Is a Roth IRA enough to retire on?

So, if you start early and save carefully, your Roth IRA will be enough to afford a modest retirement, but if you start saving late or get used to a higher standard of living before you retire, you need to think about saving more money through additional Investment accounts.

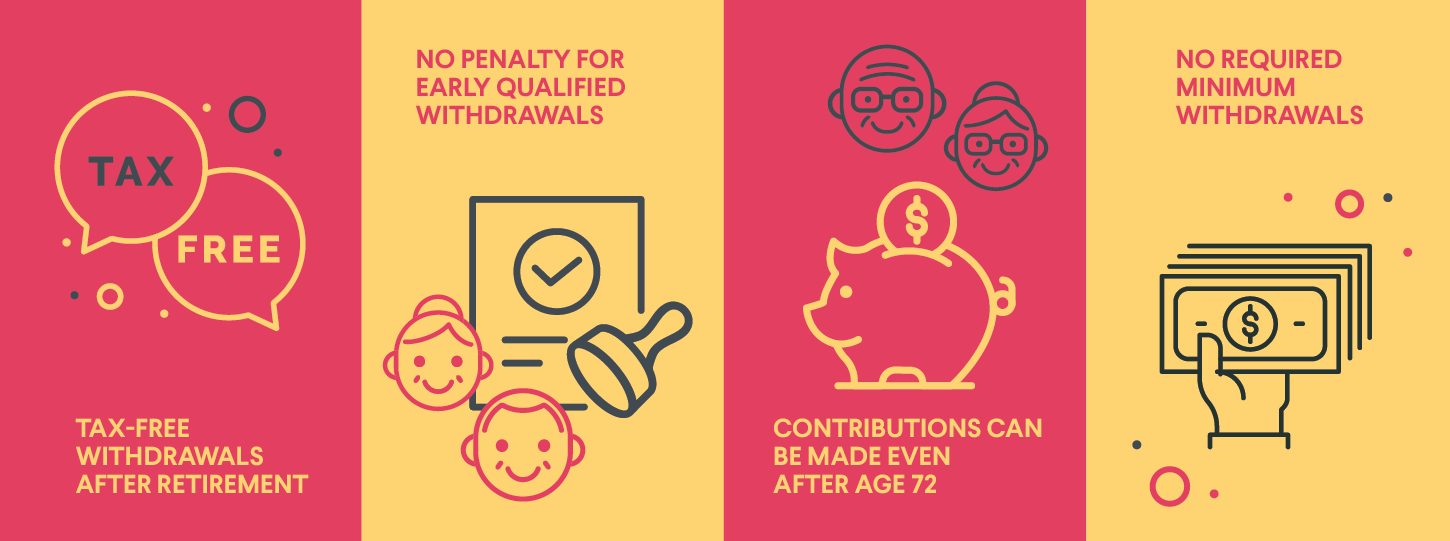

Can I withdraw at 50 with a Roth IRA? But even if you’re nearing retirement or already in retirement, this particular retirement savings vehicle can still make sense under some circumstances. There is no age limit for opening a Roth IRA, but there are income and contribution limits that investors should be aware of before funding one.

Is a Roth IRA the best way to save for retirement?

Key takeaways. A Roth IRA or 401(k) makes the most sense if you are confident of having a higher income in retirement than you do now. If you expect your income (and tax rate) to be lower in retirement than it is now, a traditional IRA or 401(k) is probably the better bet.

Is a Roth IRA the best retirement plan?

If your annual income is not too high, a Roth IRA is one of the best retirement accounts available. While your Roth IRA contributions are not tax deductible today, you won’t have to pay income tax on the withdrawals you make when you retire.

What are the downsides of a Roth IRA?

