How much do I need in a Roth IRA to retire?

As a rough guide, for every $100 you withdraw each month, you need $30,000 in your IRA. If you withdraw $1,000, for example, this is 10 times 100, so you need 10 times $30,000, or $300,000 in the IRA.

At what age does a Roth IRA not make sense? Unlike traditional IRAs, where contributions aren’t allowed after age 70 ½, you’re never too old to open a Roth IRA. As long as you’re still drawing earned income and breathing room, the IRS is fine with you opening and funding a Roth.

How much do I need in my Roth 401k to retire?

Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income. These contributions can be made in a 401(k) plan, 401(k) match received from an employer, IRA, Roth IRA and/or taxable accounts.

How much does the average retiree have in the 401 K accounts when they retire?

Average 401(k) Balance at Retirement Many US workers retire by the time they reach 65. Vanguard data shows that the average 401(k) balance at retirement is $255,151, while the average balance is $82,297.

What is the average 401k balance for a 65 year old?

| Years old | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| 65 | $279,997 | $87,725 |

Is Roth IRA good for retirement?

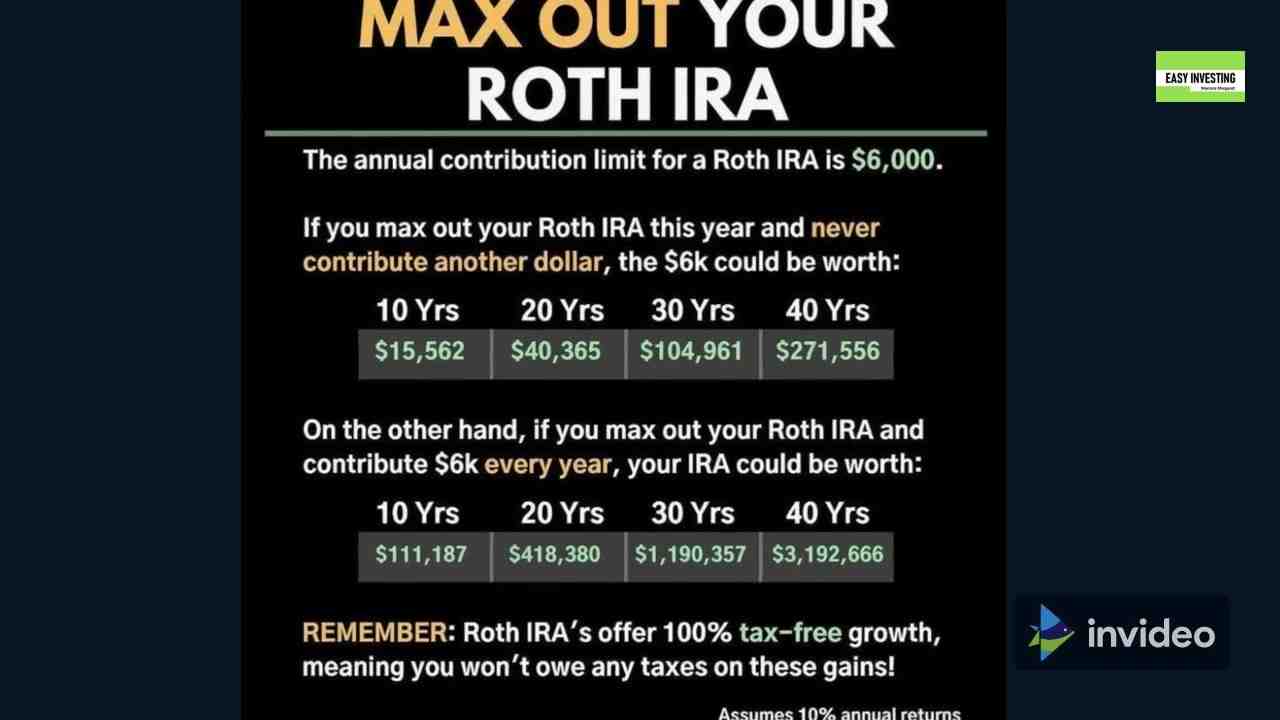

Advantages of a Roth IRA One of the best ways to save for retirement is with a Roth IRA. These tax-advantaged accounts offer many benefits: You don’t have a tax break in advance (as you do with traditional IRAs), but your contributions and earnings grow tax-free. Withdrawals during retirement are tax-free.

