Can I withdraw Roth 401k anytime?

Early withdrawals. If you’ve owned a Roth IRA for at least five years, you can withdraw contributions tax-free before age 59½ (but not earnings, in most cases you’ll pay a 10% tax penalty).

Can I withdraw my contributions from a Roth 401 K without penalty? Contributions to a Roth IRA can be withdrawn at any time, and after the account holder turns 59 ½, earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if your employer’s plan allows it.

Can I pull from my Roth 401k?

You can withdraw contributions from a Roth 401(k) without paying taxes or penalties since Roth contributions are made with after-tax dollars. However, if the withdrawal is not qualified, you will pay tax on any growth earnings you withdraw and be subject to a 10% early withdrawal penalty.

Do I have to pay taxes on Roth 401k withdrawal?

There are no tax consequences when you take money out of a Roth 401(k) when you’re 59½ and you’ve met the five-year rule. If you need $20,000, withdraw $20,000 and there will be no tax. If you take a similar distribution from a traditional 401(k) plan, the money you withdraw is subject to ordinary income tax.

What is the 5 year rule for Roth 401k?

The five-year rule after your first contribution The first five-year rule sounds simple enough: To avoid taxes on distributions from your Roth IRA, you must not withdraw money until five years after your first contribution.

Can I withdraw Roth 401k contributions at any time?

With a Roth IRA, you can withdraw contributions at any time tax- and penalty-free because the rules assume that the first money out represents your after-tax contributions.

Can Roth 401 K contributions be withdrawn at any time?

In general, you can often begin withdrawing Roth 401(k) earnings at age 59½. There is some greater leniency regarding withdrawal rules for Roth 401(k) contributions.

What is the 5 year rule for Roth 401k?

The five-year rule after your first contribution The first five-year rule sounds simple enough: To avoid taxes on distributions from your Roth IRA, you must not withdraw money until five years after your first contribution.

What happens if you withdraw from the Roth before 5 years? Your first contribution. Withdrawing funds from a Roth IRA less than five years after your initial contribution requires account holders to pay taxes on the income portion of the withdrawals.

What is the 5-year rule for 401k?

The 5-year rule: Under the 5-year rule, you choose whether you want to take any distributions in years one through four. But the entire account balance must be distributed by the end of year five.

Is there a 5-year rule for traditional IRA?

The 5-year rule applies to taking distributions from an inherited IRA. To withdraw income from an inherited IRA, the account must have been open for at least five years at the time of the death of the original account holder.

How does the 5-year rule work?

The Roth IRA five-year rule states that you cannot withdraw earnings tax-free until at least five years have passed since you first contributed to a Roth IRA account. 1 This rule applies to anyone who contributes to a Roth IRA, whether they are 59½ or 105.

