For 2022, workers under the age of 50 can defer up to $20,500 of their salary into their company’s regular pre-tax or Roth (after-tax) 401(k) account. However, you can make additional after-tax contributions to your traditional 401(k), allowing you to save more than the $20,500 cap.

Is there a salary limit to contribute to a Roth 401 K?

There is no income limit for a Roth 401(k). Roth IRA contributions are after-tax, so qualified withdrawals are tax-free.

Can you contribute to a Roth 401 K if you make over 200k? The good thing about Roth 401(k)s is that there are no income limits – you can fund a Roth 401(k) even if you bring home a $1 million salary. That is not the case with a Roth IRA.

Who is eligible to contribute to a Roth 401k?

For 2022, only if your adjusted adjusted gross income (MAGI) is less than $144,000 for single filers or $214,000 for married couples filing jointly or qualifying widow/widower that you can contribute to a Roth IRA. With a Roth IRA, you will not be required to take RMDs.

Can I contribute to a Roth 401k without an employer?

If you do not have an employer and only received unemployment income for the year, you will not be eligible to contribute to many of these retirement account options. The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

Who is eligible for a Roth 401k?

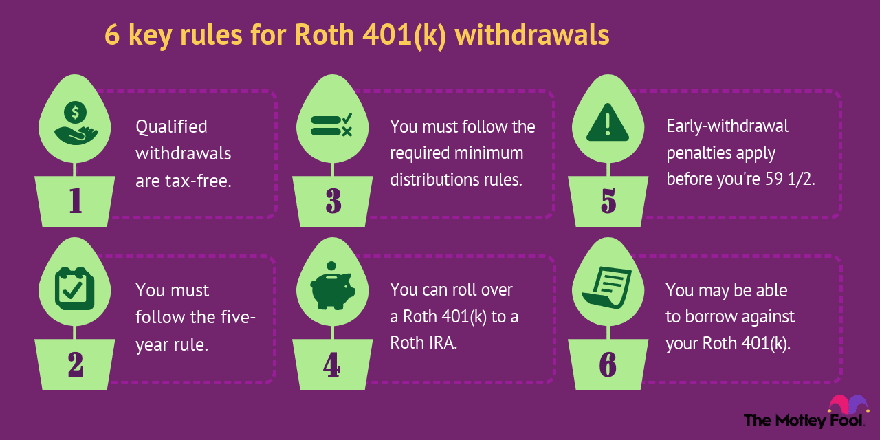

Roth contributions are made on an after-tax basis and earnings grow tax-free. Income tax. Distribution is conditional if it is at least five years since the first contribution and the participant is at least 59½, disabled or deceased. traditional pre-tax retirement plan account.

Can I contribute to a Roth IRA and a Roth 401k income limits?

Can I have a Roth 401(k) and a Roth IRA at the same time? Yes, as long as you meet all income limits and restrictions, you can contribute to both types of Roth at the same time. The contribution limit for each is different: $20,500 for a Roth 401(k) and $6,000 for a Roth IRA in 2022.

Can I contribute to a Roth IRA and a Roth 401k and a traditional 401k?

You can have a 401(k) and Roth IRA at the same time. Not only is it allowed to contribute to both but it can be an effective savings strategy for retirement. However, there are certain income and contribution limits that determine whether you are eligible to contribute to both types of accounts.

Does Roth 401k count towards Roth IRA limit?

The maximum an individual can contribute to the four accounts is $31,500, or $40,000 for those aged 50 and over. Contributions made toward a 401(k) and Roth 401(k) cannot exceed the $19,500 limit. While $6,000 can each be contributed towards a traditional IRA and a Roth IRA.

Should I put more in Roth or 401k?

If you expect to be in a lower tax bracket in retirement, a traditional 401(k) may make more sense than a Roth account. But if you’re in a low tax bracket now and believe you’ll be in a higher tax bracket when you retire, a Roth 401(k) might be a better option.

How much should I contribute to my Roth 401k? How much should I invest in a Roth 401(k)? No matter what your income, you should be investing 15% of your income in retirement savings” as long as you are debt free (everything except the house) and have a well funded emergency fund full (enough to pay for 3â). 6 months of expenses). Let’s say you make $60,000 a year.

Is Roth 401k or high income better for 401k?