Will a Roth IRA be enough for retirement?

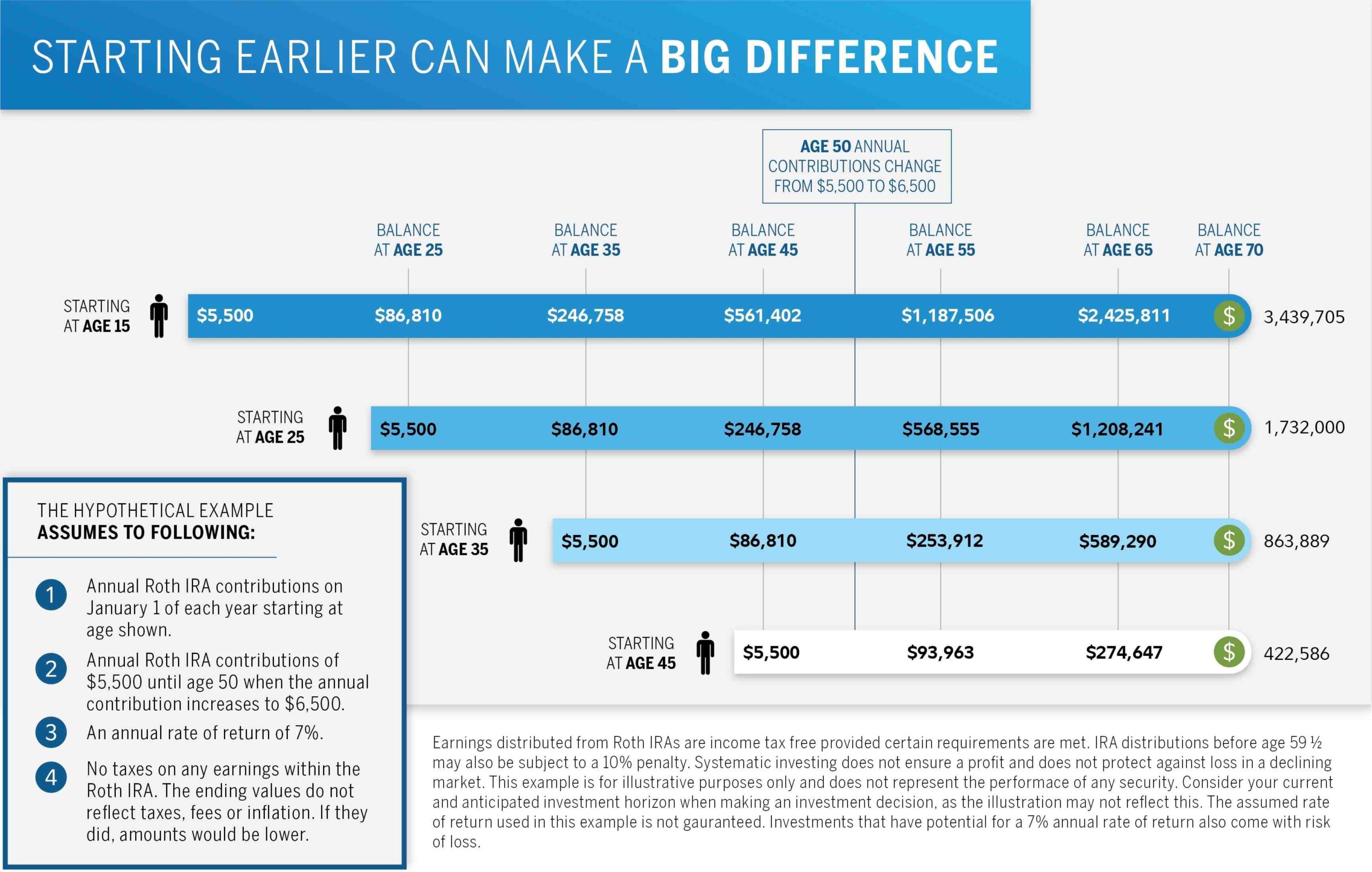

So, if you start early and save carefully, your Roth IRA will be enough to afford a modest retirement, but if you start saving late or get used to a higher standard of living before you retire, you need to think about saving. more money through additional investment accounts.

What are the downsides of a Roth IRA?

