Is it better to do a Roth 401k or traditional?

If you expect to be in a lower tax bracket in retirement, a traditional 401(k) may make more sense than a Roth account. But if you’re in a low-tax bracket now and think you’ll be in a higher tax bracket when you retire, a Roth 401(k) might be a better option.

Should I switch from a traditional to a Roth 401k? “The main thing you want to consider when choosing between Roth and traditional accounts is whether your marginal tax rate will be higher or lower in retirement than it is now,†says Young. If you think your tax rate will be higher, it makes sense to pay taxes now with Roth contributions.

How do you decide between traditional and Roth 401k?

To make the right choice between traditional and Roth deferrals, you’ll want to consider your current tax situation and your projected situation in retirement. In general, you’ll want to choose traditional deferrals if you expect to lower your tax rate in retirement and Roth deferrals if you expect to increase.

Should I have a Roth 401k and traditional 401 K?

Because it comes out of your paycheck, Roth contributions are more likely to reduce your take-home pay than a similar contribution to a traditional 401(k), which is made using pre-tax dollars. If you want to save—and take home as much money as possible—a traditional 401(k) may be the way to go.

Should I switch from traditional to Roth 401k?

If your current portfolio is all or nearly all qualified retirement assets, it may make sense to contribute to a Roth 401(k). Having multiple types of accounts with your retirement savings will allow you to diversify your income in retirement, which can be helpful from a tax perspective.

Why Roth 401k is better than traditional?

With a Roth 401(k), you’ll be contributing with after-tax money, so you won’t get a tax break today. In return, the money you withdraw in retirement will be tax-free. In a Roth 401(k), in addition to tax-free growth on your investment earnings, you’ll also enjoy tax-free withdrawals.

