How do you pay taxes on a Roth conversion?

The conversion will place $20,000 of ordinary income on line 4b of your 2022 Form 1040. If you hold 15%, $17,000 goes to your Roth IRA account and $3,000 goes to Uncle Sam. Instead you can choose not to withhold taxes and pay $3,000 directly to the Treasury from a taxable (non-retirement) account.

How do I avoid taxes on a Roth IRA conversion? If you start a Roth IRA with a conversion and earn a substantial investment return and then decide to empty your account within five years of setting up your first Roth IRA, you will not owe ordinary income tax on the converted money because you already paid it in the conversion.

When should you pay taxes on a Roth conversion?

So when you make a withdrawal, you don’t have to pay taxes on the money as long as you follow the rules. A Roth IRA must be granted before you can make a withdrawal. You must wait five tax years after your first IRA contribution to withdraw the money.

Do I need to report a Roth conversion on my taxes?

You will receive two tax documents if you convert your traditional IRA to a Roth IRA, and you must report the conversion in two places on your tax return. You will receive a Form 1099-R from your financial institution reporting the Roth conversion. This will be coded as a rollover to a Roth IRA.

How do I avoid tax penalty on Roth conversion?

But there’s a safe harbor rule designed for people like you who are experiencing unusual income spikes: As long as you paid at least 100% of last year’s tax bill (or 110% if your adjusted gross income was $150,000 or more), you ‘ll avoid underpayment penalties.

How much tax will I pay on a Roth conversion?

How Much Tax Will You Pay on a Convertible Roth IRA? Let’s say you are in the 22% tax bracket and converting $20,000. Your income for the tax year will increase by $20,000. Assuming that this doesn’t push you to a higher tax bracket, you’ll owe $4,400 in taxes on the conversion.

What is the downside of Roth conversion?

Paying income tax at the time of conversion, which can be substantial, is the main disadvantage of converting to a Roth IRA. If you anticipate lower income tax rates in the future, there may not be any tax benefit to converting a Roth IRA.

How do I avoid taxes on a Roth IRA conversion?

Reduce adjusted gross income If you’re planning a Roth conversion, you might consider reducing your adjusted gross income by contributing more to your pre-tax 401(k) plan, suggests Lawrence. You can also take advantage of what is called tax-loss harvesting, offsetting gains with losses, in a taxable account.

Do you pay state taxes on a Roth conversion?

But converting money from a 401(k) or IRA to a Roth IRA triggers not only federal income taxes but also taxable income in the state in which you currently reside.

What taxes do you pay on Roth conversion?

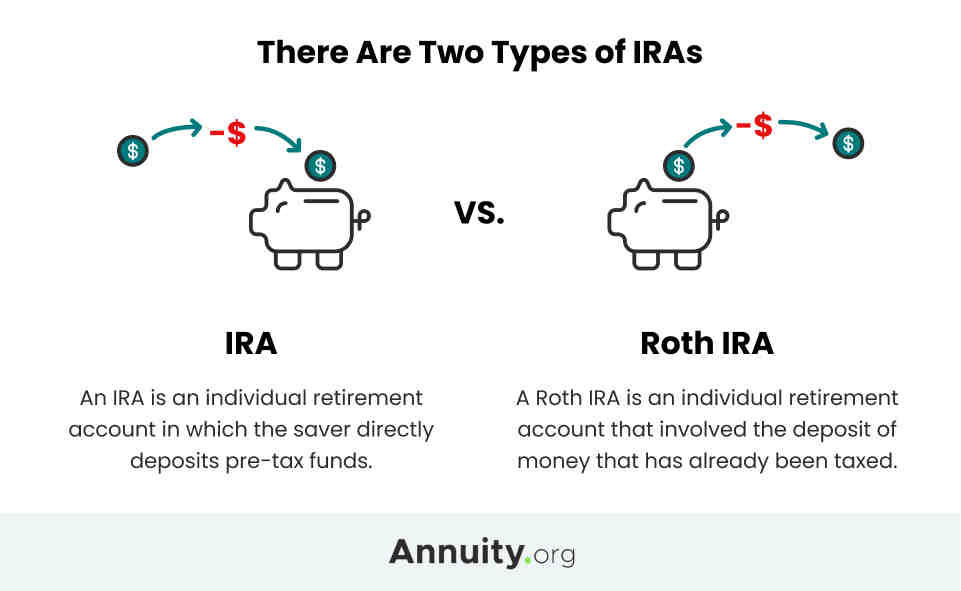

The money you pay and the money you earn are both taxable. Roth IRA contributions do not offer up-front tax breaks, but withdrawals in retirement are tax-free. 1.

