on Wednesday, August 11, 2021, from 1:00 to 4:00 PM ET. Speak one-on-one with a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional to get answers to your questions free of charge. Register today at https://www.financialwellnessday.org/ or contact the UMGC Financial Wellness Team at info@financialwellnessday.org for more information.

Got Questions About Your Taxes, Personal Finances and Investments? Get Answers!

Email Jeffrey Levine, CPA/PFS, chief planning officer at Buckingham Wealth Partners, at: AskTheHammer@BuckinghamGroup.com.