Why shouldn’t I do a Roth?

One important disadvantage: Roth IRA contributions are made on an after-tax basis, meaning no taxes are deducted in the year of the contribution. Another drawback is not paying the account income until at least five years have passed since the first contribution.

Why bother with a Roth IRA? Contributing to a Roth IRA is more tax efficient than simply investing in a taxable brokerage account. Roth IRA funds are tax-free, and all of your contributions and earnings can be withdrawn tax-free when you open your Roth IRA over five years.

Why you shouldn’t use a Roth 401k?

The main reason not to invest in a Roth 401(k) is if your tax rate will decrease when you withdraw money from the retirement account. If so, it’s best to put the money into a tax-deferred account. But if you’re really rich, you’ll still be at the top all your life.

Is it better to contribute to 401k or Roth 401k?

Roth 401(k) contributions can hit your budget hard today because after-tax contributions take a bigger bite out of your paycheck than pretax 401(k) contributions. A Roth account can be very valuable in retirement.

Is a Roth 401k worth it?

Taxes are an important consideration when it comes to deciding on a Roth 401(k) over a 401(k). If you are young and currently in a lower tax bracket but expect to be in a higher tax bracket when you retire, then a Roth 401(k) may be a better deal than a 401(k).

Who should not get a Roth IRA?

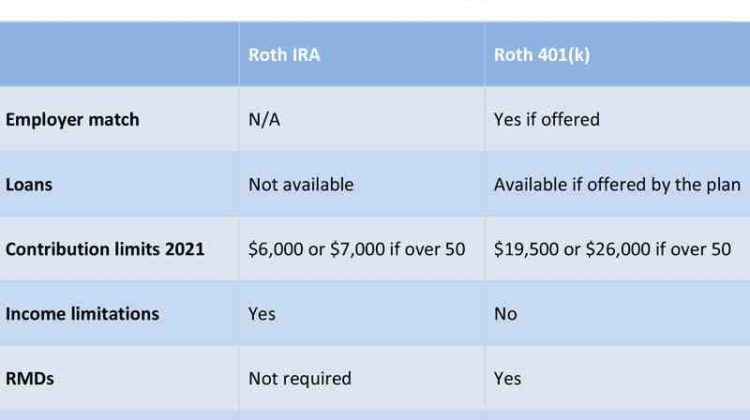

Contributions to a Roth IRA from a single filer are prohibited if your income is $140,000 or more in 2021. The dollar income withdrawal limit is $125,000 to $140,000. Single taxpayers cannot contribute to a Roth in 2022 if they earn $144,000 or more.

Who should not contribute to an IRA?

Interest, dividends, rentals, retirement or annuity income will not qualify you to make tax-deductible IRA contributions. [See: 10 ways to reduce taxes on your retirement savings.]

Is a Roth IRA good for everyone?

A Roth IRA or 401(k) makes the most sense if you’re confident you’ll have a higher retirement income than you currently do. If you expect your income (and tax rate) to be lower in retirement than it is now, a traditional IRA or 401(k) is probably best.

At what age does a Roth not make sense?

If you’re over 50, it probably doesn’t make sense to convert because there isn’t enough time to allow the growth of a Roth IRA to exceed today’s tax rate.

Should a 60 year old open a Roth IRA?

Roth IRA contributions are allowed without age restrictions as long as the senior earns income from work and does not exceed the income limits.

Should a 70 year old do a Roth conversion?

There is no age limit or income requirement to be able to convert a traditional IRA to a Roth. You must pay taxes on the amount converted, although a portion of the conversion will be tax-free if you contributed to your regular IRA.

Is it better to have a Roth or traditional 401k?

If you expect to be in a lower tax bracket in retirement, a traditional 401(k) may make more sense than a Roth account. But if you’re currently in a lower tax bracket and believe you’ll be in a higher tax bracket when you retire, a Roth 401(k) may be a good choice.

Does it make sense to have a Roth and a traditional 401k? If you’re already invested in a traditional 401(k), it might make sense to add a Roth plan to the mix. It can certainly be worth not having all your eggs in one retirement basket, even if it makes the most financial sense today. That’s because having both plans will give you flexibility later.