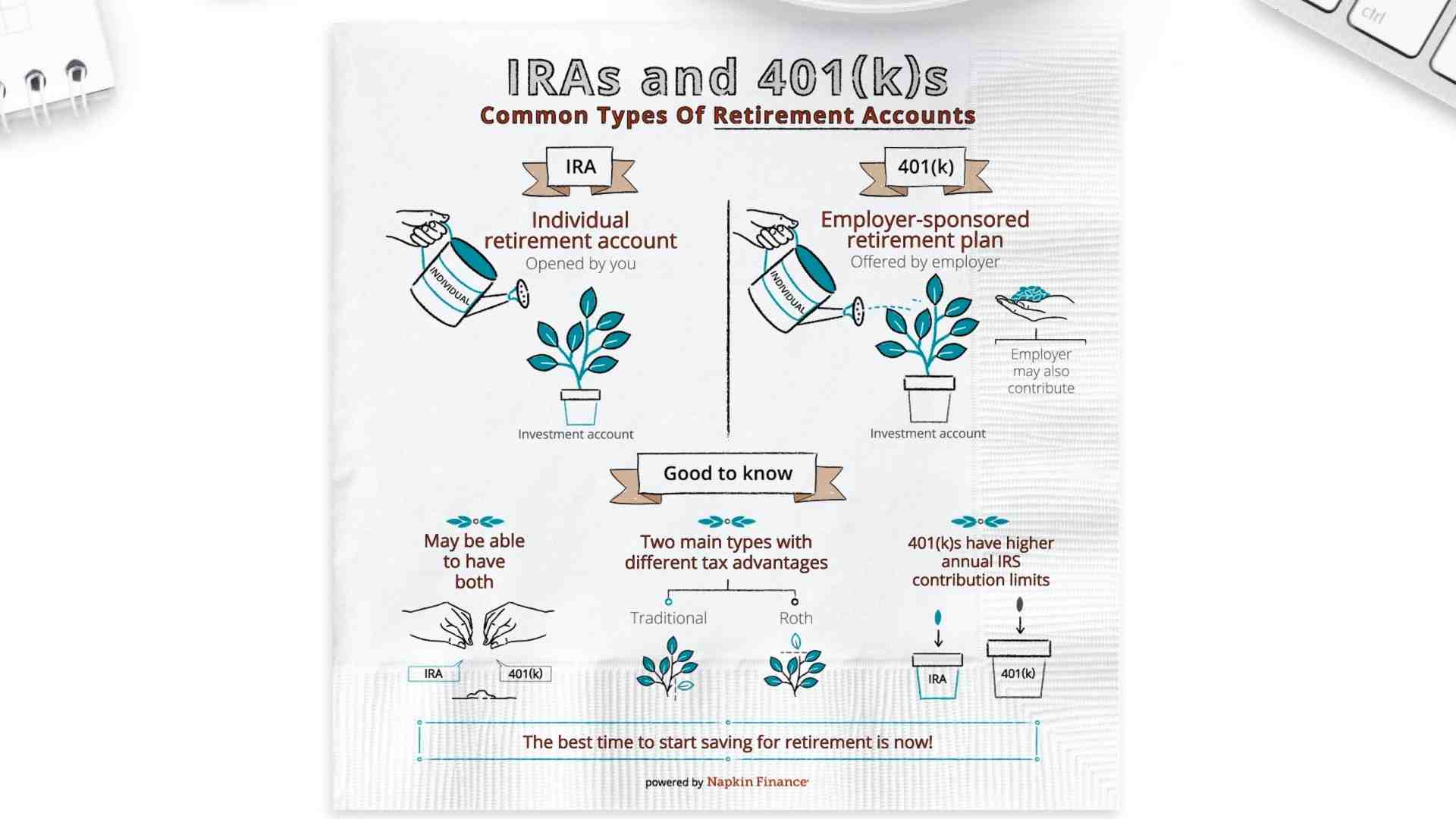

Is a Roth better than a 401k?

In many cases, a Roth IRA can be a better choice than a 401(k) retirement plan because it provides a flexible investment vehicle with greater tax benefits—especially if you think you’ll be in a higher tax bracket later.

Should I do Roth or traditional 401k contributions?

This decision mainly depends on how you want to put money into the account and how you want to take money out. Let’s start making money today. If you prefer to pay taxes now and get them out of the way, or if you think your tax rate will be higher in retirement than it is now, choose a Roth 401(k). ).

Should I do a 401k or Roth 401k?

comes retirement time, depending on your tax bracket. This means you will need to save a lot more to fund your retirement cash flow. If you are young and confident that you will earn more in the future and in a higher tax bracket, a Roth 401(k) may be a good option.

Why traditional 401k is better than Roth?

In this case, taking the tax advantage now with a Traditional contribution may make more sense than a Roth contribution. You will reduce your current taxable income while paying a higher tax rate and then take withdrawals before retirement at a lower tax rate.

What is the advantage of a Roth 401 K?

With a Roth 401(k), you’ll be contributing with after-tax money, so you won’t get a tax break today. In return, the money you withdraw in retirement will be tax-free. In a Roth 401(k), in addition to tax-free growth on your investment earnings, you’ll also enjoy tax-free withdrawals.

Why Shouldn’t You Use a Roth 401k? The biggest reason not to fund a Roth 401(k) is that your tax rate will be lower when you withdraw money from the account in retirement. If so, you’re better off putting the money into a tax-deferred account. But if you’re really rich, you’ll still have the highest status for the rest of your life.

What is the point of a Roth 401k?

Roth 401(k) contributions are made after taxes are deducted from your paycheck. That way, the money you put into your Roth 401(k) grows tax-free, and you’ll receive tax-free withdrawals when you retire.

What is the downside of a Roth 401k?

Tax bracket risk When you put money into a Roth account (a 401(k) or an IRA), you’re making a bet that your tax bracket will be higher than it is now. Your goal should be to pay taxes on your money when your marginal rate is the lowest.

Is a Roth 401k worth it?

Taxes are a key consideration when deciding on a Roth 401(k) over a traditional 401(k). If you’re young and in a low tax bracket today but expect to be in a higher tax bracket when you retire, a Roth 401(k) might be a better deal than a traditional 401(k).

What is the downside of a Roth 401k?

Tax bracket risk When you put money into a Roth account (a 401(k) or an IRA), you’re making a bet that your tax bracket will be higher than it is now. Your goal should be to pay taxes on your money when your marginal rate is the lowest.

Is a Roth 401k worth it?

Taxes are a key consideration when deciding on a Roth 401(k) over a traditional 401(k). If you’re young and in a low tax bracket today but expect to be in a higher tax bracket when you retire, a Roth 401(k) might be a better deal than a traditional 401(k).

What are the pros and cons of a Roth 401k?

The pros and cons of a Roth 401(k).

