Can you have 2 Roth IRAs?

Can you have more than one Roth IRA? You can have more than one Roth IRA and can open more than one Roth IRA at any time. There is no limit to the number of Roth IRA accounts. No matter how many Roth IRAs you have, your total contributions cannot exceed the limits set by the government.

How Many Roth IRAs Can I Have? Although there is no limit to the number of Roth IRAs you can have, you cannot exceed the contribution limits set by the IRS. In this case, if you’re 53 and have two Roth IRA accounts, you can contribute a maximum of $3,500 to each, giving you a total IRS limit of $7,000.

Can you have 2 different Roth IRAs?

How Many Roth IRAs? There is no limit to the number of IRAs. You can even have multiple IRAs of the same type, which means you can have multiple Roth IRAs, SEP IRAs, and traditional IRAs. That said, increasing the number of IRAs doesn’t necessarily increase the amount you can contribute each year.

Is it good to have 2 Roth IRAs?

Benefits of having multiple IRAs. Having multiple IRAs can help you refine your tax minimization strategy and gain access to more investment options and greater account protection. Here are the pros of owning multiple IRAs: Tax Diversification: Different types of IRAs offer different tax advantages.

Can I have 2 different IRA accounts?

There is no limit to the number of IRA accounts, but your contributions must be within the annual limit for each account. Having multiple accounts gives you additional options when it comes to taxes, investments and withdrawals, but it can make managing your investment life a bit more complicated.

Does Roth 401k count towards limit?

Your employer’s contribution does not count towards your individual maximum allowable contribution, but it does count towards the overall limit.

Can you contribute to both a 401k and a Roth 401k? If your employer offers both, you can contribute to both a Roth 401(k) and a traditional 401(k). Your employer can also match both, but the funds in your traditional 401(k) go directly into your account, while in a Roth 401(k) they are deposited into a separate tax-deferred account.

Does a Roth 401k rollover to Roth IRA count towards contribution limit?

There are two ways to rollover a Roth 401(k) to another account and meet the five-year rule. The first is to rollover Roth 401(k) funds into an existing Roth IRA. Funds spent since opening the Roth IRA count toward this clock.

Do rollovers count towards Roth IRA contribution limits?

Key Takeaways Rollovers from a traditional retirement plan (such as a 401(k) or traditional IRA) to a Roth IRA are called conversions, and the amount transferred is taxable. There’s no limit to the amount you can roll over or convert to a Roth IRA.

Are Roth IRA and Roth 401k contribution limits separate?

Yes, the contribution limits for 401(k) plans are separate from the limit for IRAs. This means that those under 50 can invest up to $20,500 in 2022, plus another $6,000 through their IRA(s).

Are 401k and Roth 401k limits separate?

While the contribution limits are the same for traditional 401(k) plans and their Roth counterparts, a designated Roth 401(k) account is technically a separate account within your traditional 401(k) that allows you to make postpaid dollars.

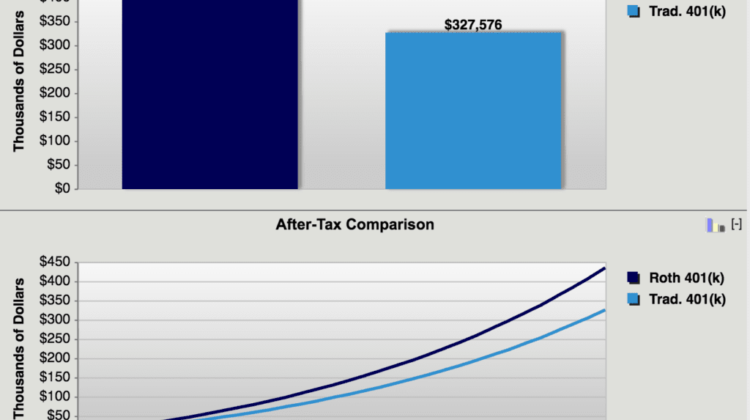

Should I invest in both traditional 401k and Roth 401k?

