If you are fired, you lose your right to any unvested funds (employee contributions) in your 401(k). You are fully vested in your contributions and cannot lose this portion of your 401(k).

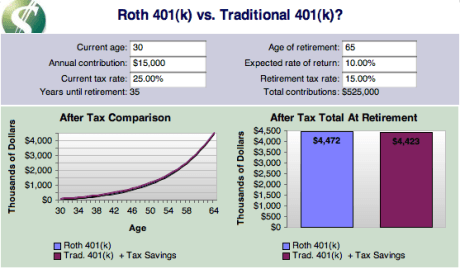

Should I max out my Roth 401k?

Invest as much as you can—at least 15% of your pretax income—financial planners recommend. The rule of thumb for retirement savings is that you should first meet your job for your 401(k), then a Roth 401(k) or Roth IRA, then return to your 401(k).

Why shouldn’t your 401k be better? If you upgrade too soon, you may miss out on company-matched contributions. Most 401(k) plans have a company contribution, which means your employer also contributes to your retirement plan based on your personal activities. save. You get these free deposits by making your own contributions to the account.

What happens when you max out Roth 401k?

If taxes go up, get out of the Roth, because you already pay taxes on the money in it. If tax rates go down, the investor can take money out of the regular 401(k) account and pay taxes at a lower rate.

Where should I put money after maxing out 401k Roth?

You can save for retirement through 401(k)s, Simplified Employee Pension (SEP) or Savings Incentive Match Plan for Employees (SIMPLE) IRAs, or Health Savings Accounts (HSAs) if you’ve outgrown your contribute to a Roth IRA. if you qualify.

What happens if I max out my Roth 401k?

You will end up paying double tax on the limit if your 401(k) is no longer paid by April 15th. correction happens, says Appleby.

What is the 5 year rule for Roth IRA?

The Roth IRA’s five-year rule says you can’t withdraw earnings tax-free until five years have passed since you first contributed to a Roth IRA account. This five-year rule applies to all Roth IRA contributors, whether they are 59 ½ or 105 years old.

What is the 5 year rule? The 5-year rule gives them a waiting period. That said, a Roth IRA must be at least five years old before you can withdraw any earnings. Even then, you may have to pay taxes and/or penalties (usually 10% of the distribution amount) depending on your age and how long you’ve held the account.

Do you have to hold a Roth IRA for 5 years?

The five-year rule for deducting Roth IRA earnings requires that you hold your account for at least five years before you can use those earnings without penalty. It is important to note that this rule applies specifically to investment income.

Why is there a 5-year rule for Roth IRAs?

The Five-Year Rule for Income Taxes The first five-year rule determines whether a distribution of income passes one of the tests to qualify and is exempt from income taxes. Because only after-tax money is contributed or distributed to a Roth IRA, the principal withdrawal is tax-free.

Do you have to wait 5 years to withdraw traditional IRA contributions?

The 5-year rule applies to taking distributions from a joint IRA. To withdraw earnings from an inherited IRA, the account must have been open for at least five years at the time of the original owner’s death.

When can you withdraw from Roth IRA without penalty?

Over age 59½ If you have not met the requirement for five years, your earnings will be subject to tax and not penalties. Withdrawal from a Roth IRA older than five years. If you’ve met the five-year requirement, you can withdraw money from a Roth IRA without any taxes or penalties.

When can you start withdrawing from an IRA Roth IRA without a tax penalty?

You can withdraw your contributions to a Roth IRA for any reason and at any time without penalty. Once you reach the retirement age of 59 ½ and the account has been open for at least five years, you can withdraw your earnings from those contributions without penalty.

What happens if you withdraw from Roth IRA before 59 1 2?

If you withdraw Roth IRA earnings before age 59½, a 10% penalty usually applies. Withdrawals before age 59½ from a traditional IRA trigger a penalty tax of 10% if you withdraw contributions or earnings.

Does the 5 year rule apply to Roth rollover?

The first five-year rule states that you must wait five years after your first contribution to a Roth IRA to withdraw your earnings tax-free. The five-year period begins on the first day of the tax year in which you made a contribution to any Roth IRA, not the one you’re withdrawing from.

Does transferring a Roth reset the 5-year rule?

The 5-year rule for qualifying distributions of income from a Roth begins with your first Roth IRA contribution or conversion. It doesn’t start over when funds are transferred to another Roth IRA.