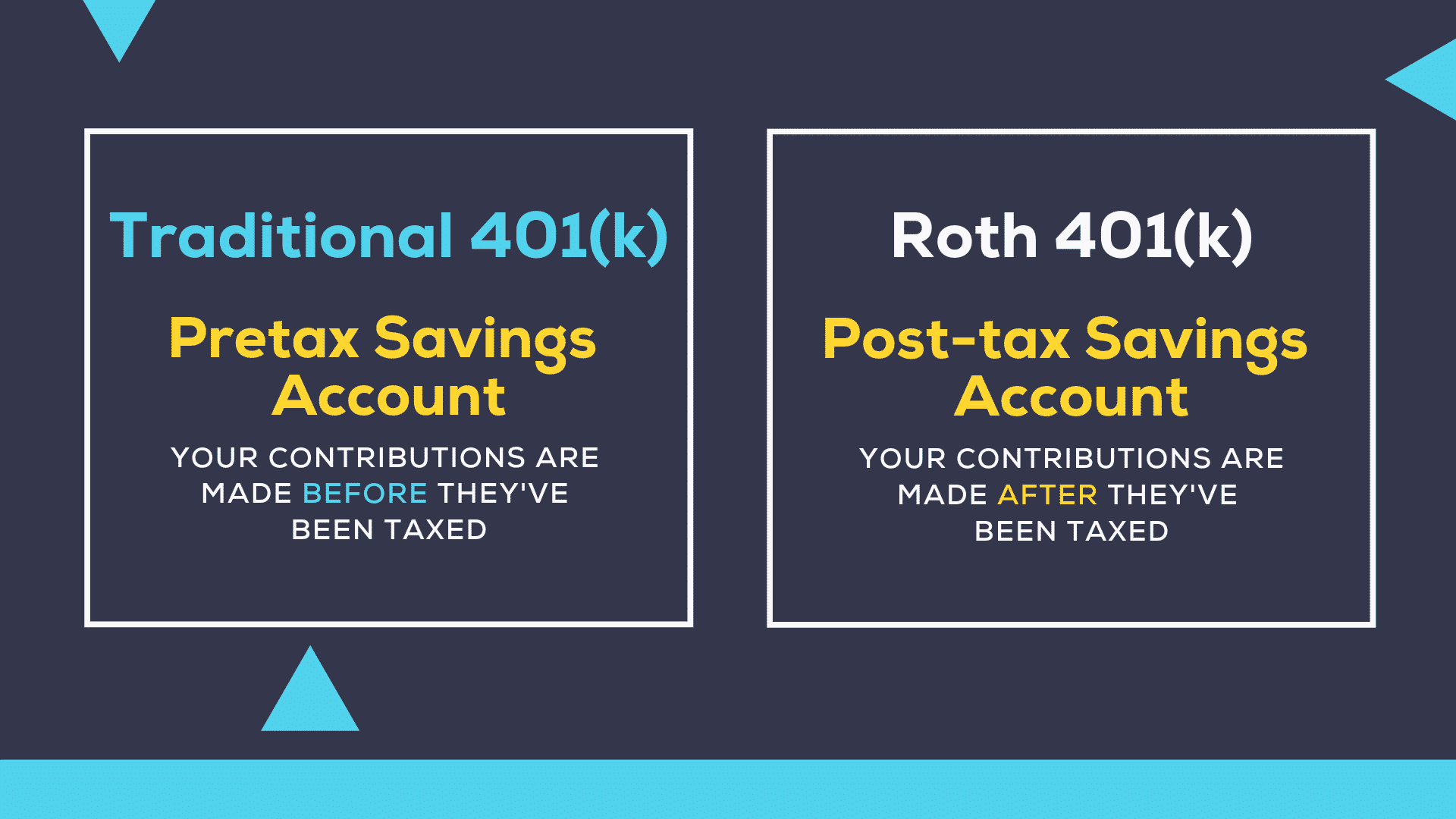

ENTER THE ROTH 401k/403b The main difference between Roth 401k contributions and Traditional 401k contributions is when you owe federal income tax on the money. When making Traditional contributions, you get an upfront tax benefit because your taxable income is reduced by the amount you contribute.

Which is better a traditional or Roth 401k?

Contributions to a Roth 401(k) can hit your budget harder today because an after-tax contribution takes a bigger bite out of your paycheck than a pre-tax contribution to a traditional 401(k). The Roth account may be more valuable in retirement.

Is it better to put more in 401k or Roth IRA?

If you’re wondering whether it’s better to contribute to a 401(k) or a Roth IRA, don’t because you should be investing in both. Experts agree that the first account you should tap into should be a 401(k), if you’re eligible through one at your job.

Should I split my 401k between Roth and traditional?

In most cases, your tax situation should determine which type of 401(k) to choose. If you’re in a low tax bracket now and anticipate being in a higher one after you retire, a Roth 401(k) makes the most sense. If you’re in a high tax bracket now, the traditional 401(k) might be the best option.

How should I split my 401k?

For example, if your 401(k) offers 10 choices, put 10% of your money in each. Or, choose one fund from each category, such as one fund from the large cap category, one from the small cap category, one from international stocks, one from bonds, and one that is a money market or fixed value fund.

Is it smart to split 401k and Roth?

It removes some risk. In this case, if you split your retirement funds between a traditional 401(k) and a Roth 401(k), you would pay half the taxes now, at what should be the lower tax rate, and half when you retire, when rates could be either higher or lower.

Should I put more in my Roth IRA or 401k?

A Roth IRA is better for taxpayers who expect to be in a higher tax bracket during retirement. You can pay the taxes today while your tax rate is lower, and then enjoy tax-free withdrawals while your tax rate is higher during retirement.

