How much should I have in my 401k at 45?

At 45: Save four times your salary. At 50: Save six times your salary. At 55: Saved seven times your salary. At 60: Eightfold salary saved.

How much should you have in 401K times 46? According to Fidelity, this is how much Americans should save at any age: By age 30, you should have saved your salary. By 40 you should have saved three times your salary. By age 50, you should have saved six times your salary.

How much should a 45 year old have in their retirement account?

While the recommended retirement savings amount is four times your annual salary, that’s not the reality for many Americans. The median income for people in their 40s is just over $50,000, but the median retirement savings for this age group is $63,000.

How much money should I have in my retirement account at age 45?

Retirement Goals By the age of 40 you should have three times your annual salary. Six times your salary up to the age of 50; at the age of 60 eight times; and at the age of 67, 10 times. 8 By the time you turn 67 and make $75,000 a year, you should have $750,000 saved.

What is a good 401k balance at age 45?

| Age | Average 401(k) balance | Average 401(k) balance |

|---|---|---|

| $6,264 | $1,786 | |

| 25-34 | $37,211 | $14,068 |

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

How much does the average 45 year old have in 401K?

Here are the reported numbers: Average 401(k) balance for ages 35-44: $86,582 (average); $32,664 (median) Average 401(k) balance for ages 45-54: $161,079 (average); $56,722 (median) Average 401(k) balance for ages 55-64: $232,379 (average); $84,714 (average)

How much does the average 40 year old have in their 401k?

How much pension do 40-year-olds actually have? The average 401(k) balance for Americans ages 40-49 is $120,800 as of the fourth quarter of 2020, according to data from Fidelity’s retirement platform. Americans in this age group contribute an average of 8.9% of their salary.

How much does average 45 year old have saved?

Average savings by age: 45 to 54 people between the ages of 45 and 54 had an average savings account balance of $48,200, according to the 2019 Fed survey.

What is a good 401K balance at age 45?

| Age | Average 401(k) balance | Average 401(k) balance |

|---|---|---|

| $6,264 | $1,786 | |

| 25-34 | $37,211 | $14,068 |

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

How much should you have in your 401K by age?

It is advisable to add an accumulated gross annual salary every five years. So by the time you’re 30, you want to have a year’s worth of your salary saved; by the age of 35 you want to have saved up two years’ salary; and by the time you’re 40 you want to have three years’ salary saved.

How much should I have in my 401K at 47?

If you make $50,000 by age 30, you should have $50,000 in the bank for retirement. By the age of 40 you should have three times your annual salary. Six times your salary up to the age of 50; at the age of 60 eight times; and at the age of 67, 10 times. 8 By the time you turn 67 and make $75,000 a year, you should have $750,000 saved.

How many retirement accounts should I have?