The good news is that it’s often possible to contribute to both a traditional and a Roth 401(k). Since no one knows what tax rates will be in the future, diversifying by contributing to both a traditional 401(k) and a Roth can be a way to hedge your tax contributions using your retirement savings.

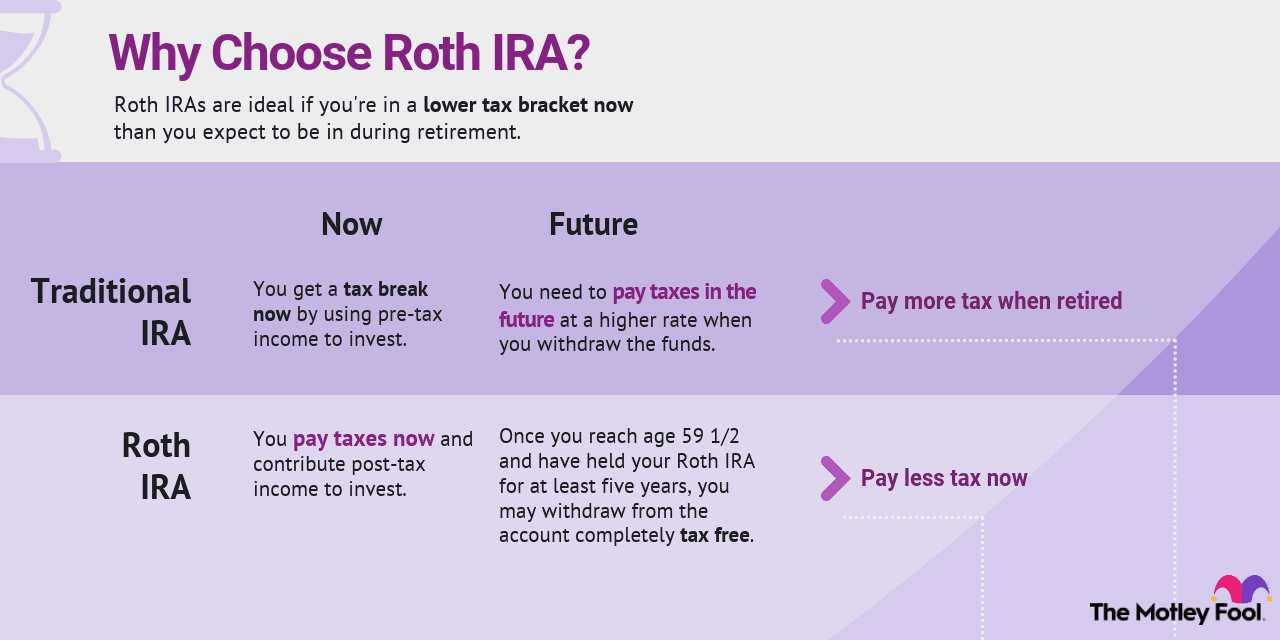

Should I split my 401k contribution between Roth and traditional?

In most cases, your tax situation should determine which type of 401(k) you choose. If you’re in a low tax bracket now and expect to be in a higher bracket after retirement, a Roth 401(k) makes the most sense. If you’re currently in a high tax bracket, a traditional 401(k) may be a better choice.

Should I contribute to Roth 401k or Roth IRA first?

First, you should save enough in your 401(k) to become a starting point for an employer match. Next, once you’ve received the full match, it makes sense to look at diversifying your taxes with a Roth IRA if you meet the income limits. If not, consider saving in your 401(k) Roth if your employer offers this option.

Why should you put money in a 401k first instead of a Roth IRA? 401(k) contributions are pre-tax, meaning they reduce your income before taxes are taken out of your paycheck. Conversely, contributions to a Roth IRA are not tax-deductible, but contributions can be withdrawn tax-free in retirement.

Should I contribute to both Roth 401k and Roth IRA?

Yes – it’s actually a good idea to diversify your retirement savings. Contributing to a 401(k), IRA, Roth IRA, and Roth 401(k) allows you to enjoy the benefits of both.

Can I contribute to both a Roth IRA and a Roth 401k?

