Can I max out 401k and Roth 401k in same year?

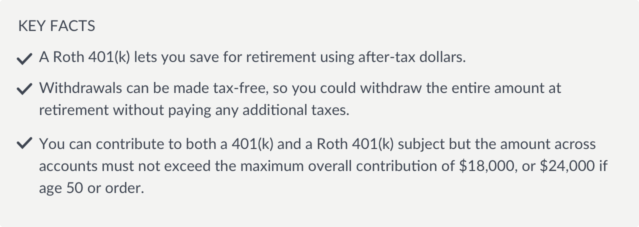

(Note: If you invest in both a Roth 401(k) and a traditional 401(k), the total amount of money you can contribute to both plans cannot exceed the annual maximum for your age, $19,500 or $26,000 for 2021. If you exceed it , the IRS could fine you a 6% overcontribution penalty.)

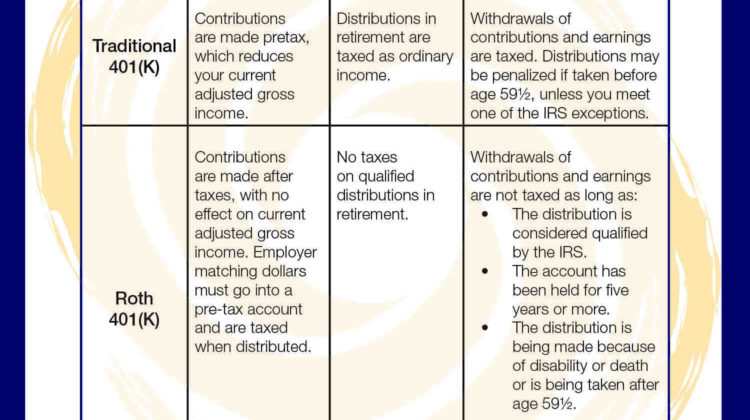

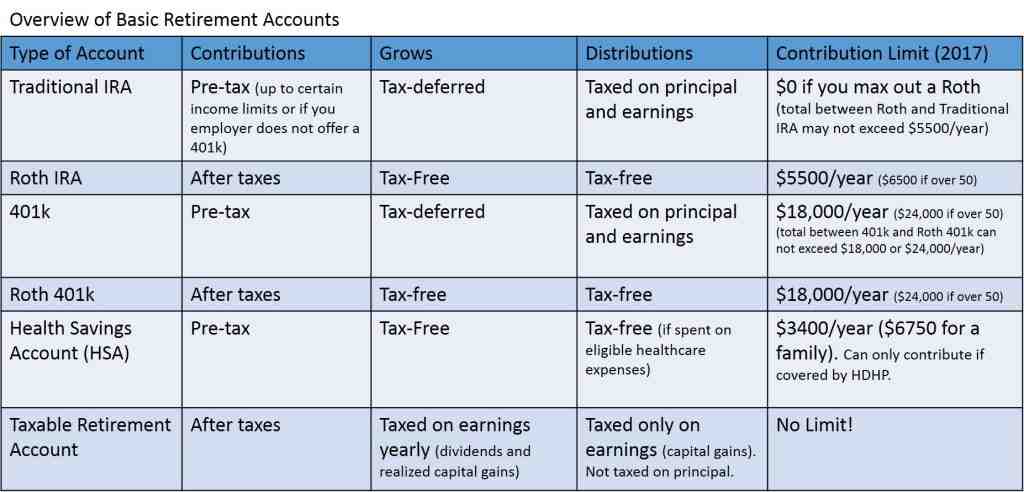

Does the 401k contribution limit include a Roth 401k? Roth 401(k) vs. Although the contribution limits are the same for traditional 401(k) plans and their related Roth plans, a designated Roth 401(k) account is technically a separate account within your traditional 401(k) plan that allows you to contribute after-tax dollars.

Can I max out 401k and Roth in same year?

Can you contribute to a 401(k) and a Roth Individual Retirement Account (Roth IRA) in the same year? That. You can contribute to both plans in the same year up to the permitted limits. However, you cannot max out both your Roth and traditional Individual Retirement Account (IRA) in the same year.