Why Is a Roth 401 K better than a traditional 401 K?

Since Roth 401(k) contributions are made after-tax, you’re paying taxes now and taking home less in your paycheck. Pretax contributions to a traditional 401(k) are deducted from the top of your gross income before your check is taxed, which will lower your tax bill for the year.

Can I contribute to both a Roth 401k and a traditional 401k?

If your employer offers both, you can contribute to a Roth 401(k) as well as a traditional 401(k). Your employer can also match both, but your traditional 401(k) funds go directly into your account while the Roth 401(k), is deposited into a separate tax-deductible account.

Is it smart to have a 401k and a Roth?

Contributing to both a 401(k) and a Roth IRA allows you to maximize your retirement savings and take advantage of tax benefits. In a 401(k) account, you’ll contribute money that you haven’t yet paid taxes on. Your employer may also match contributions up to a percentage of your annual income.

Should I split my 401k between Roth and traditional?

In most cases, your tax situation should determine the type of 401(k) you choose. If you’re in a lower tax bracket now and expect to be in a higher one after you retire, a Roth 401(k) makes sense. If you are currently in a high tax bracket, a traditional 401(k) may be the best option.

Is it wise to split 401k and Roth? It removes a significant amount of risk. In this case, if you split your retirement savings between a traditional 401(k) and a Roth 401(k), you’ll pay half the tax now, which will be lower tax, and half when you retire, when the rates will be can be higher or lower.

Should I contribute to both traditional and Roth?

It may be worth it to make traditional and Roth IRA contributions if you can. Doing so will give you tax and tax-free retirement withdrawal options. Financial planners know it as tax diversification, and it’s generally a smart strategy when you’re not sure what your tax picture will look like in retirement.

Should I contribute to both Roth and traditional 401k?

The good news is that it is often possible to combine traditional and Roth 401(k) contributions. Since no one knows what the tax rate will be in the future, diversifying contributions to both a 401(k) and Roth can be a way to control your tax gamble on your retirement savings.

How much should I put in a Roth and traditional?

For most Retirement Plans in 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot exceed: $6,000 ($7,000 if you’re age 50 or older), or . If it is less, your taxable allowance for the year.

How should I split my 401k?

For example, if your 401(k) offers 10 options, invest 10% of your money in each. Or, pick one fund from each sector, such as one fund from the cap sector, one from the cap sector, one from international stocks, one from bonds, and one from the money market or mutual fund. stable price.

Is it better to have 2 401k or 1?

There is no right answer for everyone, but in general, it will be less work in the long run to keep your investments in one account. However, there are some cases where you may be able to maximize returns by maintaining multiple accounts.

Is 20% 401k too much?

However, regardless of your age and expectations, most financial advisors agree that 10% to 20% of your salary is a good amount to contribute to your retirement fund.

Why You Should Use Roth 401k?

In a Roth 401(k) you’ll be contributing after-tax money, so you won’t enjoy a tax break today. Instead, any money you withdraw from the pension will be tax-free. With a Roth 401(k), you’ll enjoy not only tax-free growth on your investment gains, but also tax-free withdrawals.

Is a Roth 401k a good idea? Come retirement, depending on your taxes. That means you have to save more to fund your retirement income. If you are young and confident that you will have additional income and a higher tax bracket in the future, a Roth 401(k) may be a good choice.

Is there a downside to Roth 401k?

Tax credit risk When you put money into a Roth account (whether a 401(k) or an IRA), you’re taking a gamble — that is, that your tax bracket will be higher on the line than it is now. Your goal should be to pay taxes on your income when your marginal rate is low.

Is a regular 401k or Roth 401k better?

Roth 401(k) contributions can hit your budget hard today because after-tax contributions take a bigger bite out of your paycheck than pretax 401(k) contributions. A Roth account can be very valuable in retirement.

Is a Roth 401k worth it?

Taxes are an important consideration when it comes to deciding whether a Roth 401(k) is superior to a 401(k). If you are young and currently in a lower tax bracket but expect to be in a higher tax bracket when you retire, then a Roth 401(k) may be a better deal than a 401(k).

Sources :