Which states do not tax Roth conversions?

Nine of the states do not tax retirement plan income simply because distributions from the retirement plan are considered income, and these nine states have no state income tax at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Is a Roth 401k worth it?

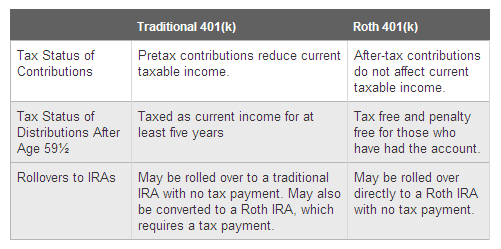

Taxes are a major consideration in deciding on a Roth 401(k) over a traditional 401(k). If you’re young and currently in a lower tax bracket but you hope to be in a higher tax bracket when you retire, then a Roth 401(k) can be a better deal than a traditional 401(k).

Is a Roth 401k better than a traditional 401k? Contributions to a Roth 401(k) can squeeze your budget even harder today because after-tax contributions take a bigger bite out of your paycheck than pre-tax contributions for a traditional 401(k). Roth accounts can be more valuable in retirement.

What are the disadvantages of a Roth 401k?

3 Disadvantages of Saving for Retirement at a Roth 401(k)

- Tax bracket risk. When you put money into a Roth account (whether 401(k) or IRA), you are betting — that is, that your tax bracket will be higher than it is now. …

- RMD is still playing. …

- Fewer investment options.

Can you lose money in a Roth 401k?

You can mix and match options to reach a level of risk that you are comfortable with taking. You could also lose money on a Roth 401(k) if you break the rules and take the early distribution. If you are considering withdrawing some money early, check with the fund manager to see if you may owe a tax penalty.

Is Roth 401k a good idea?

comes retirement, depending on your tax bracket. That means you have to save more to fund your retirement cash flow. If you are young and believe that you will earn more and be in a higher tax bracket in the future, a Roth 401(k) may be a good choice.

Is a Roth 401k a good idea?

comes retirement, depending on your tax bracket. That means you have to save more to fund your retirement cash flow. If you are young and believe that you will earn more and be in a higher tax bracket in the future, a Roth 401(k) may be a good choice.

What is the downside of a Roth 401k?

The biggest disadvantage of a Roth 401(k) for many people is that you pay taxes on contributions. For some, tax-free withdrawals and earnings may more than offset this, but for others, it may not be worth it.

Is it better to do a Roth or traditional 401k?

If you expect to be in a lower tax bracket in retirement, a traditional 401(k) may make more sense than a Roth account. But if you’re in a lower tax bracket now and believe you’ll be in a higher tax bracket when you retire, a Roth 401(k) may be a better choice.

Is it smart to have a 401k and a Roth?

Contributing to a 401(k) and Roth IRA allows you to maximize your retirement savings and benefit from tax advantages. With a 401(k) account, you’ll be donating money that you haven’t paid taxes on yet. Your employer may also match contributions up to a certain percentage of your annual income.

Is it better to put more in 401k or Roth IRA?

If you’re wondering whether it’s better to contribute to a 401(k) or a Roth IRA, don’t because you should invest in both. Experts agree that the first account you should take advantage of is a 401(k), if you qualify through it at your job.

Does it make sense to have a Roth and traditional 401k?

If you’ve funded a traditional 401(k), it makes sense to add a Roth plan to the mix. It’s actually worth it not to keep all your eggs in one retirement basket, even if it makes the most financial sense right now. That’s because having both plans will give you flexibility later.

Where should I put my 401k money after retirement?

In general, retirees with a 401(k) are left with the following options — leave your money in the plan until you reach the minimum required distribution age (RMD), convert the account to an individual retirement account (IRA), or start disbursing via lump-sum distribution, installment payments, or…

Should I put my 401k into an IRA after retirement? For many people, rolling their 401(k) account balance into an IRA is the best option. By rolling your 401(k) money into an IRA, you will avoid direct taxes and your retirement savings will continue to grow tax-deferred.

Should I move my 401k after retirement?

If your 401(k) plan has a cost-effective investment option, there may be little reason to move your money. “If they work for a large company, the company, because of economies of scale, can usually negotiate fees and expenses for a very low 401(k) plan for participants in the plan,” says M.

How long do you have to move your 401k after retirement?

How long do you have to roll over a 401(k)? If the distribution is made directly to you from your retirement plan, you have 60 days from the “date you receive” the retirement plan distribution to roll it into another plan or IRA, according to the IRS.

Can I move my 401k after I retire?

