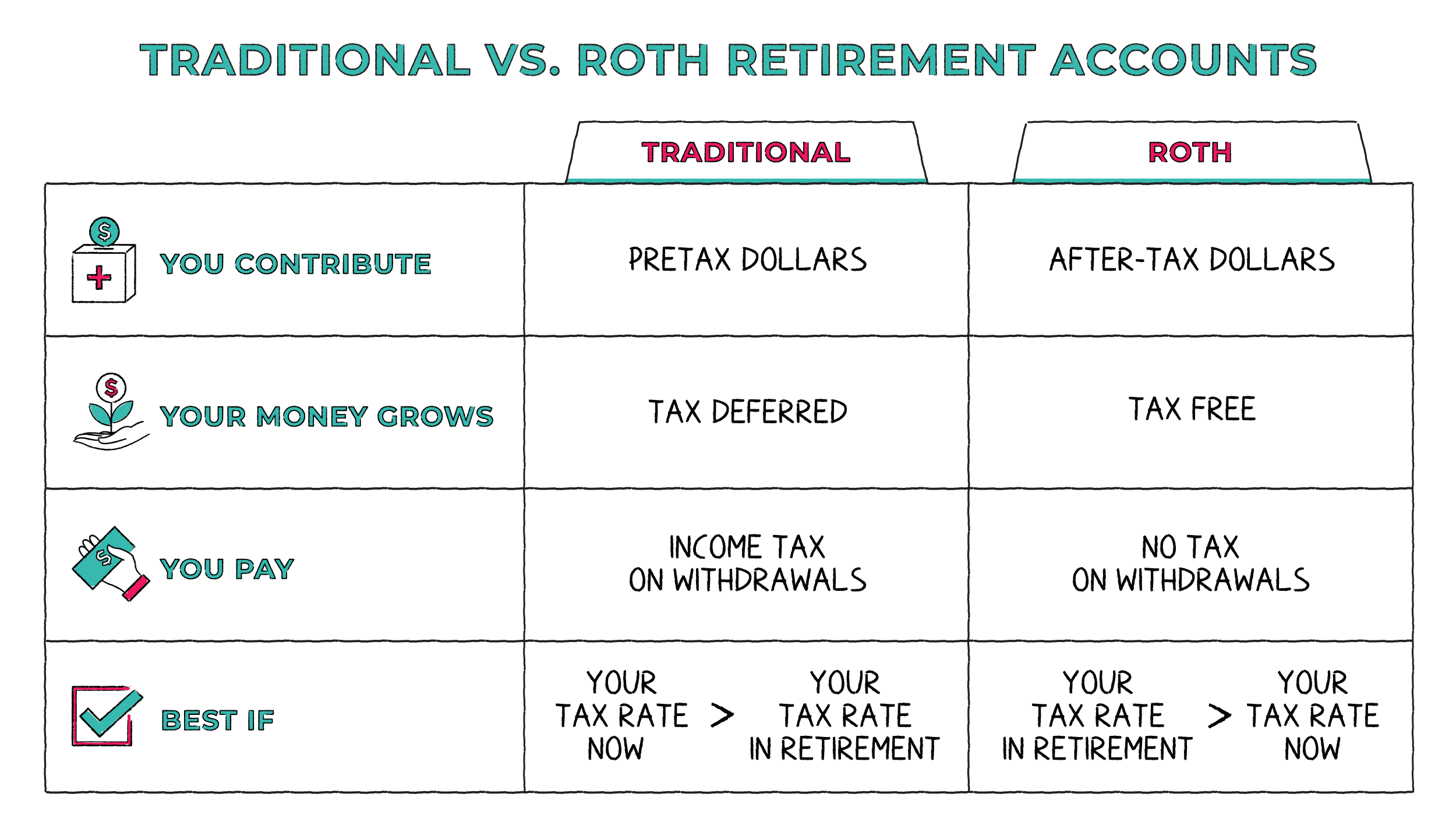

A Roth IRA is good for taxpayers who expect to be in a higher tax bracket during retirement. You can pay taxes today when your tax rate is low, then enjoy tax-free withdrawals when your tax rate is high in retirement.

Should I split my 401k contribution between Roth and traditional?

