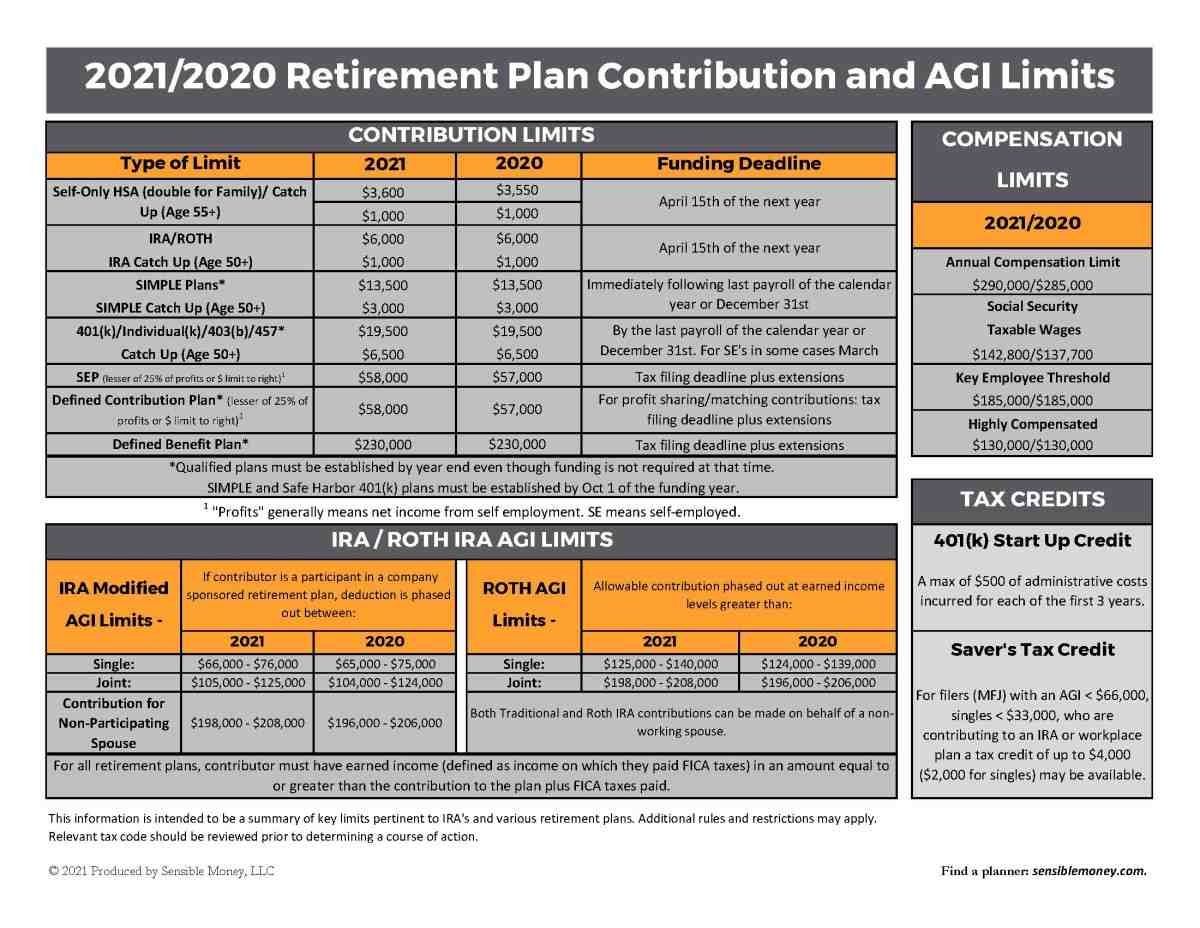

If your employer makes matching contributions, their payments will automatically stop when yours do. So, if you reach your $18,500 before the last paycheck of the year, your employer matching payments will stop before the end of the year and you may not get your full match.

Which retirement account should I use first?

Key Takeaways Managing cash flows and withdrawals in retirement should include budgeting for expenses and a distribution plan such as the 4% rule. Taxable investment accounts should be tapped first during retirement, followed by tax-free investments, then tax-deferred accounts.