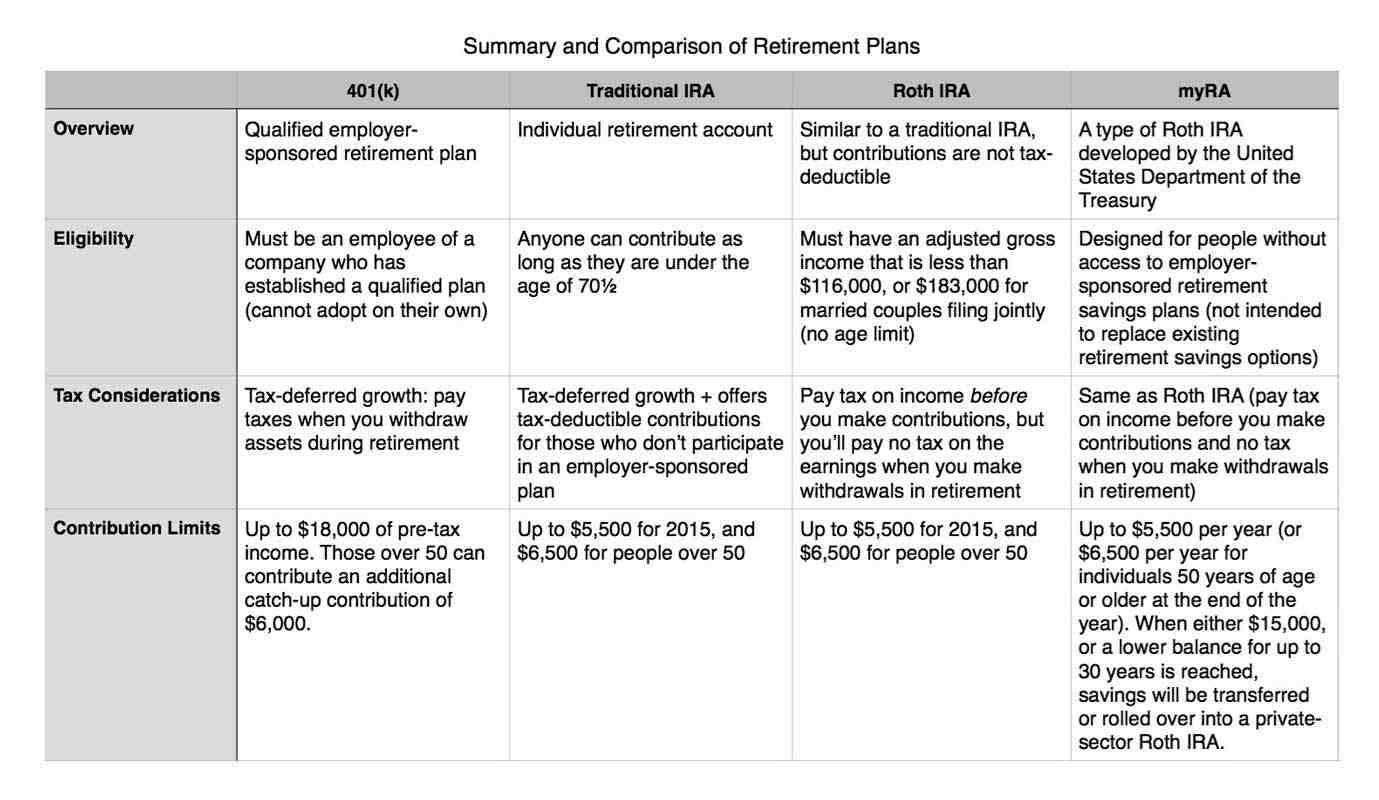

Why should I convert my 401k to Roth?

Converting a 401(k) to a Roth IRA gives you greater ownership and direction over your money. A 401(k) is a tax-advantaged retirement account managed by an employer, while a Roth IRA is a tax-advantaged retirement account managed by you.

Does it make sense to convert your IRA to a Roth after retirement? If you’re nearing retirement or need your IRA money to live on, it’s unwise to convert to a Roth. Because you pay taxes on your funds, it costs money to convert to a Roth. It takes a certain number of years before the money you pay upfront is justified by the tax savings.

Is a Roth conversion a good idea?

A Roth IRA conversion can be a very powerful tool for your retirement. If your taxes go up because of increases in marginal tax rates—or because you earn more and put yourself in a higher tax bracket—a Roth IRA conversion can save you significant money in taxes over the long term.

When should I convert my IRA to a Roth?

Historically low tax rates make 2021 a great time to convert your traditional IRA to a Roth account. “It’s the best time in history to convert to a Roth,” says Elijah Kovar, co-founder of Great Waters Financial in Minneapolis. “Between now and 2025, the last year of tax reform, taxes are on sale.”

How do I avoid taxes on a Roth IRA conversion?

Reduce adjusted gross income If you’re planning a Roth conversion, consider reducing your adjusted gross income by contributing more to your 401(k) plan before taxes, Lawrence suggested. You can also take advantage of so-called tax-loss harvesting, offsetting profits against losses, in a taxable account.

Is there a downside to Roth 401k?

Tax Bracket Risk When you put money into a Roth account (whether it’s a 401(k) or an IRA), you’re taking a chance—namely, that your tax bracket will be higher down the line than it is now. Your goal should be to pay tax on your money when the marginal interest rate is lowest.

Is it smart to have a 401k and a Roth?

Contributing to both a 401(k) and Roth IRA allows you to maximize your retirement savings and take advantage of tax advantages. With a 401(k) account, you’ll be contributing money you haven’t yet paid taxes on. Your employer can also match contributions up to a certain percentage of your annual income.

