Tesla’s stock has closed at record highs more than 30 times so far this year.

Getty Images

Tesla Inc.’s market value topped $600 billion on Monday, setting the Silicon Valley electric-car maker on track to become the sixth largest company in the S&P 500 index once it is added to the benchmark in two weeks.

Tesla stock

TSLA,

was poised for a record close, which it has notched more than 30 times this year. It got yet another tailwind with the S&P

SPX,

addition news, and last week the index provider decided that the company would be added all at once to the benchmark.

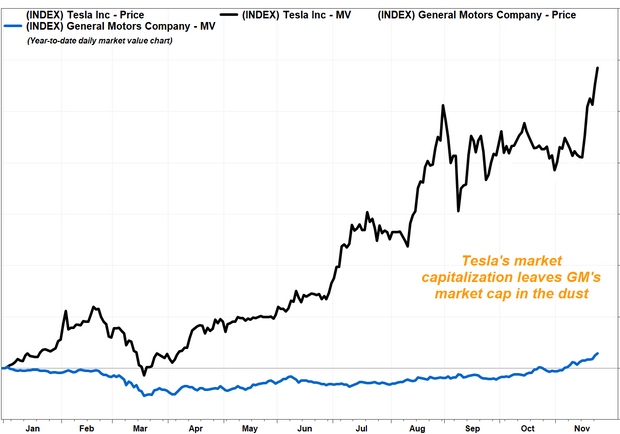

Tesla shares have gained 663% this year, compared with gains of around 14% for the S&P. Its current market cap is higher than the $193 billion market cap of Toyota Motor Corp.

TM,

excluding U.S. Treasury shares. Tesla’s market valuation is also higher than the market caps of Ford Motor Co.

F,

Fiat Chrysler NV

FCAU,

and General Motors Co.

GM,

combined.

The latest run comes ahead of the inclusion in the S&P 500, set for the start of trading on Dec. 21.

It took Tesla 111 days to go from a market valuation of $100 billion in mid-January to $200 billion by the end of June, then a short 13 days to get to $300 billion in mid-July.

The $400 billion-mark, hit in August, took 27 days. From there it was a relatively slow 63 days to hit today’s $514 billion.

FactSet, MarketWatch

Underscoring the complexity of adding the heavyweight to the benchmark, S&P Dow Jones Indices took the unusual step to consult with investors as to whether it would add Tesla in separate tranches or all at once.

The index announced in November its plan to add Tesla all at once.

Tesla’s addition to the broader, premier benchmark for U.S. equities automatically will put the shares in the portfolios of countless index-tracking funds, cascading on to the many managed funds that would have to follow suit to balance their holdings. It will also provide even greater visibility and a measure of comfort with Tesla shares for individual investors.

Tesla’s stock run also mirrors the action in other electric-vehicle and electric vehicle-related stocks. American depositary receipts of Nio Inc.

NIO,

a Shanghai-based EV maker, have skyrocketed 1,030% this year.

Nikola Corp.

NKLA,

shares gains took a hit last week after the electric-truck maker announced a watered-down agreement with GM. Still, the stock is up 79% for the year, despite the fact that the company has no revenue and short sellers have raised many questions about its business model. Nikola in November said it made “significant progress on key milestones.”