Returns wise, Novavax (NVAX) has undoubtedly been the most successful coronavirus stock of them all, with 2020 gains hitting an amazing 2920%. However, heading into the year’s final stretch, the vaccine specialist’s COVID-19 vaccine candidate NVX-CoV2373 has been at danger of getting cut adrift from the competition.

Both Moderna’s (MRNA) mRNA-1273 and Pfizer (PFE)/BioNTech’s (BNTX) BNT162b2, have already been granted emergency use authorization and are already being distributed across the U.S. and the world.

But now Novavax can finally work toward closing the gap. At long last, on Monday, the company announced the U.S. and Mexico Phase 3 study’s lift off.

The PREVENT-19 trial evaluating NVX-CoV2373 has been launched in 115 locations and 30,000 participants are expected to enroll in the program. With more than 25% of participants over the age of 65, and black/African American patients making up an additional 15%, the study has been specially designed to assess the vaccine candidate’s impact on as diverse a population as possible.

Novavax already has a fully enrolled Phase 3 clinical trial in process in the U.K. with an interim data readout expected shortly.

The company might be lagging behind the competition, but its offering has unique properties differentiating it from the already available vaccines. Unlike Moderna’s vaccine which must be kept in a freezer and Pfizer/BioNTech’s offering which requires even more extreme ultra-cold temperatures, NVX-CoV2373 can be stored in a refrigerator.

B.Riley analyst Mayank Mamtani says a first interim data readout from the U.S. study is likely in early 2Q21. The analyst believes Novavax’ offering could still have a starring role in the global distribution of Covid-19 vaccines and tells investors to buy the recent dip.

“We remain favorably biased towards our bull case scenario of NVAX’s best-in-class immunogenicity translating into 90%+ VE and differentiated target product profile in terms of reactogenicity to position ‘2373 as a preferred global vaccine solution,” the 5-star analyst said. “We believe NVAX 12/28 equity weakness (-10%), largely attributed to AZ’s positive comments regarding AZD1222 being reviewed by U.K. regulators this week, presents a compelling buying opportunity.”

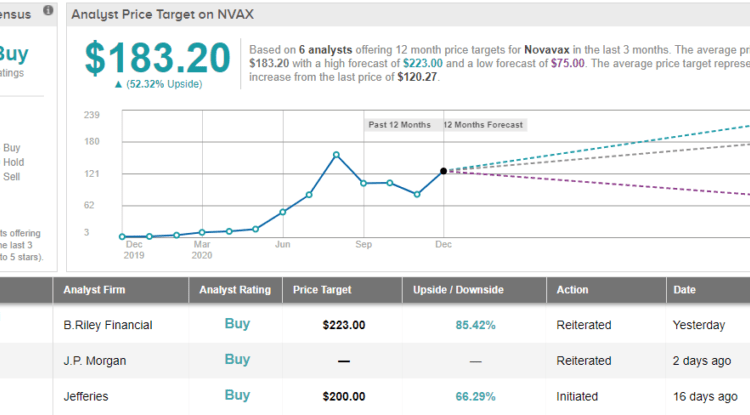

Accordingly, Mamtani’s rating stays a Buy, whilst the $223 price target remains, too. Gains of 85% could be in the cards, should the target be met over the next 12 months. (To watch Mamtani’s track record, click here)

Barring 1 Sell, all 5 other current analyst reviews rate Novavax a Buy. NVAX’s Moderate Buy consensus rating is backed by a $183.20 average price target, implying potential upside of 52% in the year ahead. (See NVAX stock analysis on TipRanks)

To find good ideas for coronavirus stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.