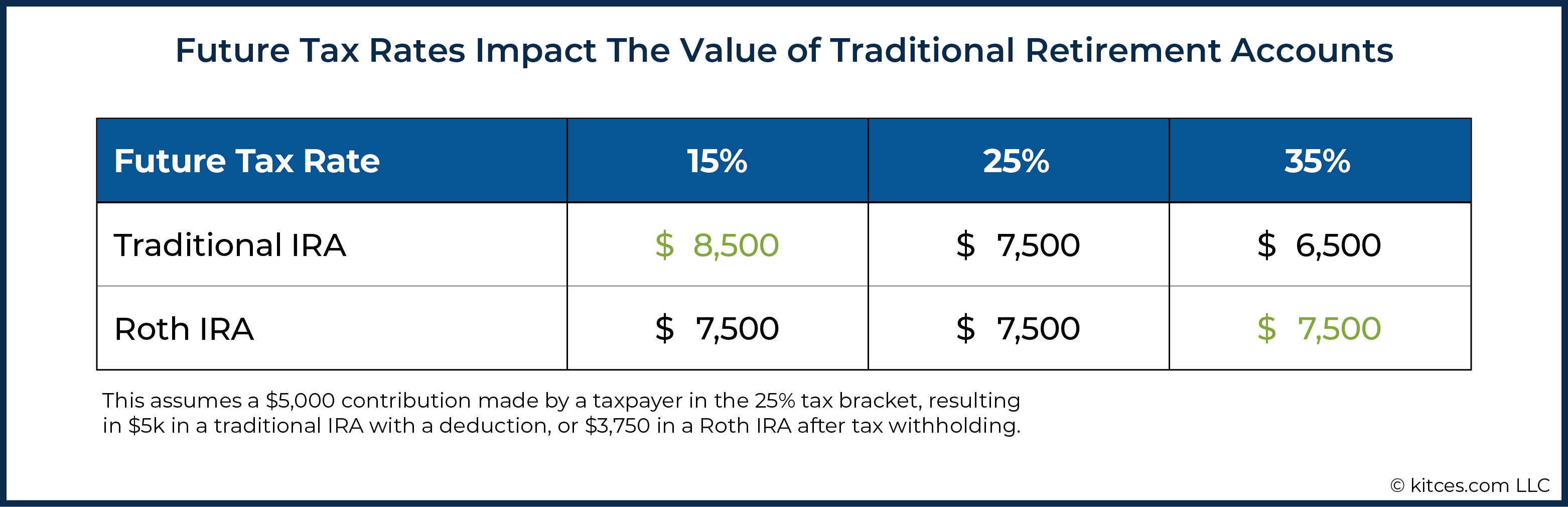

When working toward retirement, it’s generally a good idea to have two retirement accounts – a traditional vehicle and a Roth-style vehicle. This framework is fairly easy to administer, and more importantly, it allows you to maintain flexibility in taking income distributions in a tax-efficient manner.

Does it make sense to have multiple IRAs? The benefits of multiple IRAs. Having multiple IRAs can help you refine your tax minimization strategy and gain access to more investment opportunities and increased account insurance. Here are the benefits of multiple IRAs: Tax diversification: Different types of IRAs offer different tax benefits.

Can I have 3 retirement accounts?

There is no limit to the number of Individual Retirement Accounts (IRAs) you can own. Regardless of how many accounts you have, your total contributions for 2022 cannot exceed the annual limit. Check out the current 401(k) and IRA contribution limits.

Is it better to have multiple retirement accounts?

When working toward retirement, it’s generally a good idea to have two retirement accounts – a traditional vehicle and a Roth-style vehicle. This framework is fairly easy to administer, and more importantly, it allows you to maintain flexibility in taking income distributions in a tax-efficient manner.

How many retirement accounts is too many?

How many different investment accounts or retirement plans do you have? If it’s more than three, you could seriously jeopardize the long-term performance of your investments and erode your retirement savings.

Does it matter how many retirement accounts you have?

There is no limit to the number of IRA accounts you can have, but your contributions must remain within the annual limit for all accounts. Having multiple accounts gives you additional options when it comes to taxes, investments, and withdrawals, but it can make your investing life a bit more complicated.

Is it worth it to have multiple retirement accounts?

When working toward retirement, it’s generally a good idea to have two retirement accounts – a traditional vehicle and a Roth-style vehicle. This framework is fairly easy to administer, and more importantly, it allows you to maintain flexibility in taking income distributions in a tax-efficient manner.

How many retirement accounts is too many?

How many different investment accounts or retirement plans do you have? If it’s more than three, you could seriously jeopardize the long-term performance of your investments and erode your retirement savings.

Can you have too many retirement accounts?

When you have too many retirement accounts, managing your savings can become more difficult. It’s important to strategically choose your retirement accounts based on your financial situation and long-term goals.

How many retirement accounts is too many?

How many different investment accounts or retirement plans do you have? If it’s more than three, you could seriously jeopardize the long-term performance of your investments and erode your retirement savings.

How many retirements should I have?

To answer the question, we think a reasonable goal is to save one to one and a half times your income for retirement by age 35. It’s an achievable goal for someone who starts saving at age 25.

Is it smart to split 401k and Roth?