Does the 5-year rule apply to Roth 401k rollover?

To answer your first question, yes, it can make sense to open a Roth IRA at least five years before you plan to roll over your Roth 401(k). However, opening is not enough. You must contribute for five years to begin.

When can you take money out of a Roth 401k?

You can start taking qualified distributions from a Roth 401(k) after you meet two conditions: You are 59 ½ or older and you have met the five-year rule. This rule states that you must make your first contribution to the account at least five years before your first claim.

What is the 5 year rule for Roth 401k? The five-year rule after your first contribution The first five-year rule sounds simple: To avoid taxes on distributions from your Roth IRA, you shouldn’t take any money until five years later. after your first subscription.

When can I withdraw from Roth 401k without penalty?

Contributions to a Roth IRA can be taken out at any time, and after age 59 ½ the earnings can be withdrawn penalty-free and tax-free if released. the account for at least five years. The same rules apply to a Roth 401(k), but only if the employer’s plan allows it.

When can I withdraw from my Roth without penalty?

If you haven’t met the requirement for five years, your income will be subject to taxes and not penalties. Withdrawal from a Roth IRA older than five years. If you’ve met the five-year requirement, you can withdraw money from a Roth IRA without any taxes or penalties.

Can you withdraw from a Roth 401k at age 55?

What is the Rule of 55? Rule 55 is an IRS guideline that allows you to avoid paying the 10% early withdrawal penalty on 401(k) and 403(b) accounts. retirement account if you leave your job on or after the calendar year in which you turn 55.

Can you close a Roth IRA without penalty?

There are no tax penalties for closing an Individual Retirement Account (IRA)—if done properly. You can transfer the money to another IRA. Or, if you have an employer-sponsored 401(k), you can roll the money into it.

Can I close my Roth account? IRS rules allow you to close your Roth IRA at any time, but early withdrawals are discouraged with additional taxes and penalties.

What are the penalties for closing a Roth IRA?

The early withdrawal penalty is 10%. You must pay this penalty if your Roth IRA is less than five years old and you withdraw the earnings before you reach age 59½. (You can withdraw your contributions at any time without penalty since you have already paid taxes on them.)

Can I close a Roth IRA account without penalty?

There are no tax penalties for closing an Individual Retirement Account (IRA)—if done properly. You can transfer the money to another IRA. Or, if you have an employer-sponsored 401(k), you can roll the money into it.

What happens if I close my Roth?

If you’re closing your Roth IRA, you’ll need to take withdrawals from it first. You can do that in one lump sum or make multiple budgets. All tax consequences are the same. If you’re 59 1/2 or older, you can take it all out with no taxes or penalties.

How do I close my IRA without penalty?

You can avoid the early withdrawal penalty by waiting until you are at least 59 1/2 years old to start taking distributions from your IRA. Once you turn 59 1/2, you can withdraw any amount from your IRA without paying the 10% penalty. However, ordinary income taxes must still be paid on the IRA withdrawal.

What happens if I close my traditional IRA?

Traditional IRA contributions are taxed at your ordinary income tax rate. If you close a traditional IRA account before age 59 1/2, you’ll pay a 10 percent penalty on the balance. In addition, you pay tax at your ordinary income rate in the year you close the account.

Can I close my IRA and take the money?

Generally, early withdrawals from an Individual Retirement Account (IRA) before age 59½ are subject to inclusion in income. plus 10 percent additional penalty tax. There are exceptions to the 10 percent penalty, such as using IRA funds to pay for your post-employment insurance.

Can I close my Roth IRA at any time?

You can withdraw contributions you’ve made to your Roth IRA at any time, tax- and penalty-free. However, you may have to pay taxes and penalties on the earnings in your Roth IRA. Withdrawal from a Roth IRA less than five years old.

Can you close out a Roth IRA without penalty?

If you’ve met the five-year requirement, you can withdraw money from a Roth IRA without any taxes or penalties. Note that unlike a regular IRA, with a Roth IRA there are no Minimum Distribution Requirements.

How do I terminate my Roth IRA?

You are allowed to terminate your individual Roth retirement accounts at any time you wish; all you have to do is ask for your refund. It may cost you, however, because if you’re in your 20s or 30s, you likely won’t be eligible to take a qualifying distribution.