When you retire or leave your job for any reason, you have the right to transfer your 401(k) assets to an IRA. You have a number of immediate rollover options: Roll out your traditional 401(k) to a traditional IRA. You can roll up your traditional 401(k) assets into a new or existing traditional IRA.

Where should I put my retirement money after I retire?

Roll over to an IRA. This option can also retain the tax-deferred advantage of a lump-sum distribution while offering a range of investment options. Alternatively, you can invest part or all of the lump-sum rollover in an annuity. It can provide you with a guaranteed income stream throughout your retirement.

What is the safest retirement fund?

No investment is completely safe, but there are five (bank savings accounts, CDs, Treasury securities, money market accounts, and fixed annuities) that are considered the safest investments you can have. Bank savings accounts and CDs are usually FDIC insured. Treasury securities are government-backed notes.

Where should a retiree put their money?

You can mix and match these investments to suit your income needs and risk tolerance.

- Immediate Fixed Annuity. …

- Systematic withdrawal. …

- Buy Bonds. …

- Shares Paying Dividends. …

- Life insurance. …

- Home Equity. …

- Income Generating Properties. …

- Real Estate Investment Trusts (REITs)

Where is the safest place to put my 401k money?

The safest place to put your retirement funds is in low-risk investments and guaranteed growth savings options. Low-risk investment and savings options include fixed annuities, savings accounts, CDs, treasury securities, and money market accounts. Of these, fixed annuities usually provide the best interest rate.

Should I move my 401k to a stable value fund?

A stable value mutual fund is an excellent choice for conservative investors and those with relatively short maturities, such as workers nearing retirement. These funds will provide income with minimal risk and can serve to stabilize the rest of the investor’s portfolio to some extent.

What happens to 401k if stock market crashes?

Can You Lose Your 401(k) If The Market Crashes? While a 401(k) can be a great way to save for retirement, it’s important to understand how it works. Your 401(k) is invested in stocks, meaning your account value may go up or down depending on the market. If the market goes down, you could lose money in your 401(k).

How do I avoid taxes on my 401k withdrawal?

The easiest way to borrow from your 401(k) without paying taxes is to roll the funds into a new retirement account. You can do this when, for example, you leave your job and move funds from your previous employer’s 401(k) plan to a plan sponsored by your new employer.

Do I have to pay taxes on my 401k after age 65? When you withdraw funds from a 401(k)—or “take a distribution,” in IRS parlance—you start enjoying the income from this retirement flagship and face the tax consequences. For most people, and with most 401(k)s, distributions are taxed as ordinary income.

How much in taxes do you pay on a 401k withdrawal?

The IRS generally requires an automatic withholding of 20% of the initial 401(k) withdrawal for taxes. So, if you withdraw $10,000 in your 401(k) at age 40, you may only have earned about $8,000. The IRS will penalize you.

What is the tax rate for withdrawing from a 401k after 65?

The good news is, at 65, you don’t have to worry about paying a fine for distribution. You may be required to pay an early withdrawal fine of “10 percent” if you are under “59 years old”.

How do I avoid tax penalty on 401k withdrawal?

Here’s how to make a penalty-free withdrawal from your IRA or 401(k)

- Unpaid medical bills. …

- Disability. …

- Health insurance premiums. …

- Dead. …

- If you owe the IRS. …

- First time home buyer. …

- Higher education costs. …

- For income purposes.

How can I avoid 10 penalty on 401k withdrawal?

Leave money in your 401(k). Workers who leave their jobs in the year they are 55 or older can withdraw money from their 401(k) without paying a 10% fine. Eligible public safety employees can start taking penalty-free withdrawals if they leave service in the year they are 50 years old or older.

What happens if you pull money out of your 401k?

If you withdraw funds earlier than your 401(k), you will be subject to a 10% penalty. You will also need to pay an income tax rate on the amount you withdraw, as the pre-tax money is used to fund the account. In short, if you withdraw your pension early, the money will be treated as income.

When can I withdraw from my 401k without paying taxes?

Once you are 59 years old, you can withdraw your money without having to pay an early withdrawal penalty. You can choose the traditional or Roth 401(k) plan. Traditional 401(k)s offer deferred tax savings, but you still have to pay taxes when you collect the money.

How can I avoid paying 20% tax on my 401k?

Deferring Social Security payments, rolling out old 401(k)s, setting up an IRA to avoid the mandatory 20% federal income tax, and keeping your capital gains tax low are among the best strategies for reducing taxes on your 401(k) withdrawals.

Do I pay taxes on 401k withdrawal after age 62?

Distributions in retirement are taxed as ordinary income. There is no tax on eligible distributions in retirement. Withdrawals of contributions and income are taxed. Distributions can be penalized if taken before age 59, unless you meet one of the IRS exemptions.