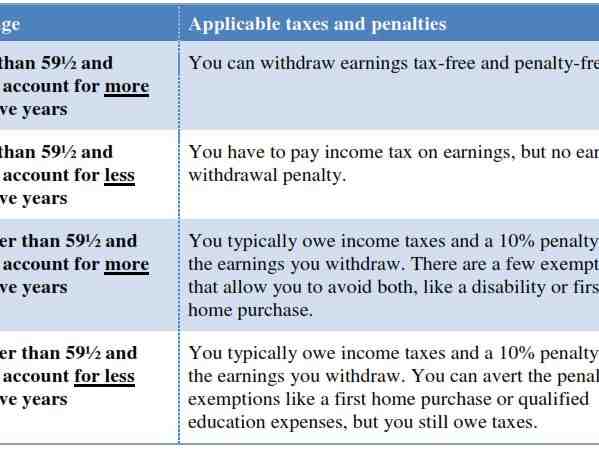

Contributions to a Roth IRA can be made at any time, and after the account owner turns 59 ½ the earnings can be withdrawn penalty-free and tax-free as long as the account has been open for at least five years. The same rules apply to a Roth 401(k), but only if the employer’s plan allows it.

Can I use my Roth 401k to buy a house?

Roth IRA Withdrawal Rules “As long as you’ve had a Roth IRA established for at least five years, you can use that free money to pay for your home as long as it qualifies as a first-time home purchase,” says Levine.

Can I use my 401k to buy a home penalty free in 2022? Can you use your 401k to buy a home penalty-free in 2022? There is a limit to how much you can withdraw from your 401(k), so you may not be able to buy your own home. Typically, this limit is 50% of your 401(k) account balance or $50,000, whichever is lower.

How much can you take out of your 401k to buy a house without penalty?

Under the law, 401(k) account holders can make hardship withdrawals of up to $100,000 without paying the 10% penalty. The bill also gives the account holder 3 years to pay income tax, instead of being in the same year.

Can I use my Roth 401k to buy an investment property?

The IRS allows people to borrow up to $50,000 or 50% of their 401k value, whichever is lower, to buy investment property. This is a good option for those who cannot afford the down payment required to purchase a rental property.

Can I take money from my Roth 401k to buy a house?

Roth IRA withdrawal rules allow you to take up to $10,000 in income tax free as long as you use it to buy your first home and you started contributing to the Roth account at least five years ago. If you take out more than $10,000 in wages, you could be in trouble, Levine said.

Can 401k funds be used to purchase investment property?

The main advantage of purchasing investment properties through a 401k is that you can do so by taking out a loan that is tax-free and penalty-free. There are other tax benefits that should be considered. For example, when buying real estate with a 401k, any income earned from that real estate will be tax-free.

Can I use my Roth to buy a house?

You can use your Roth IRA to finance a home purchase. Here are the pros and cons. You can withdraw your direct contribution to a Roth IRA at any time for any reason. In addition, if you meet certain requirements, up to $10,000 of your income can be used to purchase a home without taxes or penalties.

Can I pull from my Roth 401k?

You can withdraw contributions from a Roth 401(k) without paying taxes or penalties since Roth contributions are made with after-tax dollars. However, if the withdrawal is ineligible, you will pay taxes on any advances you withdraw and be subject to a 10% early withdrawal penalty.

Can I withdraw from a Roth 401k at any time? the first withdrawal. If you’ve owned a Roth IRA for at least five years, you can withdraw your contributions tax-free before age 59½ (but not income, in most cases you’ll pay a 10% tax).

Do I have to pay taxes on Roth 401k withdrawal?

There are no tax consequences when you withdraw money from a Roth 401(k) when you’re 59½ and you’ve met the five-year rule. If you need $20,000, take out $20,000, and no taxes are due. If you take such distributions from a traditional 401(k) plan, the money you withdraw is subject to regular income taxes.

How much tax do I pay on Roth 401k withdrawal?

What is the Early Roth 401(k) Withdrawal Penalty? If you take money out of your Roth 401(k) early, you’ll have to pay taxes on the portion you don’t contribute. In addition, the IRS assesses a 10% penalty on the non-contributing portion. There is no tax or penalty on the distribution of the contribution.

Do I need to report Roth 401k on taxes?

You do not report your Roth IRA and Roth 401(k) contributions on your tax return because they are not deductible. But keep track of these contributions over the years. If you must withdraw from your Roth account first, the contribution is tax-free or subject to early withdrawal penalties.

What is the 5 year rule for Roth 401k?

The five-year rule after your first contribution The first five-year rule is simple enough: In order to avoid taxes on distributions from a Roth IRA, you must withdraw funds until five years after your first contribution.

What is the 5-year rule for 401k?

5-year rule: Under the 5-year rule, you choose whether to take each dividend in one to four years. However, the entire account balance must be distributed by the end of the fifth year.

What happens if you withdraw from Roth before 5 years?

