Who is a highly paid employee? The IRS defines a highly compensated employee as an employee who meets one of the following two criteria: An employee who received $130,000 or more in compensation from his or her 401(k) plan sponsor employer in 2021. In 2022, this limit will increase to $135,000.

Should high earners use Roth 401k?

Is there any other reason why a high income and/or high net worth person might want to use a Roth 401k? Yes. If you’re maxing out your regular 401k and want to save even more for retirement, consider rolling your contributions into your Roth 401k.

At what income does a Roth not make sense? Roth IRA contributions from individuals are prohibited if your income is $140,000 or more in 2021. The phase-out range for single earnings is $125,000 to $140,000. Individual filers cannot contribute to a Roth in 2022 if they earn $144,000 or more.

Who should use a Roth 401k?

High earners who hope to maintain their income and spending standards until retirement may consider using Roth 401(k)s to simplify their payments by paying them up front while they work.

Who should use Roth vs Traditional 401k?

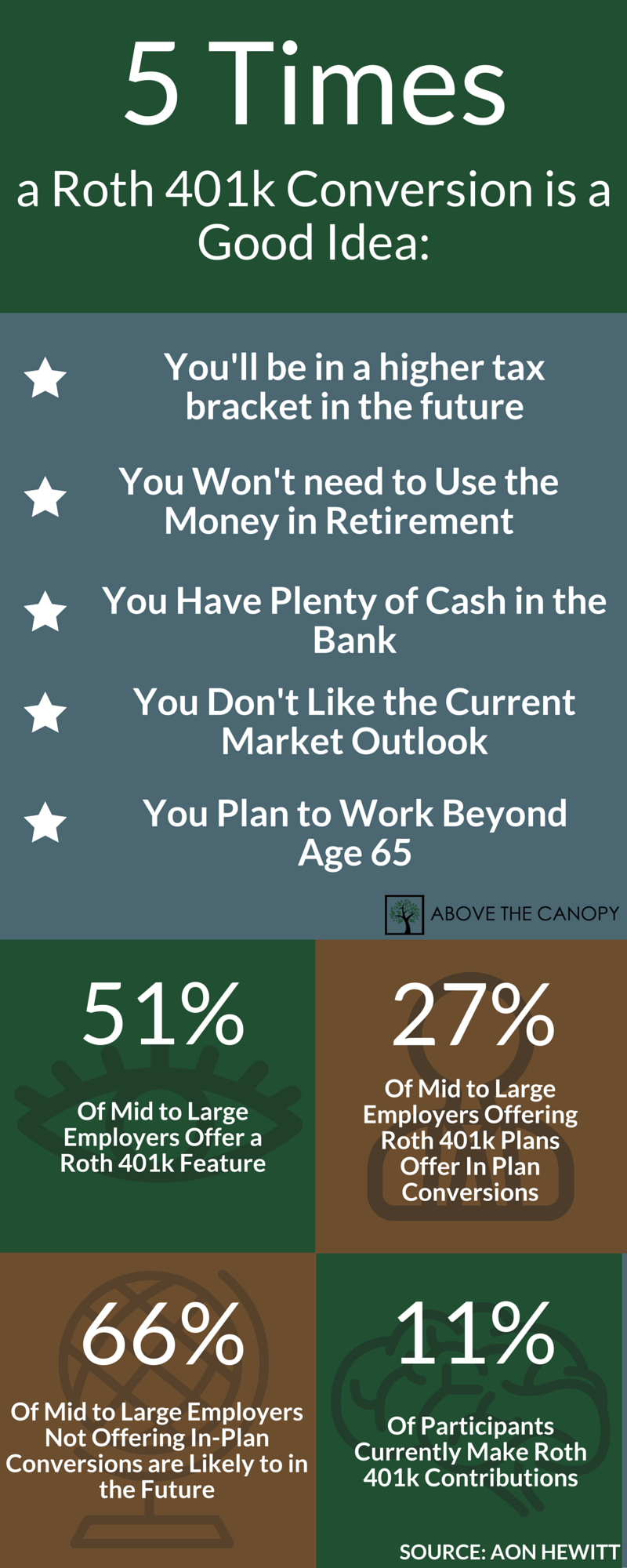

This decision mainly comes down to how you want to deposit money into your account and how you want to withdraw money. Let’s start with today – investing. If you’d rather pay taxes now and avoid them, or if you think your tax rate will be higher in retirement than it is now, choose a Roth 401(k). ).

