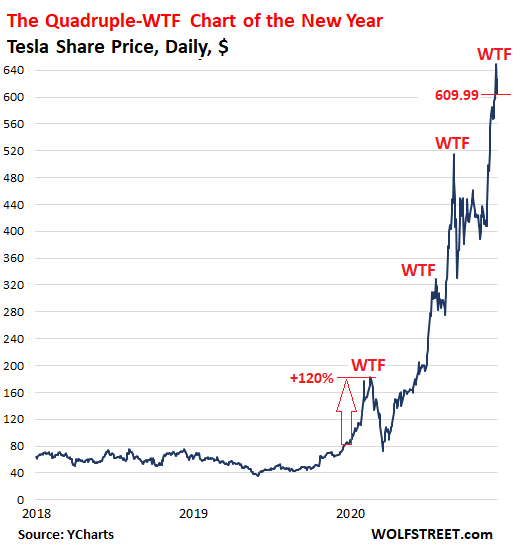

Tesla Inc (NASDAQ: TSLA) bear Wolf Richter wrote in a blog over the weekend that the sharp spikes in the automaker’s stock — as charted by him — have always been followed by plunges.

What Happened: Richter, the author of the Wolfstreet.com blog, wrote over the weekend that the latest spike on his “Quadruple WTF chart of the Year” has been powered by the automaker’s inclusion in the S&P500.

The analyst said that the latest surge in the stock of the Elon Musk-led company “annihilated” his preceding chart dating back to Aug. 31 and the two charts released before that on July 1 and Feb. 4 respectively.

Richter noted that Tesla has earnings per share of $0.50 over the past four quarters and the company has a PE ratio of 1,220 times earnings, while profitable automakers typically have that number around 10 to 20.

Tesla shares have returned 629.08% on a year-to-date basis.

Why It Matters: The Palo Alto-based automaker has 1% of the world’s market share of passenger vehicle market but its market cap this month exceeded that of the combined market cap of Toyota Motor Corporation (NYSE: TM), Volkswagen AG (OTC: VWAGY), Daimler AG (OTC: DDAIF), General Motors Company (NYSE: GM), Bayerische Motoren Werke AG (OTC: BMWYY), Honda Motor Co, Ltd (NYSE: HMC), and Ford Motor Company (NYSE: F), noted Richter.

The analyst says Tesla has taken advantage of the situation and “extracted $12.3 billion in new funds from investors via three stock sales this year — of which $10 billion in three months.”

Richter said the inclusion in S&P 500 had created a demand for the company’s shares and “Tesla was more than happy to sell them into this demand at this huge big-fat share price.”

See Also: Tesla Passes 0B Market Cap As S&P Inclusion Approaches

The author noted that at the rate of its net income over the past four quarters — nearly $500 million — it would take Tesla nearly 10 years to earn enough money from operations to equal just one-quarter worth of share sales.

“Tesla would be far better off just giving up on the sordid cash-consuming business of making cars and building factories,” wrote Richter. He suggests the EV maker “just focus on what it does best and pulls off flawlessly each time: Selling shares at hugely inflated prices.”

Richter suggests Tesla could just sell them once a quarter on Autopilot and “no one would get killed, and it could shut down all its factories, and shed its people, and be done with pesky regulators and expenses.”

See Also: Tesla Gets Downgrade From Long-Term Bull Pierre Ferragu, Analyst Says Time To Book Profits

Price Action: Tesla shares closed nearly 2.7% lower at $609.99 on Friday and fell 0.39% in the after-hours session.

Click here to check out Benzinga’s EV Hub for the latest electric vehicles news.

Latest Ratings for TSLA

|

Date |

Firm |

Action |

From |

To |

|---|---|---|---|---|

|

Dec 2020 |

Jefferies |

Downgrades |

Buy |

Hold |

|

Dec 2020 |

New Street |

Downgrades |

Buy |

Neutral |

|

Dec 2020 |

JP Morgan |

Maintains |

Underweight |

View More Analyst Ratings for TSLA

View the Latest Analyst Ratings

See more from Benzinga

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.