Does spouse automatically inherit 401k?

If you’re married, federal law says your spouse* is automatically a beneficiary of your 401k or other retirement plan, period. You should still fill out the beneficiary form with your spouse’s name, for the record. If you want to name a beneficiary other than your spouse, your spouse must sign a waiver.

.

Can you withdraw early from Roth 401 K?

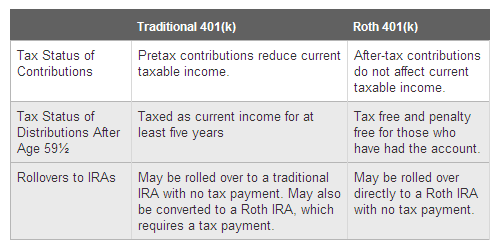

Qualified Withdrawals Are Tax-Free According to the IRS, “qualified withdrawals” from a Roth 401(k) can be tax-free. A withdrawal is considered qualified if: It occurs at least five years after the tax year in which you first made the Roth 401(k) contribution. It’s made after you turn 59 1/2.

Can You Withdraw Roth 401k Contributions Before 59? If you didn’t start contributing to a Roth by age 60, you couldn’t make tax-free withdrawals for five years, even though you’re over 59 ½. You can take early withdrawals from your Roth 401(k) before you turn 59 ½ if you haven’t met the five-year rule above, but with a caveat.

Can I withdraw my contributions from a Roth 401 K without a penalty?

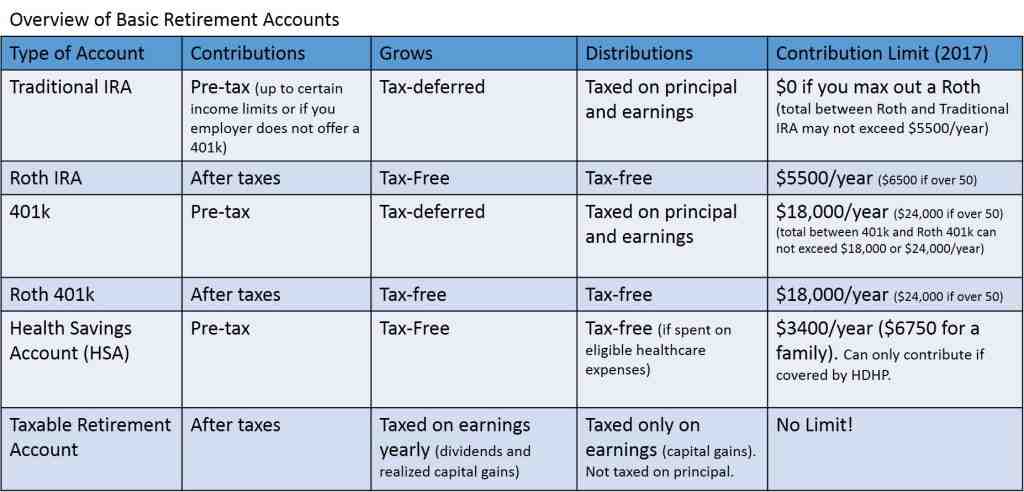

Roth IRA contributions can be made at any time, and after the account owner turns 59 ½, earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if the employer’s plan allows it.

When can you withdraw Roth contributions without penalty?

In general, you can withdraw your earnings without owing taxes or penalties if: You are at least 59½ years old3. It has been at least five years since you first contributed to any Roth IRA (five-year rule).

Can you withdraw 401 K contributions without penalty?

The IRS mandates that you can withdraw funds from your 401(k) without penalty only after you turn 59½, become permanently disabled, or are otherwise unable to work.

Can I withdraw Roth 401k contributions at any time?

With a Roth IRA, you can withdraw contributions at any time tax-free and penalty-free because the rules assume that the first amount of money represents your after-tax contributions.

How do I cash out my Roth 401k?

According to the IRS, “qualified withdrawals” from a Roth 401(k) can be tax-free. A withdrawal is considered qualified if: It occurs at least five years after the tax year in which you first made the Roth 401(k) contribution. It’s made after you turn 59 1/2.

Can Roth 401 K contributions be withdrawn at any time?

In general, you can often start withdrawing Roth 401(k) earnings when you’re 59½. There is more leniency in the withdrawal rules for Roth 401(k) contributions.

Can I cash out my 401k if I quit my job?

Can I cash out my 401k if I quit or am laid off? Sure, you can cash out and run. There’s nothing standing in your way if you want to take a lump sum distribution from your old 401(k) today. Any withdrawals before age 59½ are subject to a 10% early withdrawal penalty in addition to ordinary income tax.

Can you claim your 401k if you quit? If you lose or quit your job in the year you turn 55 or later, you can take 401(k) withdrawals without incurring the 10% early withdrawal penalty. But if you put the money in an IRA, you’ll have to wait until age 59 1/2 to avoid the early withdrawal penalty.