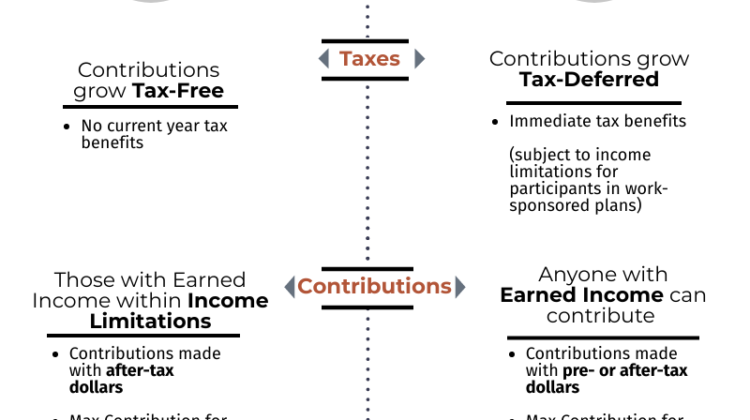

Key Takeaways One key downside: Roth IRA contributions are made with after-tax money, meaning there is no tax deduction in the year of the contribution. Another disadvantage is that withdrawals from the account income may not be made until at least five years have passed since the first contribution.

How much do I need in my Roth IRA to retire?

As a rough guide, for every $100 you withdraw each month, you need $30,000 in your IRA. If you withdraw $1,000, for example, that’s 10 times 100, so you need 10 times $30,000, or $300,000 in the IRA.

How much should I put in my Roth IRA monthly?

Since the maximum annual contribution amount for a Roth IRA is $6,000, following a dollar-cost-averaging approach means that you would therefore contribute $500 per month to your IRA. If you’re 50 or older, your $7,000 limit translates to $583 a month.

How much does the average person have in their Roth IRA?

The average 401(k) balance increased to $112,300, up from $95,600 in 2018. The average IRA increased 17 percent to $115,400. The average 403(b) – which is typically used by teachers, health care workers and employees of nonprofit organizations – was up 18 percent to $93,100.

What are the downsides of a Roth IRA?

Key Takeaways One key downside: Roth IRA contributions are made with after-tax money, meaning there is no tax deduction in the year of the contribution. Another disadvantage is that withdrawals from the account income may not be made until at least five years have passed since the first contribution.

Can Roth IRAs lose money?

Yes, you can lose money in a Roth IRA. The most common causes of a loss include: adverse market fluctuations, early withdrawal penalties, and insufficient time to compound. The good news is, the more time you allow a Roth IRA to grow, the less likely you are to lose money.

Is having a Roth IRA worth it?

Benefits of a Roth IRA One of the best ways to save for retirement is with a Roth IRA. These tax-advantaged accounts offer many advantages: You don’t get an up-front tax break (as you do with traditional IRAs), but your contributions and earnings grow tax-free. Withdrawals during retirement are tax-free.

Do I have to report my Roth IRA on my tax return?

Contributions to a Roth IRA are not deductible (and you do not report the contributions on your tax return), but qualified distributions or distributions that are a return of the contributions are not subject to tax. To be a Roth IRA, the account or annuity must be designated as a Roth IRA when it is set up.

Do I have to report my IRA contributions on my tax return? The key to remember is that traditional IRA contributions are fully deductible unless you or your spouse have a retirement plan through an employer and you have MAGI above certain deduction limits. But even if your IRA contributions aren’t deductible, you still have to report those contributions on your tax return.

How does the IRS know my Roth IRA contribution?

Form 5498: IRA Contributions Information reports your IRA contributions to the IRS. Your IRA trustee or issuer—not you—is required to file this form with the IRS by May 31.

How do Roth IRA contributions get reported?

While you do not need to report Roth IRA contributions on your return, it is important to understand that the IRA custodian will report these contributions to the IRS on Form 5498. You will receive a copy of this form for your own information, but you will no need to file it with your federal income tax return.

How does IRS track Roth contributions?

Roth IRA contributions are not reported anywhere on the tax return, so they are often not tracked except on the monthly Roth IRA account statements or on the annual tax return Form 5498, IRA Contribution Information. Let clients and their tax advisors know that Roth IRA contributions are tax deductible.

Do I have to report Roth IRA contributions on my tax return TurboTax?