- The good sides:

- Withdrawals are tax-free. …

- Special circumstances allow early distribution without penalty. …

- There is no income limit. …

- Cons:

- Contributions are not tax deductible. …

- Minimum distributions required.

When can I withdraw from my Roth without penalty?

In general, you can withdraw your earnings without paying tax or penalty if: You are at least 59 1/2 years old3. At least five years have passed since you made your first contribution to a Roth IRA (the five-year rule).

What if you withdraw from a Roth IRA before 59 1 2? If you withdraw Roth IRA earnings before age 59 ½, a 10% penalty usually applies. Withdrawals from a traditional IRA before age 59 ½ result in a 10% penalty regardless of whether contributions or earnings are deducted.

What is the Roth IRA 5 Year Rule?

The five-year Roth IRA rule states that you cannot withdraw earnings tax-free until at least five years have passed since you contributed to a Roth IRA account. This five-year rule applies to everyone who contributes to a Roth IRA, whether they are 59 ½ or 105.

What happens if you withdraw from Roth before 5 years?

Your first contribution. Withdrawing funds from a Roth IRA less than five years after your first contribution requires account holders to pay taxes on the earnings portion of the withdrawal.

When can you withdraw from Roth IRA without penalty?

Age 59 and over. If you have not met the five-year holding requirement, your earnings will be subject to taxes, but not penalties. Withdrawals from a Roth IRA you’ve had for more than five years. If you’ve met the five-year holding requirement, you can withdraw money from a Roth IRA without tax or penalty.

How can I withdraw money from my Roth IRA without penalty?

If you’ve had your Roth IRA for more than five years, you can withdraw your contributions and earnings without tax or penalty when you’re over 59 ½. That’s why Roth IRAs are so special, so invest early and often if you can.

When can you pull money out of a Roth IRA?

You can withdraw contributions from a Roth IRA at any age without penalty. At age 59½, you can withdraw contributions and earnings without penalty as long as your Roth IRA has been in your Roth IRA for at least five tax years. 1.

How can I avoid paying taxes on my Roth IRA withdrawal?

If you meet the five-year rule, you can avoid taxes on withdrawals. However, if less than five years have passed since the first IRA contribution, you will pay income taxes on the earnings portion of the distribution. Withdrawals from a Roth IRA come in a specific order: contributions.

Can I borrow from my Roth IRA to buy a house?

In short, up to $10,000 in Roth IRA earnings can be withdrawn—tax- and penalty-free—if you meet certain home purchase requirements. That’s because you’re not only allowed to withdraw direct contributions at any time, but you’ve already paid taxes on that money.

How much can I use from my Roth IRA to buy a house? You can withdraw direct contributions to a Roth IRA at any time for any reason. Additionally, if you meet certain requirements, up to $10,000 in earnings can be used to purchase a home without tax or penalty.

How much can you borrow from a Roth IRA?

Internal Revenue Service (IRS) rules do not allow borrowing from a Roth retirement account (Roth IRA) and repaying a 401(k) in the same way. The first withdrawal of earnings from a Roth IRA (before age 59 ½) carries a 10% penalty.

Can you loan yourself money from Roth IRA?

The IRS does not accept Roth IRA loans. However, you can withdraw from your Roth IRA. Withdrawals of contributions are not taxable.

Can I use my Roth IRA to buy a house without penalty?

If you qualify as a first-time home buyer, you can withdraw up to $10,000 from your traditional IRA and use the money to buy, build, or rebuild a home. 3 With a Roth IRA, you can withdraw your contributions tax- and penalty-free at any time, for any reason, as long as you’ve held the account for at least five years.

Can I withdraw from my IRA to buy a house?

If you qualify as a first-time home buyer, you can withdraw up to $10,000 from your IRA to use as a down payment (or to help build a home) without having to pay the 10% upfront penalty. However, you will have to pay ordinary income tax on the withdrawal.

How do I report an IRA withdrawal to buy a house?

You don’t have to prove to the IRA administrator that you’re using the money to buy a home, according to Vanguard, but you do have to file IRS Form 5329 with your tax return for the year you withdraw.

What reasons can you withdraw from IRA without penalty?

- IRA withdrawals in retirement.

- What are penalty-free IRA withdrawals?

- Unpaid medical expenses.

- Unemployment Health Insurance Premiums.

- Permanent Disability

- Higher Education expenses.

- You inherit an IRA.

- To buy, build or rebuild a home.

Sources :