Can I contribute to a 401k and a Roth 401k in the same year?

If your employer offers both, you can contribute to a Roth 401(k) as well as a traditional 401(k). Your employer can also combine the two, but the funds in your traditional 401(k) go directly into your account, while with a Roth 401(k) they are deposited into a separate tax-deferred account.

Should you max out 401k or Roth IRA first?

Key takeaways Financial planners recommend contributing as much as you can – at least 15% of your pre-tax income. The rule of thumb for retirement savings is to first satisfy an employer match for your 401(k), then max out your Roth 401(k) or Roth IRA, then switch back to your 401(k).

How much can I contribute to my 401k and Roth 401k in 2022?

| Designated as a Roth 401(k) | |

|---|---|

| Maximum electoral contribution | Total* employee elective contributions limited to $20,500 in 2022; $19,500 in 2021 (plus an additional $6,500 in 2022 and 2021 for employees over age 50). |

Can I contribute the max to both 401k and Roth IRA?

You can have both a 401(k) and a Roth IRA at the same time. Contributions to both are not only allowed, but can be an effective retirement savings strategy. However, there are some income and contribution limits that determine your eligibility to contribute to both types of accounts.

What is the max 401k and Roth contribution for 2022?

After taxes starting in 2022, employees under the age of 50 can defer up to $20,500 of their wages into a pre-tax regular account or a Roth (after-tax) 401(k) account. However, you can make additional after-tax contributions to your traditional 401(k), allowing you to save more than the $20,500 cap.

Is a Roth 401k worth it?

Taxes are a key factor when choosing a Roth 401(k) over a traditional 401(k). If you’re young and currently in a low tax bracket, but expect to be in a higher tax bracket when you retire, then a Roth 401(k) may be a better deal than a traditional 401(k).

What is the downside of a Roth 401k? Tax Bracket Risk When you put money into a Roth account (whether a 401(k) or an IRA), you’re taking a gamble — namely, that your tax bracket will be higher than it is now. Your goal should be to pay tax on your money when your marginal rate is lowest.

Is a Roth 401k better than a traditional 401k?

Roth 401(k) contributions can hit your budget harder today because after-tax contributions take a bigger bite out of your paycheck than before-tax contributions to a traditional 401(k). A Roth account may be more valuable in retirement.

Why traditional 401k is better than Roth?

In this case, taking the tax break now with a traditional contribution may make more sense than a Roth contribution. You’ll reduce your current taxable income while paying a higher tax rate, then withdraw funds at a potentially lower tax rate later in retirement.

Which is better a Roth 401k or a traditional 401k?

Because your Roth 401(k) contributions are paid after-tax, you now pay taxes and take home a little less in your paycheck. Traditional pre-tax 401(k) contributions are deducted from your pre-tax gross earnings from your paycheck, which will lower your tax bill for the year.

Why you shouldn’t use a Roth 401k?

The biggest reason not to fund a Roth 401(k) is if your tax rate will be lower when you withdraw money from the account in retirement. If so, you’re better off putting the money in a tax-deferred account. But if you’re really rich, you’ll still have the highest rate for life.

Why shouldn’t I do a Roth?

One key drawback: Roth IRA contributions are made with after-tax money, meaning there is no tax deduction in the year of contribution. Another disadvantage is that withdrawals of earnings from the account may not be made until at least five years have passed since the first contribution.

Is a Roth 401k a good idea?

when it comes time to retire, depending on your tax bracket. That means you’ll need to save that much more to fund your retirement cash flow. If you are young and confident that you will earn more and be in a higher tax bracket in the future, a Roth 401(k) may be a good choice.

Is it better to have a Roth or traditional 401k?

If you expect to be in a lower tax bracket in retirement, a traditional 401(k) may make more sense than a Roth account. But if you’re in a lower tax bracket now and believe you’ll be in a higher tax bracket when you retire, a Roth 401(k) may be a better option.

How much should I contribute to my Roth 401k?