It eliminates some risk. In this case, if you split your retirement savings between a traditional 401(k) and a Roth 401(k), you would pay half the taxes now, at the lower tax rate, and half when you retire, if rates could be higher or lower.

Should I split between Roth and 401k? In most cases, your tax situation should determine which type of 401(k) you should choose. If you’re in a low tax bracket now and expect to be in a higher tax bracket when you retire, a Roth 401(k) makes the most sense. If you’re in a high tax bracket now, the traditional 401(k) might be a better option.

Should I split my retirement contributions?

Depending on your income, it may make sense to start with a Roth 401(k) if you are in the lower tax brackets. But what if you later move to a middle tax bracket? If you expect your income to stay about the same in retirement, split contributions offer a diversified tax strategy.

Should I do both Roth and traditional 401k?

The good news is that it is often possible to contribute to both a traditional and a Roth 401(k). With no one knowing what future tax rates will apply, diversifying with contributions to both a traditional 401(k) and Roth could be a way to hedge your tax bets with your retirement savings.

Why should I split my retirement into different accounts?

One of the main benefits of pooling retirement savings in one pool – or as few accounts as possible – is behavioral: it reduces an investor’s oversight responsibilities. The more accounts, the more choices, and it’s cognitively harder for people to deal with.

Is it smart to have a 401k and a Roth?

By contributing to both a 401(k) and Roth IRA, you can maximize your retirement savings and enjoy tax benefits. With a 401(k) account, you’re contributing money that you haven’t yet paid taxes on. Your employer can also contribute up to a certain percentage of your annual income.

What are the benefits of having a 401k and Roth IRA?

Contributions to a 401(k) are pretax, meaning they reduce your income before your taxes are deducted from your paycheck. Conversely, there is no tax deduction for contributions to a Roth IRA, but contributions can be deducted tax-free in retirement.

Should I have both a Roth IRA and 401k?

Investing your money in both a 401(k) plan and a Roth IRA gives you the perfect mix of tax savings — some now and some in the future. Roth IRA savings are made with after-tax dollars, so there is no conflict between this type of plan and a traditional 401(k) funded with pre-tax dollars.

Is it better to put more in 401k or Roth IRA?

If you’re wondering whether it’s better to contribute to a 401(k) or a Roth IRA, don’t because you should invest in both. Experts agree that if you are authorized by one at work, the first account you should use should be a 401(k).

How much should I contribute to my 401k and Roth IRA?

Save at least that percentage if your employer covers your 401(k) contributions. A good rule of thumb is to save 10% to 15% of your pre-tax income. Consider maximizing a Roth IRA after you reach this point, or at least putting as much as possible into this type of account throughout the year.

How much should I have in my 401k at 30?

Pension plan provider Fidelity recommends that by age 30, you have the equivalent of your salary saved. That means if your annual salary is $50,000, you should aim to have $50,000 in retirement savings by 30. While that can be a daunting number, start by saving what you can.

On average, how much do 30-year-olds save? The latest Fed numbers show that the average savings for the 30-year-old age group is $11,250. The average saving is $3,240. If you’re in your 30s, you may have some benefits that could help increase your savings.

How much should I have in my 401k at 35?

To answer the question, we think a reasonable goal is to save one to one and a half times your income for retirement by age 35. It’s an achievable goal for someone who starts saving at age 25. For example, a 35-year-old earning $60,000 would be on track if she had about $60,000 to $90,000 in savings.

What should net worth be at 35?

By age 35, your net worth should be roughly 4 times your annual expenses. Alternatively, by age 35 your net worth should be at least twice your annual income. Given the median household income of about $68,000 in 2021, the above-average household should have net worth of about $136,000 or more.

How much retirement savings should I have at 35?

By the time you’re 35, you should have saved at least four times your annual spending. Alternatively, you should have at least four times your annual expenses as net worth. In other words, if you’re spending $60,000 a year to live by age 35, you should have at least $240,000 in savings or a net worth of at least $240,000.

Sources :