Is Roth 401k better than 401k?

Contributions to a Roth 401(k) can hit the budget harder today because an after-tax contribution takes a bigger chunk out of your paycheck than a pre-tax contribution to a traditional 401(k). The Roth account may be more valuable in retirement.

What is the benefit of Roth over 401k?

With a Roth 401(k), the main difference is when the IRS takes its cut. You make Roth 401(k) contributions with money that has already been taxed—just as you would with a Roth Individual Retirement Account (IRA). Any earnings then grow tax-free, and you pay no tax when you start taking withdrawals in retirement.

Should I contribute to Roth IRA or 401k?

The best choice. So to sum it all up: Your best bet is to invest in your 401(k) until your match and then invest in a Roth IRA – making sure you reach your goal of investing 15% of your gross income in retirement. ! Always seek good advice and invest in mutual funds with good growth with a history of strong returns.

Why a Roth is better than a 401k?

Contributions to a 401(k) are pre-tax, meaning they reduce your income before taxes are deducted from your paycheck. Conversely, there is no tax deduction for contributions to a Roth IRA, but contributions can be withdrawn tax-free at retirement.

Should I convert my 401k to a Roth 401k?

Converting all or part of a traditional 401(k) to a Roth 401(k) can be a smart move for some, especially younger people or those moving up in their careers. If you think you’ll be in a higher tax bracket during retirement than you are now, a conversion will likely save you money.

Should I roll over my 401k to a Roth 401k? Should I Convert My 401(k) to a Roth IRA? Converting a 401(k) to a Roth IRA can make sense if you think you’ll be in a higher tax bracket in the future, since withdrawals are tax-free. But you owe tax in the year the conversion takes place. You need to crunch the numbers to make a sensible decision.

Is there a downside to Roth 401k?

Tax Bracket Risk When you put money into a Roth account (whether it’s a 401(k) or an IRA), you’re taking a chance—namely, that your tax bracket will be higher down the line than it is now. Your goal should be to pay tax on your money when the marginal interest rate is lowest.

Is it worth doing Roth 401k?

Taxes are a key factor when deciding on a Roth 401(k) over a traditional 401(k). If you’re young and currently in a low tax bracket, but you expect to be in a higher tax bracket when you retire, a Roth 401(k) may be a better deal than a traditional 401(k).

Is it smart to have a 401k and a Roth?

Contributing to both a 401(k) and Roth IRA allows you to maximize your retirement savings and take advantage of tax advantages. With a 401(k) account, you’ll be contributing money you haven’t yet paid taxes on. Your employer can also match contributions up to a certain percentage of your annual income.

Is it better to contribute to 401k or Roth 401k?

Contributions to a Roth 401(k) can hit the budget harder today because an after-tax contribution takes a bigger chunk out of your paycheck than a pre-tax contribution to a traditional 401(k). The Roth account may be more valuable in retirement.

Is it better to contribute to a Roth 401k or Roth IRA?

A Roth 401(k) has higher contribution limits and allows employers to make matching contributions. A Roth IRA allows your investments to grow over a longer period of time, offers more investment options and makes early withdrawals easier.

Can I contribute to both a 401k and a Roth 401k?

The good news is that it is often possible to contribute to both a traditional and a Roth 401(k). Since no one knows what tax rates will be in the future, diversifying with contributions to both a traditional 401(k) and Roth can be a way to hedge your tax efforts with your retirement savings.

Is converting a 401k to Roth a good idea?

But unlike a 401(k), it offers the potential for tax- and penalty-free withdrawals. If you plan to be financially independent before traditional retirement age, or if you want to reduce the taxes you owe later in life, converting a 401(k) to a Roth IRA can be a smart strategy.

Can I roll my 401k into a Roth without penalty?

Fortunately, the definitive answer is “yes.” You can roll your existing 401(k) into a Roth IRA instead of a traditional IRA. If you choose to do that, you just add a few extra steps to the process. Every time you leave your job, you have a decision to make about your 401k plan.

What are the disadvantages of Roth IRA?

Key Takeaways One key downside: Roth IRA contributions are made with after-tax money, meaning there’s no tax deduction in the year of contribution. Another disadvantage is that account income must not be withdrawn until at least five years have passed since the first contribution.

Sources :