What happens if I max out my Roth IRA?

By increasing your contributions each year and paying tax at your current tax rate, you eliminate the possibility of paying an even higher rate when you start withdrawing funds. Just as you diversify your investments, this move diversifies your future tax exposure.

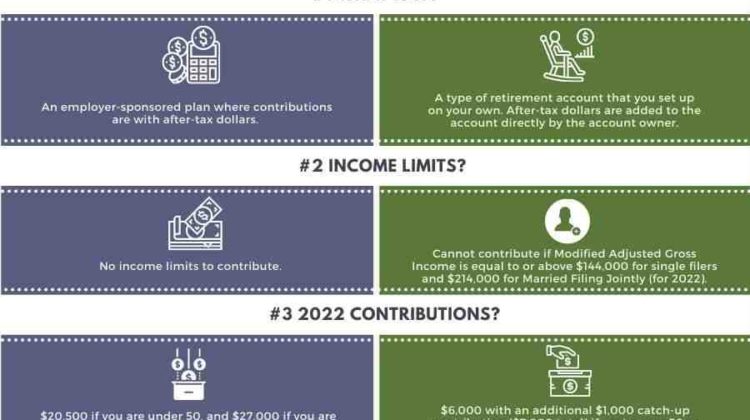

Is it a good idea to max out your Roth IRA? Maxing out your Roth IRA can help you make the most of this retirement savings vehicle, but it may not make sense if you have competing financial priorities. Some experts advise saving an emergency fund, paying off high-interest debt and maxing out your employer 401(k) before maxing out your Roth IRA.

What happens after you max out your Roth IRA?

Key Takeaways You can save for retirement through 401(k)s, Simplified Employee Pensions (SEPs), or Employee Incentive Savings Plans (SIMPLE), IRAs, or Health Savings Accounts (HSAs) if you’ve maxed out your Roth IRA contributions as long as you meet conditions.

Should I max out my Roth IRA right away?

When in doubt, be prudent: Don’t try to grow your IRA if you’ve racked up high-interest debt in the meantime or don’t have enough to cover your monthly expenses. Contribute whatever you can this year and resolve to increase that amount in the future.

What happens to a Roth IRA after exceed income limit?

You could contribute too much to your Roth IRA if your income unexpectedly jumps, making you ineligible for a full (or any) contribution. You can withdraw the money, recharacterize the Roth IRA as a traditional IRA, or apply your excess contributions to the Roth next year.

At what age do you not have to pay taxes on an IRA?

Because you pay taxes upfront on the money you invest in a Roth IRA, any returns your investment earns over the years are tax-free. Once you reach the age of 59 and a half and have had the account open for at least five years, you can withdraw any amount tax-free.

How Much Tax Do You Pay on IRA Withdrawals? Generally, early withdrawals from an Individual Retirement Account (IRA) before age 59½ are subject to inclusion in gross income plus a 10 percent additional tax penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay health insurance premiums after losing a job.

Do you have to pay taxes on an IRA after 70?

You must begin taking minimum withdrawals from your traditional IRA in the year you turn 70 1/2. The amount you withdraw at that point is taxed as ordinary income, but the funds that remain in your IRA continue to grow tax-deferred regardless of your age.

How do I avoid paying taxes on my IRA withdrawal?

9 Ways to Avoid Taxes on IRA Withdrawals

- Do not accept unqualified distributions early. …

- Use Rule 72(t) to avoid withdrawal penalties. …

- Don’t miss required minimum distributions. …

- Be careful where the distributions come from. …

- Roll over your IRA correctly. …

- Optimize your high growth investments. …

- Hire a professional.

What happens to my IRA when I turn 70?

You generally must start withdrawing funds from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you turn 72 (70 ½ if you turn 70 ½ before January 1, 2020). Roth IRAs do not require withdrawals until the death of the owner. You can withdraw more than the minimum required amount.

How can I avoid paying taxes on my IRA withdrawal?

You can use your annual contribution to your traditional IRA to reduce your current taxes because they can be directly deducted from your income. You can then use what you deposit into your Roth IRA as access to tax-free income in retirement.

How do I withdraw from my IRA tax free?

Funds must be redeemed within 120 days, and there is a pre-tax lifetime limit of $10,000. Some educational expenses for you and your immediate family are eligible. If you are disabled, you can withdraw IRA funds without penalty. If you die, there are no withdrawal penalties for your beneficiaries.