What is the order of retirement accounts? Table of contents

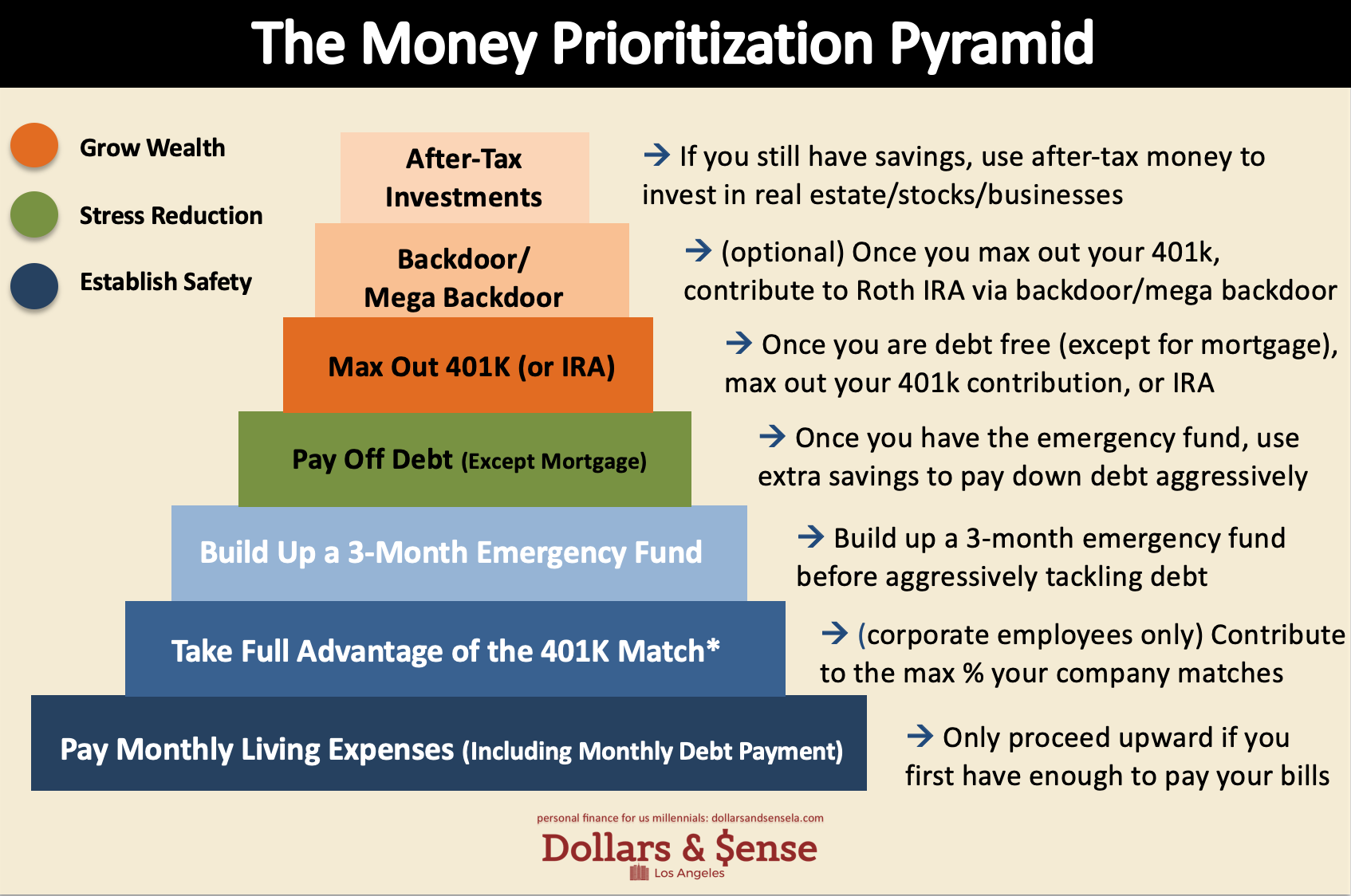

- The Order of Operations for Saving.

- Step 1 – Save in Your 401k (Until The Match)

- Step 2 – Keep The Maximum In Your IRA.

- Step 3 – Continue to Maximize Your 401k Contributions.

- Step 4 – Max Out Your HSA.

Is it better to have one retirement account or multiple?

As you work toward retirement, it’s generally advisable to have two retirement accounts – a traditional vehicle and a Roth-style vehicle. This framework is fairly easy to manage, and more importantly, it will allow you to maintain flexibility in taking income distributions in a tax-efficient manner.

Is it better to have all retirement money in one account?

Also, it’s generally best to keep your retirement money in one place; it’s easier to observe it that way. So, roll all your retirement accounts into an I.R.A. once you leave a company to simplify things, especially as you approach retirement.

How many retirement accounts is too much?