In most cases, your tax situation should dictate which type of 401(k) you should choose. If you are in a low tax bracket now and expect to be in a higher position after you retire, a Roth 401(k) makes a lot of sense. If you’re in a high tax bracket right now, a traditional 401(k) may be the best option.

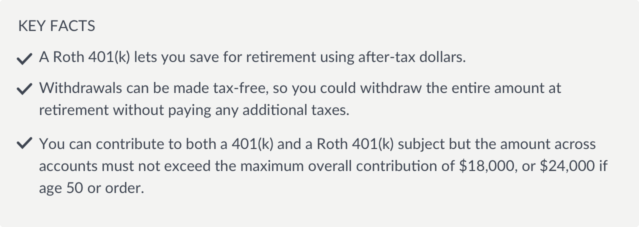

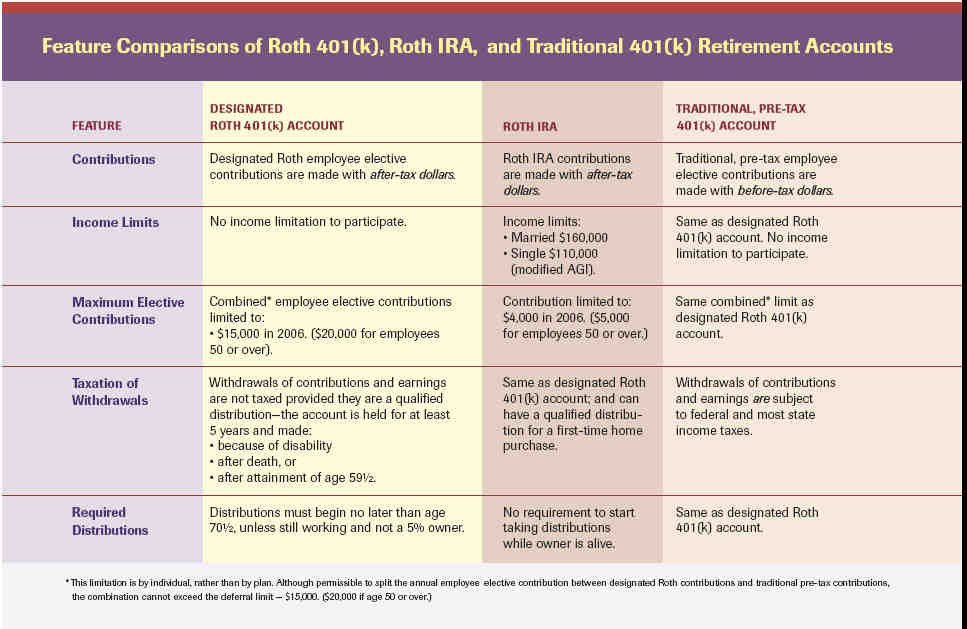

Can you contribute to a Roth and a traditional 401k at the same time? The good news is that it is often possible to contribute to traditional and Roth 401(k) plans. Since no one knows what future tax rates will be, switching contributions to a 401(k) and a traditional Roth may be a way to limit your tax liability. your retirement income.

Can I contribute to a Roth IRA and a Roth 401k and a traditional 401k?

You can have a 401(k) and a Roth IRA at the same time. Both contributions are not only permissible but can be an effective retirement savings strategy. However, there are income and contribution limits that determine whether you are eligible to contribute to both types of accounts.

How much can I contribute to a Roth 401k and a traditional 401k?

You can contribute up to $20,500 to a Roth 401(k) in 2022 at the same amount as a traditional 401(k). 9 If you are 50 or older, you can contribute up to $6,500 as a catch-up contribution.

Can you invest in a Roth 401k and a Roth IRA at the same time?

It is possible to have a Roth IRA and a Roth 401(k) at the same time. However, keep in mind that a Roth 401(k) must be offered by your employer in order to participate. Meanwhile, anyone with income (or any spouse whose spouse has earned income) can open an IRA, subject to specified income limits.

Should I contribute to both traditional and Roth?

It may be worth it to contribute to both a traditional and a Roth IRA – if you can. Doing so will give you both taxable and tax-free retirement options. Financial planners call these types of taxes, and they’re often a smart strategy when you’re not sure what your tax picture will look like when you retire.

Should I contribute to my Roth or traditional?