You do not have to report your contribution to a Roth IRA; However, you may want to input it into TurboTax so that you can track your basis. To avoid taxes on the income, it is necessary to leave your contributions in your Roth IRA for at least five years.

Why is TurboTax tax ask for Roth IRA contributions?

The reason the system asks about prior year contributions is to determine if any of those prior contributions to your ROTH IRA are considered taxable income. You can always withdraw contributions (but not earnings) you made to your Roth IRA tax and penalty free at any time.

How do I report Roth IRA contributions to TurboTax?

Your IRA contributions are reported on Form 5498, IRA Contributions Information. Your IRA trustee or issuer—not you—is required to file this form with the IRS, usually by May 31st. You won’t find this form in TurboTax, nor will you file it with your tax return.

How much will my IRA be worth in 20 years?

You’ll save $148,268.75 over 20 years. If you are in a 28,000% tax bracket when you retire, this will be worth $106,753.50 after paying taxes. If you or your spouse retire before the age of 60, a 10% penalty will be incurred. The penalty adjusted savings amount would be $91,926.63.

How much can I expect my IRA to grow? Historically, with a properly diversified portfolio, an investor can expect anywhere between 7% and 10% average annual returns. Time horizon, risk tolerance, and the overall mix are all important factors to consider when trying to project growth.

How much will an IRA grow in 10 years?

The actual rate of return is largely dependent on the types of investments you choose. The Standard & Poor’s 500® (S&P 500®) for the 10 years ended December 31, 2016, had an annual compounded return of 6.6%, including reinvestment of dividends.

How much does an IRA earn in 10 years?

Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you just opened a Roth IRA, $6,000 in contributions each year for 10 years at a 7% interest rate will accumulate $83,095.

How much will an IRA grow in 30 years?

For example, by investing $6,000 a year in a stock index fund for 30 years with an average return of 10%, you can grow your account to over $1 million (even if you are aware of the impact of investment fees).

How much will an IRA grow in 30 years?

For example, by investing $6,000 a year in a stock index fund for 30 years with an average return of 10%, you can grow your account to over $1 million (even if you are aware of the impact of investment fees).

How much does a Roth IRA grow in 30 years?

Typically, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and you just opened a Roth IRA, $6,000 in contributions each year for 10 years at a 7% interest rate will accumulate $83,095. Wait another 30 years and the account will grow to more than $500,000.

How much can a Roth IRA grow in 20 years?

How much will a Roth IRA grow in 20 years? While a $6,000 initial deposit in a Roth IRA can grow to $23,218 in 20 years at a 7% annual return, it will grow much more if you continue to make monthly or annual contributions to the Roth IRA.

Can I transfer my Roth IRA to my child?

Key Takeaways A Roth individual retirement account (IRA) makes a great gift for children and teens because they can take full advantage of many years of tax-free compounding. You can give a minor child a Roth IRA by setting up a custodial account for them and helping to fund it.

Can you gift a Roth IRA before death? Possible taxes are income tax or gift tax. You cannot transfer a Roth IRA to another person during your lifetime, so a gift to your wife is not possible. However, you can name her as the beneficiary of the Roth IRA, and she would have free access to it when you die.

What happens when a child inherits a Roth IRA?

If you are the sole beneficiary of the account, you can treat the account as you would your own. You have no RMDs. However, if you open the Roth IRA as a new inherited account, you must take RMDs, but you can stretch them out over your lifetime. You are the small child of the original owner.

What happens when a minor inherits a Roth IRA?

Minors cannot directly inherit an IRA. A guardian would manage the money until the children reached their state’s recognized age of majority. At that time they would have complete access to the funds. If you do not appoint a custodian, a parent must ask the probate court to become a custodian.

Can an inherited Roth IRA be passed on?

As a holder of a Roth Individual Retirement Account (IRA), it is important to name a beneficiary so that the money you have saved goes where you intended, with the most tax benefits possible. If you inherit a Roth IRA as a spouse—and you’re the sole beneficiary—you have the option of treating the account as your own.

Sources :