How many different investment accounts or retirement plans do you have? If it’s more than three, you could seriously jeopardize the long-term performance of your investments and undermine your retirement plan.

Is it better to withdraw from 401k or Roth IRA?

Contributions to a 401(k) are pre-tax, meaning they reduce your income before taxes are taken out of your paycheck. Conversely, there is no tax deduction for contributions to a Roth IRA, but contributions can be withdrawn tax-free in retirement.

Which accounts should I withdraw from first in retirement?

The first places you should generally withdraw from are your taxable brokerage accounts—your least tax-efficient accounts subject to capital gains and dividend taxes. By using these first, you give your tax-advantaged accounts (IRA, Roth IRA) more time to grow and compound.

Should I withdraw from Roth or 401k?

Traditionally, tax professionals suggest withdrawing first from taxable accounts, then tax-deferred accounts, and finally Roth accounts where withdrawals are tax-free. The goal is to allow tax-deferred assets to grow longer and faster.

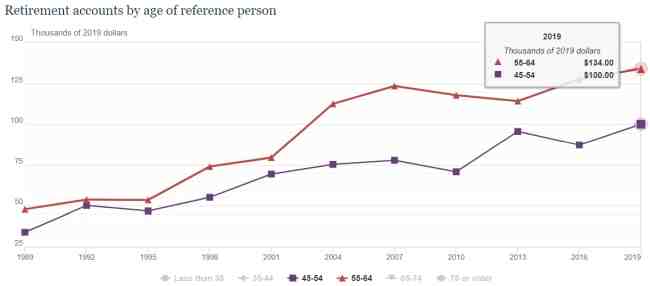

How much should I have in my 401k at 40?

Fidelity says by age 40, aim to have a multiple of three times your salary saved. That means if you earn $75,000, your retirement account balance should be around $225,000 by the time you turn 40. If your employer offers both a traditional and a Roth 401(k), you may want to split your savings between the two.

How much should you have saved for retirement by 40? To stay on track to retire at age 67, you should have saved 3 times your income by age 40, according to retirement plan provider Fidelity Investments.

What is a good 401k balance by age?

| Age | Average 401k Balance | Average 401k Balance |

|---|---|---|

| 20-29 | $14,600 | $4,500 |

| 30-39 | $51,200 | $18,400 |

| 40-49 | $120,200 | $37,600 |

| 50-59 | $206,100 | $62,700 |

What is the average 401K balance for a 50 year old?

Ages 50-59 Average 401(k) balance: $174,100. Median 401(k) balance: $60,900. This group has reached the age at which the IRS allows catch-up contributions: Participants age 50 and older can contribute an additional $6,000 per year in 2019.

How much should you have in 401K by 55?

Experts say you should have saved at least seven times your salary by age 55. That means if you earn $55,000 a year, you should have at least $385,000 saved for retirement. Remember that life is unpredictable… economic factors, medical care and how long you will live will also affect your retirement expenses.

How much should I have in my 401k at 35?

So, to answer the question, we believe that having one to one and a half times your income saved for retirement by age 35 is a reasonable goal. It’s an achievable goal for someone who starts saving at age 25. For example, a 35-year-old earning $60,000 would be on track if she saved about $60,000 to $90,000.

What should net worth be at 35? At age 35, your net worth should equal approximately 4X your annual expenses. Alternatively, your net worth at age 35 should be at least 2X your annual income. Considering the median household income is approximately $68,000 in 2021, the upper median household should have a net worth of approximately $136,000 or more.

How much retirement savings should I have at 35?

By the time you’re 35, you should have at least 4X your annual expenses saved. Alternatively, you should have at least 4X your annual expenses as your net worth. In other words, if you spend $60,000 a year to live on at age 35, you should have at least $240,000 in savings or have at least a $240,000 net worth.

Where should I be financially at 35?

By age 35, you should aim for your net worth to be equal to 5X your gross annual income. Your ultimate goal is to reach 20X your average annual income before you can consider yourself financially independent.

Is 35 too late for 401K?

Key Takeaways. It’s never too late to start saving money for your retirement. Starting at age 35 means you have 30 years to save for retirement, which will have a big compounding effect, especially in tax-sheltered retirement vehicles.

How much money should a 36 year old have in 401K?

Ages 35-44 Fidelity says by age 40, aim to have a multiple of three times your salary saved. That means if you earn $75,000, your retirement account balance should be around $225,000 by the time you turn 40.

Is it too late to start a 401K at 40?