Bottom line If you expect future tax rates to rise, either because your wealth and income will be higher in retirement or a change in tax law, consider Roth accounts. Also, be sure to talk to your CPA or tax professional about whether a traditional or Roth IRA—or both—makes sense for you.

Can I contribute to both a traditional and a Roth IRA?

Can You Contribute to a Roth and Traditional IRA in the Same Year? Yes, you can contribute to as many types of IRAs as you like. Opening multiple accounts, however, does not mean you can contribute more in total—the contribution guidelines apply to all accounts.

Should I do both 401k and Roth IRA?

Making your 401(k) and IRA work together If your 401(k) has limited investment options, consider opening a traditional or Roth IRA and contributing most of the year. Next, if you can, put more money into your company’s project until you use it up.

How much can you contribute to a 401k and a Roth IRA in the same year?

You can contribute up to $20,500 in 2022 to a 401(k) plan. If you are 50 or older, the maximum annual contribution increases to $27,000. You can contribute up to $6,000 to a Roth IRA in 2022. That jumps to $7,000 if you’re 50 or older.

Should I have both a Roth IRA and 401k?

Putting your money into a 401(k) plan and a Roth IRA offers the perfect combination of tax savings — some now and some in the future. A Roth IRA is funded with post-tax dollars, so there is no conflict between this type of plan and a traditional 401(k), which is funded with pre-tax dollars.

Should I convert my 401k to a Roth 401k?

Converting all or part of a traditional 401(k) to a Roth 401(k) can be a smart move for some, especially young people or those at the top of their careers. If you believe you will be in a higher tax bracket in retirement than you are now, the change may save you money.

Is it better to contribute to a 401k or a Roth 401k? Contributions to a Roth 401(k) can hit your budget hard today because an after-tax contribution takes a larger amount out of your paycheck than a pre-tax contribution to a traditional 401(k). A Roth account can be very valuable in retirement.

Should I roll over my 401k to a Roth 401k?

Should I convert my 401(k) to a Roth IRA? Converting a 401(k) to a Roth IRA may make sense if you believe you’ll be in a higher tax bracket in the future, since withdrawals are tax-free. But you will owe tax in the year the change takes place. You will need to crunch the numbers to make a wise decision.

Is there a downside to Roth 401k?

Tax bracket risk When you put money into a Roth account (whether it’s a 401(k) or an IRA), you’re gambling — that is, that your tax bracket is higher than it actually is. now. Your goal should be to pay taxes on your income when your interest rate is as low as possible.

Can I roll my 401k into a Roth 401k?

Fortunately, the clear answer is “yes.†You can roll your 401(k) into a Roth IRA instead of a traditional IRA. Choosing to do so only adds a few steps to the process. Whenever you retire, you have a decision to make about your 401k plan.

Is there a downside to Roth 401k?

Tax bracket risk When you put money into a Roth account (whether it’s a 401(k) or an IRA), you’re gambling — that is, that your tax bracket is higher than it actually is. now. Your goal should be to pay taxes on your income when your interest rate is as low as possible.

Is it worth doing Roth 401k?

Taxes are a more important consideration when it comes to deciding on a Roth 401(k) than a traditional 401(k). If you are young and currently in a low tax bracket but expect to be in a high tax bracket when you retire, then a Roth 401(k) may be a better option than a traditional 401(k ).

What are the disadvantages of a Roth 401k?

3 Disadvantages of Saving for Retirement with a Roth 401(k)

- Tax bracket risk. When you put money into a Roth account (whether it’s a 401(k) or an IRA), you’re gambling — namely, that your tax bill will be higher than it is now. …

- RMDs are still in play. …

- Limited investment options.

Is converting a 401k to Roth a good idea?

But unlike a 401(k), it offers tax and penalty relief. If you plan to become financially independent before retirement age, or if you want to minimize the taxes you will owe later in life, converting a 401(k) to a Roth IRA may be a wise strategy. .

What are the disadvantages of Roth IRA?

Important Points One important point: Roth IRA contributions are made on an after-tax basis, meaning there is no tax deduction in the year of the contribution. Another drawback is that withdrawals of account earnings do not have to be made until at least five years have passed since the initial contribution.

Does it make sense to convert IRA to Roth after retirement?