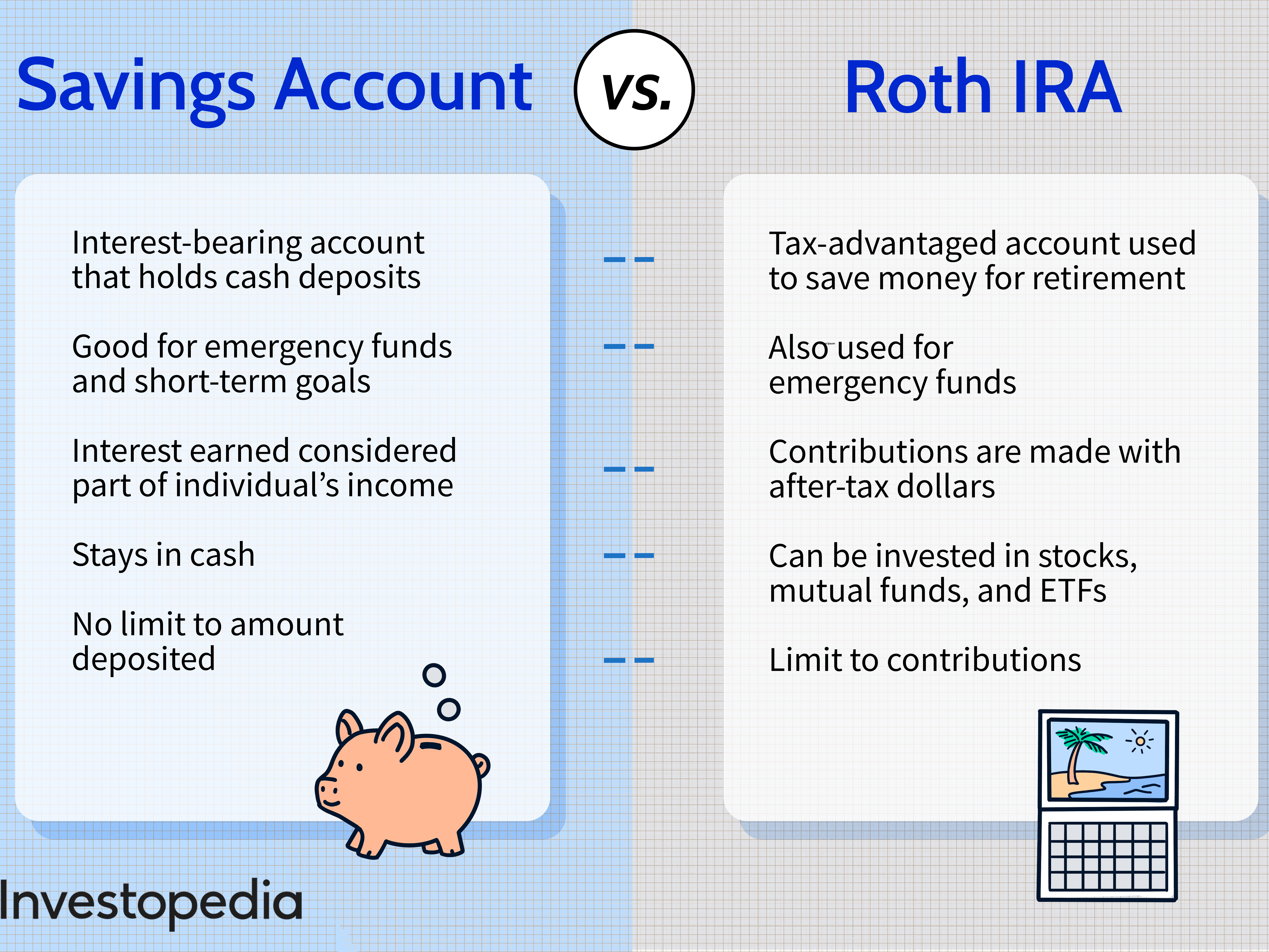

Key Takeaways A key disadvantage: Roth IRA contributions are made with after-tax money, which means there is no tax deduction in the year of the contribution. Another disadvantage is that withdrawals of account earnings must not be made until at least five years have passed since the first contribution.

What are the downsides of a Roth IRA?

Key Takeaways A key disadvantage: Roth IRA contributions are made with after-tax money, which means there is no tax deduction in the year of the contribution. Another disadvantage is that withdrawals of account earnings must not be made until at least five years have passed since the first contribution.

Is it worth having a Roth IRA? Advantages of a Roth IRA One of the best ways to save for retirement is with a Roth IRA. These tax-advantaged accounts offer many benefits: You don’t have a tax break in advance (as you do with traditional IRAs), but your contributions and earnings grow tax-free. Withdrawals during retirement are tax-free.

Can Roth IRAs lose money?

Yes, you can lose money in a Roth IRA. The most common causes of a loss include: negative market fluctuations, early withdrawal penalties, and an insufficient amount of time for compounding. The good news is that the more time you allow a Roth IRA to grow, the less likely you are to lose money.

Can Roth IRA fail?

A withdrawal that incurs taxes or penalties is called a nonqualified distribution. Failure to understand the difference between the two and withdrawing earnings too early is one of the most common Roth IRA mistakes.

What happens if a Roth IRA loses money?