Who Is a Roth 401k good for?

If you are young and confident that you will earn more and earn a higher tax rate in the future, a Roth 401(k) may be a good option. But even if you’re in your 40s, 50s, or 60s, you might want to take a closer look at the Roth option.

Does a Roth IRA make sense for high income earners?

A Roth IRA or 401(k) makes the most sense if you’re confident you’ll have more income in retirement than you have now. If you expect your income (and tax rate) to be lower in retirement than it is now, a traditional IRA or 401(k) is probably a better bet.

How much should I be putting in a Roth IRA?

If your employer contributes (dollar-for-dollar) up to 6 percent of your salary, make sure you contribute at least 6 percent of each paycheck first.

How much does a Roth IRA grow in 10 years?

Roth IRAs typically see an average annual return of 7-10%. For example, if you’re under 50 and you’ve just opened a Roth IRA, $6,000 in contributions each year for 10 years at 7% would add up to $83,095.

Should I max out Roth 401k or traditional?

Financial planners recommend contributing as much as you can – at least 15% of your pre-tax income. A rule of thumb for retirement savings is that you should first match your employer’s 401(k), then max out your Roth 401(k) or Roth IRA, and then go back to your 401(k).

Should I put more in Roth or traditional 401k?

If you expect to be in a lower tax bracket when you retire, a traditional 401(k) may make more sense than a Roth account. But if you currently have low tax rates and believe you’ll be in a higher tax bracket when you retire, a Roth 401(k) may be a better choice.

Is it worth it to max out Roth 401k?

Using Your Retirement Savings The unfortunate truth about maxing out your 401(k) is that it’s not always the best financial move. While this can certainly provide tax savings, it comes at a cost. These costs are fees associated with the 401(k) plan and account inflexibility.

Is 40 too old to start a Roth IRA?

There is no age limit for opening a Roth IRA, but there are income and contribution limits that investors should be aware of before funding one.

Is it worth opening a Roth IRA at age 50? IRA owners age 50 and older can contribute more money each year than younger workers. Building a Roth at age 50 takes planning and discipline. Make the maximum contribution each year. As of publication, it is $6,000, $1,000 more than those under 50 can contribute.

At what age does a Roth IRA not make sense?

Unlike a traditional IRA, where contributions are not allowed after age 70½, you’re never too old to open a Roth IRA. As long as you have earned income and a breather, the IRS is fine with you opening and funding a Roth.

At what age should you stop contributing to a Roth IRA?

You cannot deduct contributions to a Roth IRA. If you qualify, qualified withdrawals are tax-free. You can make contributions to your Roth IRA after you turn 70 and a half. You can leave the amounts in your Roth IRA as long as you live.

Should I open a Roth IRA at 60 years old?

Opening or converting to a Roth in your 50s or 60s may be a good option if: Your income is too high to contribute to a Roth through regular channels. You want to avoid RMDs. You want to leave tax-free money to your heirs.

What age should you start Roth IRA?

Starting at 25 is better than 30, and 30 is better than 35. It may be hard to imagine now, but five extra years of contributions early in your career can equate to several hundred thousand dollars more. tax-free pension income.

Is it smart to open a Roth IRA at 18?

Roth IRAs are a good choice for young adults because you’re likely to be in a lower tax bracket (see your tax bracket here) at this stage of your life than you will be when you retire. A great feature of a Roth IRA for young people is that you can withdraw your contributions at any time without any taxes or penalties.

Should a 20 year old have a Roth IRA?

Bottom row. Because of the Roth IRA’s unique tax advantages, eligible people in their 20s should seriously consider contributing to it. A Roth IRA may be a smarter long-term choice than a traditional IRA, although contributions to traditional IRAs are tax deductible.

How much can a 40 year old contribute to a Roth IRA?

Key offers For 2021 and 2022, individuals can put away up to $6,000 a year (those aged 50 and over can save an additional $1,000). Roth IRA contributions may be limited by an individual’s overall income.

How much can I contribute to my 2022 Roth?

The 2022 changes highlight the contribution limit for employees participating in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan will be increased to $20,500. Contribution limits for traditional and Roth IRAs remain unchanged at $6,000.

How much can a 40 year old contribute to an IRA?