Most financial planning studies suggest that the ideal retirement savings contribution percentage is between 15% and 20% of gross income. These contributions can be made to a 401(k), employer-matched 401(k), IRA, Roth IRA, and/or taxable accounts.

How much should I have in my Roth 401k by age? Fidelity says that by age 40, you should aim to have three times your salary saved. This means that if you earn $75,000, your retirement account balance should be around $225,000 when you turn 40. If your employer offers both a traditional and a Roth 401(k), you may want to split your savings between the two.

How much should I contribute to my Roth monthly?

When should people contribute to their Roth IRA? However, not everyone can afford to spend up to $7,000 all at once each year. As a result, monthly contributions are common and the suggested amount is 20% of their income.

How much should I contribute to my Roth IRA per month?

Since the maximum annual contribution amount for a Roth IRA is $6,000, the dollar cost averaging approach means you would contribute $500 per month to your IRA. If you’re 50 or older, your $7,000 limit means $583 a month.

Is it better to contribute monthly or yearly to Roth IRA?

Benefits of Contributing Monthly Additionally, funding your Roth IRA monthly instead of annually allows you to take advantage of dollar cost averaging, which refers to buying smaller amounts of stocks multiple times a year rather than in one lump sum.

What percentage should I contribute to my Roth IRA?

If your employer makes dollar-for-dollar contributions up to 6 percent of your salary, make sure you contribute at least 6 percent of each paycheck first. It’s free money, so don’t leave it on the table!

How much should you put into Roth IRA each month?

Since the maximum annual contribution amount for a Roth IRA is $6,000, the dollar cost averaging approach means you would contribute $500 per month to your IRA. If you’re 50 or older, your $7,000 limit means $583 a month.

How much do Roth IRAs grow 30 years?

Typically, Roth IRAs generate average annual returns of 7-10%. For example, if you’re under 50 and just opened a Roth IRA, contributing $6,000 each year for 10 years at 7% interest would accumulate $83,095. Wait another 30 years and the bill will grow to more than $500,000.

How much should I have in my Roth 401k by 30?

How much should you save for early retirement? Retirement plan provider Fidelity recommends saving the equivalent of your salary by the time you turn 30. That means if your annual salary is $50,000, you should aim to have $50,000 in retirement savings by age 30.

How much should I have in my Roth by 30?

Retirement plan provider Fidelity recommends saving the equivalent of your salary by the time you turn 30. That means if your annual salary is $50,000, you should aim to have $50,000 in retirement savings by age 30.

How much does an average 30 year old have in 401k?

Select used information from Vanguard’s How America Saves 2021 survey to see how much money the average American in their 30s has saved in their 401(k) account. Here’s what they found: Average 401(k) balance ages 25–34: $33,272 (average); $13,265 (median)

Is it better to contribute to 401k or Roth 401k?

Roth 401(k) contributions can hit your budget harder today because after-tax contributions take a bigger bite out of your paycheck than before-tax contributions to a traditional 401(k). A Roth account may be more valuable in retirement.

Is it better to contribute to a Roth 401k or a Roth IRA? The Roth 401(k) has higher contribution limits and allows employers to make matching contributions. A Roth IRA allows your investments to grow longer, offers more investment options, and makes early withdrawals easier.

Can I contribute to both a 401k and a Roth 401k?

The good news is that it’s often possible to contribute to both a traditional and a Roth 401(k). Since no one knows what tax rates will be in the future, diversifying your traditional 401(k) and Roth contributions could be a way to hedge your tax bets with your retirement savings.

Can I contribute to both pretax and Roth 401k?

Investors can contribute to both a traditional 401(k) and a Roth 401(k) at the same time. However, maximum annual limits apply to total contributions. If you contribute to a Roth 401(k), all employer funds will still go into the 401(k) on a pre-tax basis.

Should I split my 401k contribution between Roth and traditional?

In most cases, your tax situation should dictate which type of 401(k) you choose. If you’re in a lower tax bracket now and expect to be in a higher one after retirement, a Roth 401(k) makes the most sense. If you’re in a high tax bracket now, a traditional 401(k) may be a better option.

Sources :