Does it make sense to have both 401k and Roth IRA?

Contributing to a 401(k) and Roth IRA allows you to maximize your retirement savings and benefit from tax advantages. With a 401(k) account, you contribute money on which you have not yet paid taxes. Your employer may also match contributions up to a certain percentage of your annual income.

How much should I contribute to my 401k and Roth IRA?

Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income. These contributions could be made to a 401(k), employer-accepted matching 401(k), IRA, Roth IRA, and/or taxable accounts.

What is the average 401k balance for a 65 year old?

| Age | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| 65+ | $279,997 | $87,725 |

How much does the average person have in a 401K when they retire? Many US workers retire by the time they reach 65. Vanguard data shows that the average 401(k) balance at retirement is $255,151, while the median balance is $82,297.

How much should a 65 year old have in retirement savings?

Since higher earners will receive a smaller portion of their income in retirement from Social Security, they generally need more assets relative to their income. We estimated that most people looking to retire around age 65 should aim for assets that are between seven and 13½ times their gross pre-retirement income.

What does the average 65 year old have saved for retirement?

Those who had retirement accounts did not have enough money in them. According to our research, people aged 56 to 61 have an average of $163,577. Those aged 65 to 74 have even less. If that money were converted into a life annuity, it would only amount to a few hundred dollars a month.

How much should I have in my 401K at 67?

By the age of 40, you should have three times your salary saved. By age 50, you should have six times your salary saved. By age 60, you should have eight times your salary saved. By the age of 67, you should have saved ten times your salary.

How much retirement should I have at 67?

According to Fidelity, by age 67 you should have retirement savings worth 10 times your current salary. That assumes that as your incomeâand, likely, your spending and standard of living increaseâ¦, you will save more too.

What is the average 401K balance for a 70 year old?

Following this, 401(k) balances begin to decrease as more people start tapping their accounts. The average balance for those age 70 and older is $182,100; the median is $51,900.

Should I max out Roth IRA or 401k first?

The general rule of thumb for retirement savings is that you should first meet your employer’s match for your 401(k), then max out your Roth 401(k) or Roth IRA, then go back to your 401(k) .

Is it better to max out a Roth IRA early? Maxing out your Roth IRA can help you make the most of this retirement savings vehicle, but it may not make sense if you have competing financial priorities. Some experts advise saving an emergency fund, paying off high-interest debt, and maxing out an employer’s 401(k) match before maxing out your Roth IRA.

How do I prioritize my 401k and Roth IRA?

How to Prioritize Your 401(k), Roth IRA, and HSA Contributions in…

- Contribute enough to your 401(k) to maximize your employer match. …

- Maximum your HSA contributions. …

- Make Roth IRA contributions if you can. …

- Maximum your 401(k) contributions. …

- Invest through a traditional IRA or standard brokerage account.

Is 401k more important than Roth IRA?

Key Takeaway. A Roth 401(k) has higher contribution limits and allows employers to make matching contributions. A Roth IRA allows your investments to grow for longer, offers more investment options, and makes early withdrawals easier.

Should I invest in Roth or 401k first?

First, you should save enough in your 401(k) to get the employer match as a starting point. Next, once you have received the full match it may make sense to look at diversifying your taxes by using a Roth IRA if you meet the income limits. If not, consider saving in your Roth 401(k) if your employer offers that option.

Can you max out your 401k and contribute to a Roth IRA?

Can you contribute to a 401(k) and a Roth (Roth IRA) individual retirement account in the same year? Yes. You can contribute to both schemes in the same year up to the permitted limits. However, you cannot max out your Roth and traditional individual retirement accounts (IRAs) in the same year.

How much can you max out 401k and Roth IRA?

You can contribute up to $20,500 in 2022 to a 401(k) plan. If you’re 50 or older, the maximum annual contribution jumps to $27,000. You can also contribute up to $6,000 to a Roth IRA in 2022. That jumps to $7,000 if you’re 50 or older.

What is the maximum 401k and Roth IRA contribution for 2021?

You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions, but your combined contributions cannot exceed the deferral limit – $20,500 in 2022; $19,500 in 2021 ($27,000 in 2022; $26,000 in 2021 if you qualify for catch-up contributions).

Should I max out my 401k at the beginning of the year?

There is no real benefit to maxing out your 401(k) early in the year. If your company offers an employer match, then you may not want to max out your 401(k) early in the year, because if your contributions stop because of the maximum, then the pairing also ends.

Can you max out 401k at end of year?

There is an annual limit to 401k contributions. In 2018, the limit was $18,500 plus an additional $6,000 for those aged 50 or over. In 2019 the limit increased to $19,000 plus an additional $6,000 for those aged 50 or over. How quickly you reach these limits each year is largely up to you.

Is it better to front load 401k contributions?

If you believe growth is on the horizon, it makes sense to front-load your 401(k) contributions. That way, you have more money in the markets immediately to take advantage of that growth.

Sources :