How do I cash out my 401k after I quit?

The 60-Day Rule However, you can also roll over your 401(k) account by cashing it out and then depositing that money into a new account (“indirect rollover”). The IRS allows you to do this tax-free and penalty-free as long as you deposit the money into a qualified retirement account within 60 days of your withdrawal.

Can I withdraw my 401k after I quit?

If you cash out your 401(k), you have 60 days to put that money into another qualified retirement account or penalties and taxes will apply. Other common options include transferring your retirement account directly to another qualifying account or leaving it there.

How long does it take to cash out 401k after leaving job?

When you leave your job, you may choose to cash in your 401(k). Generally, once you request a payout, it may take a few days to two weeks for you to receive the funds from your 401(k) plan. However, depending on the employer and the amount of funds in your account, the waiting period may be longer than two weeks.

How long does it take to cash out 401k after leaving job?

When you leave your job, you may choose to cash in your 401(k). Generally, once you request a payout, it may take a few days to two weeks for you to receive the funds from your 401(k) plan. However, depending on the employer and the amount of funds in your account, the waiting period may be longer than two weeks.

How do I get my 401k after I quit my job?

When you leave your employer, you have several options:

- Leave the receipt where it is.

- Roll it over to your new employer’s 401(k) on a pre- or after-tax basis.

- Roll it into a traditional or Roth IRA outside of your new employers’ plan.

- Get a lump sum (pay it off)

How long after you leave a company can you cash out your 401k?

The Bottom Line If you cash out your 401(k), you have 60 days to put that money into another qualified retirement account or penalties and taxes will apply. Other common options include transferring your retirement account directly to another qualifying account or leaving it there.

When you quit a job what happens to your 401k?

After you leave your job, there are several options for your 401(k). You may be able to leave your account where it is. Alternatively, you can roll money from your old 401(k) into your new employer’s plan or an Individual Retirement Account (IRA).

How long do you have to move your 401k after leaving a job?

There are a few things to remember when going for a 401(k) rollover from a previous employer. If your previous employer pays out your 401(k) funds, you have 60 days to transfer those funds to an appropriate retirement account. Take too long and you’ll be subject to early withdrawal penalty taxes.

What happens to my 401k if I quit or get fired?

If you’ve been let go or laid off, or even worried about it, you may be wondering what to do with your 401k after you leave your job. The good news is that your 401k money is yours and you can take it with you when you leave your old employer.

When can I withdraw from Roth IRA 401k?

In general, you can often start withdrawing Roth 401(k) earnings when you’re 59½. There is more leniency in the withdrawal rules for Roth 401(k) contributions.

Can you withdraw from a Roth 401k at age 55? What is Rule 55? Rule 55 is an IRS guideline that allows you to avoid paying the 10% early withdrawal penalty on 401(k) and 403(b) retirement accounts if you leave your job during or after the calendar year you turn 55.

Can I withdraw from my Roth 401k at any time?

Early withdrawal. If you’ve owned a Roth IRA for at least five years, you can withdraw your contributions penalty-free before age 59½ (but not the earnings, in most cases you pay a 10% tax penalty).

What is the 5 year rule for Roth 401k?

The Five-Year Rule After Your First Contribution The first five-year rule sounds simple enough: To avoid taxes on distributions from your Roth IRA, you can’t take any money until five years after your first contribution.

When can I take money out of my Roth 401k without penalty?

Roth IRA contributions can be made at any time, and after the account owner turns 59 ½, earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if the employer’s plan allows it.

What is the 5 year rule for Roth 401k?

The Five-Year Rule After Your First Contribution The first five-year rule sounds simple enough: To avoid taxes on distributions from your Roth IRA, you can’t take any money until five years after your first contribution.

When can you withdraw from Roth 401k without penalty?

Roth IRA contributions can be made at any time, and after the account owner turns 59 ½, earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if the employer’s plan allows it.

What happens if you withdraw from Roth before 5 years?

Your first contribution. Withdrawing funds from a Roth IRA less than five years after your first contribution requires account holders to pay taxes on a portion of the withdrawal earnings.

When can you withdraw from Roth 401k without penalty?

Roth IRA contributions can be made at any time, and after the account owner turns 59 ½, earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if the employer’s plan allows it.

When can I withdraw from 401k Roth?

You can start making qualified distributions from a Roth 401(k) when you meet two conditions: You are 59 ½ or older and you meet the five-year rule. This rule states that you must make your first contribution to the account at least five years before your first withdrawal.

Can you withdraw money from a Roth 401k without penalty?

If you withdraw funds from a Roth 401(k) early, you must pay taxes on the non-contributory portion of your withdrawal. In addition, the IRS assesses a 10% penalty on the unpaid portion. There are no taxes or penalties on the contribution portion.

Sources :