Some of the most important things you can do include: Diversify your IRA portfolio: One of the best ways to prevent your IRA from losing money is to diversify your IRA portfolio. By investing in a variety of different asset classes, you can minimize the risks associated with investing in an IRA.

What are the pro and cons of Roth IRA?

| Pros | cons |

|---|---|

| Tax-free withdrawals No required withdrawals No maximum age requirement for contributions Ways to get one even if you don’t qualify Limited penalties on early distributions | Contributions are taxed Income-based limits Earnings withdrawal restrictions Some retirees may not benefit |

Who benefits from a Roth IRA?

The Roth IRA is a powerful retirement account that is available to Americans even if they don’t have an employer-sponsored retirement plan like a 401(k). That is, all American workers have access to a plan that provides serious tax advantages for retirement savings.

Is a traditional IRA or Roth better?

A Roth IRA or 401(k) makes the most sense if you’re confident you’ll have a higher income in retirement than you do now. If you expect your income (and tax rate) to be lower in retirement than it is now, a traditional IRA or 401(k) is probably the best bet.

Does money in IRA grow?

Your money will go into your IRA that will grow and grow without being taxed every year. You are not taxed on the money you put into a traditional IRA until you withdraw it at retirement.

Can you make a lot of money with an IRA? Stocks are a popular choice for IRAs because the earnings earned are basically extra contributions to the IRA. Stocks also grow the IRA through dividends and stock price increases. While no one can predict the future, the annual range of return for stock investments has historically been between 8% and 12%.