When can you withdraw from IRA without paying taxes?

You can avoid the early withdrawal penalty by waiting until at least 59 1/2 before you start taking distributions from your IRA. After you turn 59½, you can withdraw any amount from your IRA without paying the 10% penalty. However, regular income tax will still be payable on each IRA withdrawal.

At what age do you stop paying taxes on IRA withdrawals?

To withdraw your earnings, you must wait until you are 59½ or older and at least five years have passed since you first contributed to a Roth IRA to avoid taxes and penalties.

At what age can you withdraw from IRA without paying taxes?

You can avoid the early withdrawal penalty by waiting until at least 59 1/2 before you start taking distributions from your IRA. After you turn 59½, you can withdraw any amount from your IRA without paying the 10% penalty.

How can I avoid paying taxes on my IRA withdrawal?

9 Ways to Avoid Taxes on IRA Withdrawals

- Do not accept unqualified distributions early. …

- Use Rule 72(t) to avoid withdrawal penalties. …

- Don’t miss required minimum distributions. …

- Be careful where the distributions come from. …

- Roll over your IRA correctly. …

- Optimize your high growth investments. …

- Hire a professional.

What are the downsides of a Roth IRA?

Key Takeaways One key drawback: Roth IRA contributions are made with after-tax money, meaning there are no tax deductions in the year of contribution. Another disadvantage is that withdrawals of earnings from the account may not be made until at least five years have passed since the first contribution.

At what age does a Roth IRA not make sense? Unlike a traditional IRA, where contributions are not allowed after age 70½, you’re never too old to open a Roth IRA. As long as you’re still drawing earned income and breathing room, the IRS is OK with you opening and funding a Roth.

Can Roth IRAs lose money?

Yes, you can lose money in a Roth IRA. The most common causes of loss include: negative market fluctuations, early withdrawal penalties and insufficient time to collect. The good news is that the more time you let your Roth IRA grow, the less likely you are to lose money.

Can Roth IRA fail?

A payment that includes taxes or penalties is called a nonqualified distribution. Not understanding the difference between the two and withdrawing earnings too early is one of the most common Roth IRA mistakes.

What happens if a Roth IRA loses money?

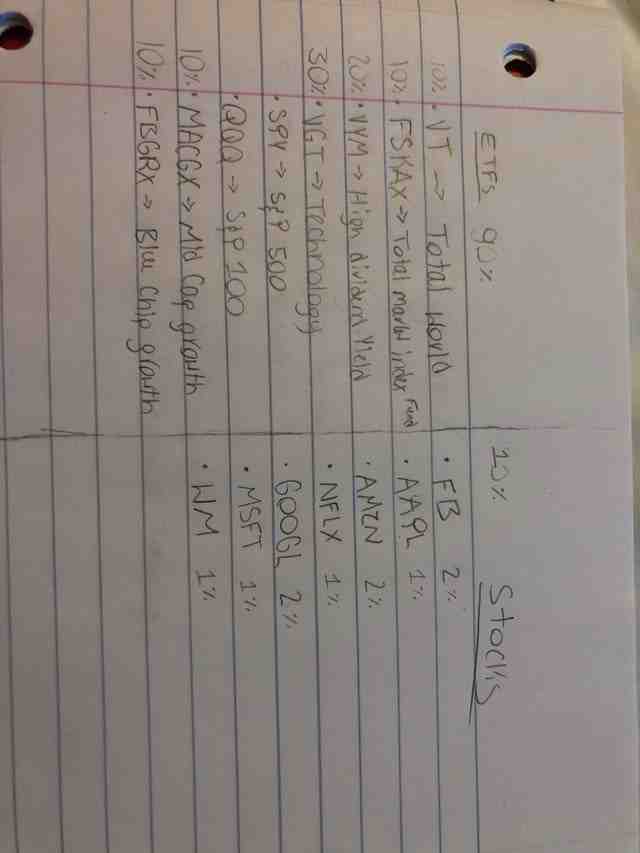

Some of the most important things you can do include: Diversify your IRA portfolio: One of the best ways to prevent losing money from your IRA is to diversify your IRA portfolio. By investing in a variety of different asset classes, you can minimize the risks associated with investing in an IRA.