If you’re nearing retirement or need the money from an IRA to survive, it’s a no-brainer to convert to a Roth. Because you pay taxes on your investments, converting to a Roth costs money. It takes a number of years before your down payment can be justified by the tax savings.

Where is the safest place to put your retirement money?

The safest place to put your retirement money is in low-risk investments and savings options with guaranteed growth. Low-risk investment and savings options include fixed annuities, savings accounts, CDs, treasuries, and money market accounts. Of these, fixed annuities usually offer the best interest rates.

Where should I put my 401k money after retirement? Generally, retirees with a 401(k) are left with the following options—leave your money in the plan until you reach the age of required RMDs), convert the account to an individual account individual retirement account (IRA), or start withdrawing money by making large contributions, paying in installments, or …

Where should I keep retirement savings?

Where should I put my pension money?

- You can contribute to a retirement account provided by your employer, such as a 401(k) or 403(b) plan. …

- You can put money into a tax-advantaged retirement account, like an IRA.

Where should I put my 401k money after retirement?

If your 401(k) allows you to set up a regular income or repayment plan, then it may make sense to keep your money in the plan. “If your 401(k) doesn’t allow you to make periodic payments, consider rolling your savings over to an IRA.â€

Where should I put my retirement money after I retire?

Roll it over to an IRA. This option can also preserve the tax-deductible advantage of capital distributions while providing a wide range of investment options. Alternatively, you can invest some or all of the money in a year. That can give you a guaranteed income when you retire.

What is the safest retirement fund?

No investment is completely safe, but there are five (bank savings accounts, CDs, treasuries, money market accounts, and fixed annuities) that are considered it is the safest investment you can have. Bank savings accounts and CDs are usually FDIC insured. Treasury securities are government-backed securities.

Do employers match Roth 401k?

Yes, your employer can match contributions to your designated Roth contributions.

Do most companies accept Roth 401k? This explains the misconception that employers don’t match Roth 401(k) contributions. The truth is, employers match Roth 401(k) contributions, but these contributions are placed in a separate 401(k) account.

Do most companies match Roth contributions?

Can you get matching contributions for your Roth 401(k)? Some companies will offer to match their employees’ Roth 401(k) contributions. With matching contributions for a regular 401(k), the employer matches the employer’s contributions, usually between 2% and 5% of the individual’s paycheck.

Do companies match Roth or traditional?

The company can make matching contributions to the employee’s Roth 401(k) account. As long as the company offers a match, you will receive a company match at the same rate that the employer matches traditional 401(k) contributions.

Does employer match go to Roth or traditional 401k?

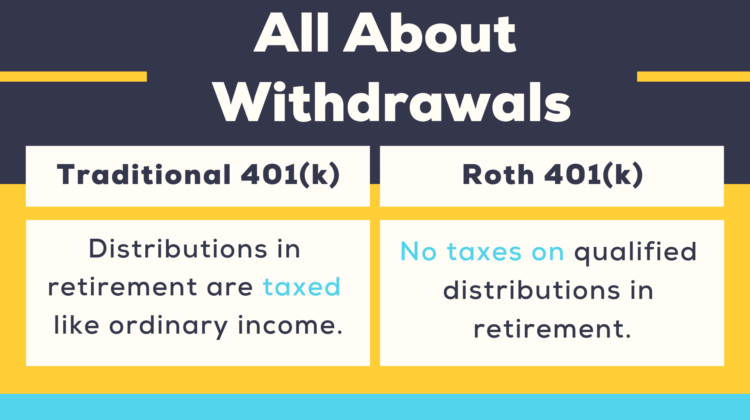

Matches with Roth 401(k)s As a result, the matching funds your employer contributes to a Roth 401(k) (and any earnings on those funds) will be taxed as ordinary income when you withdraw them. .

Does employer match go to Roth or traditional 401k?

Matches with Roth 401(k)s As a result, the matching funds your employer contributes to a Roth 401(k) (and any earnings on those funds) will be taxed as ordinary income when you withdraw them. .

Is employer 401k match Roth or traditional?

As long as the company offers a match, you will receive a company match at the same rate that the employer matches traditional 401(k) contributions. However, the employer will add matching contributions to a separate pre-tax 401(k) account, not to a Roth 401(k) account.