It’s not too late to save for the future: If you start investing at 40, you’ll be “good for retirement,” says an expert. One in five Gen X Americans, who are between the ages of 41 and 56, want to increase their retirement savings, according to a recent survey.

How much should I have in my 401K by 36?

Given that the median age in America is about 36 years old, the average 36-year-old should have a 401(k) balance of about $121,700.

How much should you have in your 401K by age 30?

Assuming you’ve been working since you were 22 or 23, by 30, a great goal is to have a 401(k) or IRA equal to about one year’s salary. For example, if you earn $40,000 a year, you could try to have $40,000 saved for retirement.

How much should a 36 year old have in 401K?

| AGE | AVERAGE 401K BALANCE | MEDIAN 401K BALANCE |

|---|---|---|

| $6,718 | $2,240 | |

| 25-34 | $33,272 | $13,265 |

| 35-44 | $86,582 | $32,664 |

| 45-54 | $161,079 | $56,722 |

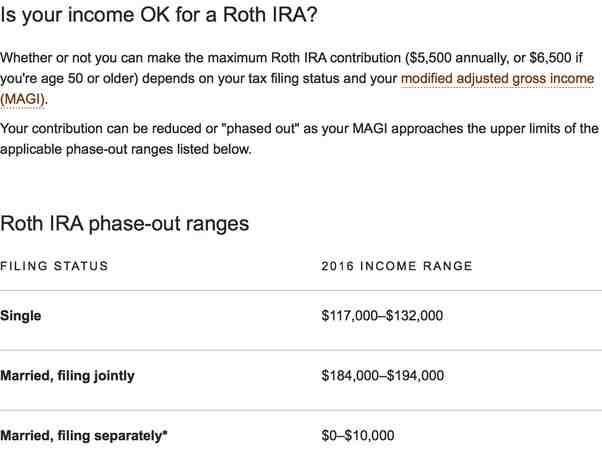

How much can a Roth IRA grow in 20 years?

How much will a Roth IRA grow in 20 years? While an initial deposit of $6,000 in a Roth IRA can grow to $23,218 in 20 years at a 7% annual return, it will grow much more if you continue to make monthly or annual contributions to the Roth IRA.

How much will an IRA grow in 10 years? The actual rate of return largely depends on the types of investments you choose. The Standard & Poor’s 500® (S&P 500®) for the 10 years ending December 31, 2016, had an annual compound return of 6.6%, including dividend reinvestment.

How much will an IRA be worth in 20 years?

You’ll save $148,268.75 over 20 years. If you are in a 28,000% tax bracket when you retire, this will be worth $106,753.50 after paying taxes. If you or your spouse retire before the age of 60, a 10% penalty will be applied. The penalty adjusted savings amount would be $91,926.63.

How much should my IRA grow each year?

Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you just opened a Roth IRA, $6,000 in contributions each year for 10 years at a 7% interest rate would accumulate $83,095. Wait another 30 years and the account will grow to more than $500,000.

How much does a Roth IRA grow in 30 years?

Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you just opened a Roth IRA, $6,000 in contributions each year for 10 years at a 7% interest rate would accumulate $83,095. Wait another 30 years and the account will grow to more than $500,000.

How long does it take to make a million dollars in a Roth IRA?

For those 50 and older, you can contribute up to $7,000 per year. But even with these increased contributions, it doesn’t take a math whiz to realize that it would take you 166 years to reach a million dollars in your Roth if you put in the maximum of $6,000 a year.

What is the average return on a Roth IRA over 30 years?

There are several factors that will affect how your money grows in a Roth IRA, including how diversified your portfolio is, what your timeline for withdrawal is, and how much risk you’re willing to take. That said, Roth IRA accounts have historically delivered between 7% and 10% average annual returns.

How much does Roth IRA increase per year?

There are several factors that will affect how your money grows in a Roth IRA, including how diversified your portfolio is, what your timeline for withdrawal is, and how much risk you’re willing to take. That said, Roth IRA accounts have historically delivered between 7% and 10% average annual returns.

How much will my Roth IRA grow?

The annual return is the amount that the investments in your Roth IRA make in a year. The Roth IRA calculator defaults to a 6% rate, which should be adjusted to reflect the expected annual return on your investments.

Does a Roth IRA always go up?

Do I have to continually contribute to my Roth IRA to keep it growing? Technically, no, but the rate of growth depends on when you start investing. If you start early, then you have the advantages of time and compound interest on your side. Even a modest contribution will grow over time.

Sources :