Can you contribute to a 401(k) and a Roth Individual Retirement Account (Roth IRA) in the same year? Yes. Contributions to both plans can be made in the same year up to the permitted limits. However, you cannot max out both your Roth and traditional Individual Retirement Accounts (IRAs) in the same year.

Should I have a Roth 401k and a Roth IRA?

A Roth 401(k) is best for you. Both accounts are easy to set up, but your employer does most of the setup with a Roth 401(k), while you have to do the work yourself with a Roth IRA (some employers offer payroll deductions for IRAs). You want access to many different investments. A Roth IRA is best for you.

Should I max out my Roth 401k or Roth IRA first?

A rule of thumb for retirement savings is that you should first match your employer’s 401(k), then max out your Roth 401(k) or Roth IRA, and then go back to your 401(k).

Is it better to max out Roth IRA early?

Maxing out a Roth IRA can help you make the most of this retirement savings vehicle, but it may not make sense if you have competing financial priorities. Some experts recommend saving for an emergency fund, paying off high-interest debt and maxing out your employer’s 401(k) match before you tap into your Roth IRA.

Can I max out a Roth IRA and a Roth 401k?

Can you contribute to a 401(k) and a Roth Individual Retirement Account (Roth IRA) in the same year? Yes. Contributions to both plans can be made in the same year up to the permitted limits. However, you cannot max out both your Roth and traditional Individual Retirement Accounts (IRAs) in the same year.

Can you contribute to a Roth 401k and a Roth IRA at the same time?

You can have both a 401(k) and a Roth IRA at the same time. Contributing to both is not only permissible, but can be an effective retirement savings strategy. However, there are some income and contribution limits that determine your eligibility for both types of accounts.

How much can I contribute to a Roth IRA if I have a 401k?

In 2022, you can contribute up to $20,500 to a 401(k) plan. If you’re 50 or older, the maximum annual contribution increases to $27,000. You can also contribute up to $6,000 to a Roth IRA in 2022. If you’re 50 or older, that goes up to $7,000.

Can you contribute to a Roth IRA 401k and a Roth IRA and what is the maximum?

One financial strategy for those looking to maximize tax-advantaged savings: Open both types of Roth accounts. Between the two, you can invest up to $26,500 in a Roth 401(k) and Roth IRA, or even more if you hit the 50-year mark by the end of the year.

What is a good monthly retirement income?

But if you can supplement your retirement income with other savings or sources of income, $6,000 a month can be a good starting point for a comfortable retirement.

How much does the average pensioner live per month? Average pension costs by category. According to the Bureau of Labor Statistics, an American household headed by someone 65 and older spent an average of $48,791 a year, or $4,065.95 a month, from 2016 to 2020.

Is $150 000 a good retirement income?

While everyone’s income needs are different, experts say the average retiree needs to replace about 80% of their pre-retirement income with savings and Social Security benefits. Therefore, someone with an annual salary of $150,000 would need about $120,000 a year to maintain their lifestyle in retirement.

What is the average income to retire on?

| Age of the household | Median income | Average income |

|---|---|---|

| Households aged 50-54 | $89,389 | $125,837 |

| Households aged 55-59 | $82,430 | $116,191 |

| Households aged 60-64 | $66,803 | $96,996 |

| Households aged 65-69 | $57,992 | $87,920 |

What is considered a wealthy retirement?

One rule of thumb for what a person can comfortably retire on is 10 times their retirement age income. Schwab survey respondents had a median household income of $68,000, meaning the average retiree would need $680,000.

How much does the average person retire with?

On average, Americans have about $141,542 saved for retirement, according to “How America Will Save in 2022,” a report by Vanguard, an investment firm that represents more than 30 million investors. However, most people likely have far less: the average 401(k) balance is just $35,345.

What is the average nest egg in retirement?

Keys to take with you. American workers had an average of $95,600 in their 401(k) plans at the end of 2018, according to a major survey.

How much does the average 65 year old have in retirement savings?

Those who had retirement accounts did not have enough money. According to our research, 56-61 year olds have an average of $163,577. 65-74 year olds have even less. If that money were converted into a lifetime annuity, it would only be a few hundred dollars a month.

Sources :