What are the pro and cons of Roth IRA?

| Avg | Against |

|---|---|

| Tax-free payouts No mandatory payouts No maximum contribution age Ways to get it even if you don’t qualify Limited early distribution penalties | Contributions are taxed Income-based limits Limits on withdrawals Some retirees may not benefit |

Is a traditional IRA or Roth better?

A Roth IRA or 401(k) makes the most sense if you’re confident you’ll have more income in retirement than you do now. If you expect your income (and tax rate) to be lower in retirement than it is now, a traditional IRA or 401(k) is probably a better bet.

Who benefits from a Roth IRA?

A Roth IRA is a powerful retirement account available to Americans even if they don’t have an employer-sponsored retirement plan, such as a 401(k). That is, all working Americans have access to a plan that provides serious tax advantages for retirement savings.

Is having a Roth IRA worth it?

Roth IRA Benefits One of the best ways to save for retirement is a Roth IRA. These tax-advantaged accounts offer many benefits: You don’t get an upfront tax break (as with traditional IRAs), but your contributions and earnings grow tax-free. Payments during retirement are tax-free.

Is it better to have a 401k or a Roth IRA?

In many cases, a Roth IRA can be a better choice than a 401(k) retirement plan, as it offers a flexible, tax-advantaged investment vehicle, especially if you think you’ll be in a higher tax bracket later.

Does your money grow in a Roth IRA?

A Roth IRA increases in value over time by compounding interest. Whenever investments earn interest or dividends, that amount is added to the account balance. Account holders then earn interest on additional interest and dividends, a process that continues indefinitely.

What will my IRA be worth in 20 years?

Calculator Results You’ll save $148,268.75 over 20 years. If you are in the 28,000% tax bracket when you retire, that will be worth $106,753.50 after taxes. If you or your spouse retire before age 60, a 10% penalty will be charged. The penalty-adjusted savings amount would be $91,926.63.

How much can a Roth IRA grow in 20 years? How much will a Roth IRA grow in 20 years? While an initial deposit of $6,000 in a Roth IRA can grow to $23,218 in 20 years at an annual rate of return of 7%, it will grow much more if you continue to make monthly or annual contributions to a Roth IRA.

How much does an IRA grow in 10 years?

Typically, Roth IRAs generate average annual returns of 7-10%. For example, if you’re under 50 and just opened a Roth IRA, contributing $6,000 each year for 10 years at 7% interest would accumulate $83,095.

How much can I expect my IRA to grow?

Historically, with a properly diversified portfolio, an investor can expect between 7% to 10% average annual returns. Time horizon, risk tolerance and overall mix are important factors to consider when trying to project growth.

How much will an IRA grow in 30 years?

For example, by investing $6,000 a year in a stock index fund over 30 years with an average return of 10%, you could see your account grow to over $1 million (though be aware of the impact of investment fees).

How much can I expect my IRA to grow?

Historically, with a properly diversified portfolio, an investor can expect between 7% to 10% average annual returns. Time horizon, risk tolerance and overall mix are important factors to consider when trying to project growth.

Does your money grow in an IRA?

Your money will sit in your IRA growing and growing tax-free each year. You don’t pay taxes on the money you put into a traditional IRA until you withdraw it after you retire.

How much will an IRA grow in 10 years?

The actual rate of return depends largely on the types of investments you choose. The Standard & Poor’s 500® (S&P 500®) for the 10 years ended December 31, 2016 had an annualized rate of return of 6.6%, including dividend reinvestment.

How much will an IRA grow in 30 years?

For example, by investing $6,000 a year in a stock index fund over 30 years with an average return of 10%, you could see your account grow to over $1 million (though be aware of the impact of investment fees).

How much will my IRA be worth in 20 years?

You’ll save $148,268.75 over 20 years. If you are in the 28,000% tax bracket when you retire, that will be worth $106,753.50 after taxes. If you or your spouse retire before age 60, a 10% penalty will be charged. The penalty-adjusted savings amount would be $91,926.63.

How much does a Roth IRA grow in 30 years?

Typically, Roth IRAs generate average annual returns of 7-10%. For example, if you’re under 50 and just opened a Roth IRA, contributing $6,000 each year for 10 years at 7% interest would accumulate $83,095. Wait another 30 years and the bill will grow to more than $500,000.

Sources :