IRA contribution limits are raised every few years to keep up with inflation. For 2021 and 2022, individuals can put away up to $6,000 a year (those 50 and older can save an additional $1,000). Roth IRA contributions may be limited by an individual’s overall income.

How much should I have in my 401k at 45?

At 45: Save four times your salary. At 50: Save six times your salary. At 55: Save seven times your salary. At 60: Save eight times your salary.

How much does the average 45 year old have in 401k? Here are the numbers: Average 401(k) balance for 35-44 year olds: $86,582 (average); $32,664 (median) Average 401(k) balance for ages 45-54: $161,079 (average); $56,722 (median)

What is a good 401K balance at age 45?

| Age | Average 401(k) balance | Median 401(k) Balance |

|---|---|---|

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65 | $279,997 | $87,725 |

How much should you have in your 401k at 47 years old?

By age 30, you should have a lump sum of annual salary saved. For example, if you earn $50,000, you should have $50,000 for retirement. By the time you turn 40, you should have three times your annual salary already saved. By the time you turn 50, you should have six times your salary in your account.

How much should a 50 year old have in 401k?

Now, most financial advisors recommend that you have five to six times your annual income in a 401(k) or other retirement savings account by age 50. If growth continues throughout the rest of your working career, this amount should generally allow you to have enough savings to retire comfortably at age 65.

How much should a 45 year old have in their retirement account?

Although the recommended retirement plan savings amount is up to four times your annual salary, this is not a reality for many Americans. The average income for 40-year-olds is just over $50,000, but the average retirement savings for this age group is $63,000.

How much money should I have in my retirement account at age 45?

Retirement Savings Goals By age 40, you should have three times your annual salary. Six times your salary at age 50; eight times by the age of 60; and at the age of 67 10 times. 8 If you reach age 67 and earn $75,000 a year, you should have $750,000 saved.

How much should you have in your 401k at 50?

By age 50, you should aim to save at least six times your salary in order to retire at age 67, according to calculations by retirement plan provider Fidelity. If you make $50,000 a year, you should aim to put away $300,000 over 50 years.

What is a good 401k balance at age 50? By the time you turn 50, you should have six times your salary in your account. By age 60, eight times your salary should be working for you. At age 67, your total savings goal is 10 times your current annual salary. For example, if you make $75,000 a year, you should have $750,000 in savings.

How much does the average 55 year old have in 401k?

Average 401k balance for ages 55-64 – $586,486; Median – $270,698.

What is the average retirement savings for a 55 year old?

| Average retirement account balance by age | |

|---|---|

| Age group | 401(k)/IRA balance |

| 35-44 | $51,000 |

| 45-54 | $90,000 |

| 55-64 | $120,000 |

How much should a 54 year old have in 401k?

By age 50, retirement plan provider Fidelity recommends saving at least six times your salary to retire comfortably at age 67. By age 55, he recommends having seven times your salary.

How much should be in my 401k at my age?

How much should I have in my 401(k)? A general rule of thumb is to save six to eight times your salary by age 60, although more conservative estimates may be higher. The truth is, your retirement savings plan depends on your individual goals and financial situation.

What is a good 401K balance by age?

| Age | Average 401k balance | Average 401k balance |

|---|---|---|

| 20-29 | $14,600 | $4,500 |

| 30-39 | $51,200 | $18,400 |

| 40-49 | $120,200 | $37,600 |

| 50-59 | $206,100 | $62,700 |

How much should a 35 year old have in 401K?

So, to answer the question, we believe that the income saved by age 35 is one to one and a half times higher. This is an achievable goal for someone who starts saving at age 25. For example, a 35-year-old earning $60,000 would be on track if they have saved about $60,000 to $90,000.

How much should I have saved for retirement at 50 years old?

In fact, according to retirement plan provider Fidelity Investments, by age 50, you’d need to have six times the income saved to leave the workforce at age 67. The latest data from the Bureau of Labor Statistics for the third quarter of 2020 shows that the median annual total wage for Americans aged 45-54 is $60,008.

Is 500k enough to retire at 50?

The short answer is yes – $500,000 is enough for some retirees. The question is how to succeed. With an income source like Social Security, relatively low expenses, and a little luck, it’s doable.

How much does the average 50 year old have in their 401k?

The amount of your 401k by age 50 depends on whether you are average or above average. The average 401k by age 50 is about $150,000. But for the above-average 50-year-old, he should have $401,000 between $500,000 and $1,200,000.

Sources :