Your first contribution. Withdrawals from a Roth IRA less than five years after your initial contribution require account holders to pay taxes on the distribution of the withdrawal.

Can I withdraw Roth 401k contributions after rollover?

Although a Roth 401(k) meets the 5-year rule and then some, if you roll it into a three-year Roth IRA, you’ll have to wait another two years before you can withdraw the money tax-free. (although, like any Roth account, you can withdraw your contributions tax-free at any time).

Can I withdraw from my 401k after a rollover? To authorize the rollover, you fill out the forms required by your Roth IRA provider and your 401(k) plan administrator. Earnings that accrue after the rollover will be eligible for a tax-free deduction when the IRA from which your assets are moved has been open for at least five years and you are at least 59½.

Does a Roth 401k rollover count as a contribution?

Does my conversion count as a donation? No. It is considered separately from your annual contribution limit. So you can contribute more money to your rollover IRA in the year you open it, up to your maximum allowed contribution.

Does a Roth 401 K rollover count against the yearly contribution limit?

This means the 401(k) rollover doesn’t count as a contribution, meaning you can trust your balance on the 401(k), even if it’s more than $20,500, which is the annual contribution for 2022.

How are 401k rollovers to Roth taxed?

This rollover transaction is not taxable, unless the rollover is to a Roth IRA or other designated Roth account from another type of plan or fund, but it is reportable on your federal tax return. You must include the taxable amount of the distribution that you do not roll over in your income in the year of the distribution.

Can Roth 401 K contributions be withdrawn at any time?

Generally, you can start withdrawing money from a Roth 401(k) as often as you are 59½ years old. There are some more relaxed withdrawal rules for Roth 401(k) contributions.

Can I cash out my Roth 401k?

According to the IRS, “qualified withdrawals” from a Roth 401(k) can be made for free. A withdrawal is considered qualified if: It occurs at least five years after the tax year in which you first make a Roth 401(k) contribution. It is done after you turn 59 1/2.

Can I withdraw Roth 401k contributions at any time?

With a Roth IRA, you can withdraw contributions at any time tax-free and without penalty because the rules assume that the initial contribution represents your after-tax contribution.

How much should I have in my 401k at 55?

By age 50, retirement plan provider Fidelity recommends having at least six times your salary in savings to retire comfortably at age 67. By age 55, it recommends having seven times your salary.

What is a good 401K amount to retire with? A general rule of thumb is to earn six to eight times your annuity by age 60, although more conservative estimates may add up even higher. The truth is, your retirement savings plan depends on your goals and financial situation.

What is a good 401K balance at age 50?

Now, most financial advisors recommend that you have between five and six times your annual income in a 401(k) or other retirement savings account by age 50. With continue to grow on the rest of your career, this amount should leave you completely. have enough savings to retire comfortably by age 65.

What is the average 401k balance for a 55 year old?

| YEAR | TEACHER 401K BALANCE | MEDIAN 401K BALANCE |

|---|---|---|

| 25-34 | $33,272 | $13,265 |

| 35-44 | $86,582 | $32,664 |

| 45-54 | $161,079 | $56,722 |

| 55-64 | $232,379 | $84,714 |

How much should a 50 year old have in retirement?

One suggestion is to save five or six times your annual salary by age 50 to retire in your mid-60s. For example, if you make $60,000 a year, that means having $300,000 to $360,000 in your retirement account. It is important to understand that this is a broad, ballpark, recommended figure.

What is the average 401K balance for a 55 year old?

| YEAR | TEACHER 401K BALANCE | MEDIAN 401K BALANCE |

|---|---|---|

| 25-34 | $33,272 | $13,265 |

| 35-44 | $86,582 | $32,664 |

| 45-54 | $161,079 | $56,722 |

| 55-64 | $232,379 | $84,714 |

What is a good 401K balance at age 60?

How much will I have in my 401(k)? A general rule of thumb is to earn six to eight times your annuity by age 60, although more conservative estimates may add up even higher. The truth is, your retirement savings plan depends on your goals and financial situation.

How much should I have in my 401K by age?

By age 40, you should have three times your annual salary already saved. By age 50, you should have six times your salary in the account. By age 60, you should have eight times your salary working for you. By age 67, your total savings goal is 10 times your annual salary.

How much should be in a 401K by the age of 53?

By age 50, you should have six times your salary saved. By age 60, you should have eight times your salary saved. By age 67, you should have ten times your salary saved.

How much should I have in my 401K by age 52?

By age 50, you should have six times your salary in the account. By age 60, you should have eight times your salary working for you. By age 67, your total savings goal is 10 times your annual salary. So, for example, if you earn $75,000 per year, you should have $750,000 saved.

How much should a 53 year old have saved?

In fact, according to retirement planning provider Fidelity Investments, you should have 6 times your income saved by age 50 to leave the workforce at 67. The Bureau of Labor Statistics’ latest Q3 2020 shows that the median annual salary for Americans aged 45 to 54 was $60,008.

Sources :