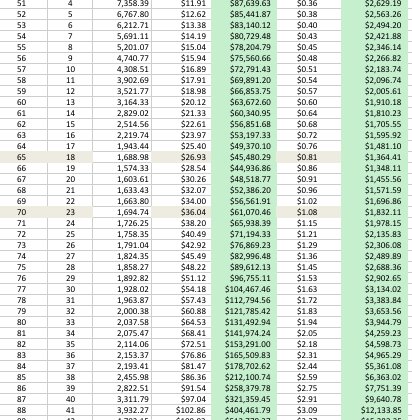

How fast does money grow in an IRA?

Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you just opened a Roth IRA, $6,000 in contributions each year for 10 years with a 7% interest rate would total $83,095.

How much will an IRA grow in 30 years?

For example, if you invest $6,000 a year in a stock index fund for 30 years with an average return of 10%, you can see your account grow to more than $1 million (although be aware of the impact of investment fees).

How much can I expect my IRA to grow?

Historically, with a properly diversified portfolio, an investor can expect anywhere between 7% to 10% average annual returns. Time horizon, risk tolerance and overall mix are all important factors to consider when trying to project growth.

Is putting money in an IRA worth it?

An IRA is such an effective savings tool because it allows you to access the financial markets in a tax-advantaged way. Traditional IRA contributions are tax deductible today, but you’ll pay income taxes when you withdraw that money in retirement.

Is it better to have a 401k or an IRA?

The 401(k) is just objectively better. The employer-sponsored plan allows you to add much more to your retirement savings than an IRA – $20,500 compared to $6,000 in 2022. Plus, if you’re over 50, you’ll get a maximum catch- up larger with the 401(k) â $6,500 compared to $1,000 in the IRA.

Is it better to put money in IRA or savings?

It’s usually best to use Roth IRAs for their own purpose: retirement savings. Offering tax-free withdrawals after you’ve had your account for five years and age 59 ½, they’re an ideal way to invest in individual funds and securities that can potentially grow over many years.

Does an IRA grow interest?

Roth IRA Growth (They are not investments in their own.) Those investments put your money to work, allowing it to grow and compound. Your account can grow even in years when you are not able to contribute. Earn interest, which is added to your balance, and then earn interest on interest, and so on.

In what life stage should you start an IRA?

Before working full-time (22 and younger) There is no minimum age to open an IRA. Students can open one for themselves, and parents can open an account on behalf of their children. Getting an early start can help make it easier to reach retirement goals later.

Can I rollover my current 401k to an IRA?

You can roll your traditional 401(k) assets into a new or existing traditional IRA. To initiate the rollover, complete the forms required by the IRA provider you choose and your 401(k) plan administrator. Money is moved directly, either electronically or by check.

Is Roth IRA better than 401k?

In many cases, a Roth IRA may be a better choice than a 401(k) retirement plan, as it offers a flexible investment vehicle with greater tax benefits, especially if you think you’ll be in a higher tax bracket later.

Why is traditional 401k better than Roth? It’s a question of when you pay taxes The basic difference between a traditional and a Roth 401(k) is when you pay taxes. With a traditional 401(k), you make contributions with pre-tax money, so you get a tax break up front, helping to lower your income tax bill.

Is it worth having a Roth IRA and a 401k?

If your company offers a 401(k), does it also make sense to have a Roth IRA? Roth IRAs and 401(k) plans are essential tools for building your retirement savings. They are both tax-advantaged, which means they are designed to minimize a person’s tax burden (aka the amount you owe the IRS at the end of the year).

Should I put more into 401k or Roth IRA?

If you’re wondering whether it’s better to contribute to a 401(k) or a Roth IRA, don’t because you should invest in both. Experts agree that the first account you should take advantage of should be a 401(k), if you are eligible for one at your job.

Is it good to have a 401k and a Roth IRA?

Contributing to a 401(k) and Roth IRA allows you to maximize your retirement savings and take advantage of tax advantages. With a 401(k) account, you contribute money that you haven’t yet paid taxes on. Your employer can also match the contributions up to a certain percentage of your annual income.

Sources :