General Electric Co.

Shares of General Electric Co. ran up Tuesday to the highest price seen in nearly nine months, after a long-time skeptical analyst turned bullish, saying the industrial conglomerate has “clearly set a positive direction” after years of struggles.

Oppenheimer analyst Christopher Glynn raised his rating on GE to outperform, after being at perform since June 2018, and at underperform before that.

Glynn set a stock price target at $12, which is 19.2% above Monday’s closing price of $10.07. That now makes him the second-most bullish on GE of the 20 analysts surveyed by FactSet.

The stock

GE,

surged 6.3% in morning trading to the highest price seen since March 5. The stock has soared 61.5% over the past three months, enough to make it the fourth best performer among S&P 500 index

SPX,

components over that time.

Glynn said GE has “clearly set a positive direction with broadening momentum, on diligent and better-focused restructuring,” as management culture has decentralized and accountability has taken hold.

“GE continues to emphasize a long game of inches, but we also believe the pace of manifest improvements picking up, as lean becomes culturally reinforcing and [Chief Executive Larry] Culp’s turnaround gaining traction,” Glynn wrote in a note to clients.

“We also like the extended duration of the debt structure and strong liquidity, now affording a backdrop to emerge from the Aviation downturn in a position of resilience,” Glynn added.

Glynn’s upbeat outlook comes as the CEO of GE’s aviation unit warned employees Tuesday that more job cuts would be coming, with the unit needing to shrink over the next 18 months, as the COVID-19 pandemic continues to wreak havoc and a vaccine won’t be coming as fast has he’d like, according to a report in The Wall Street Journal.

GE CEO Culp said earlier this year that he expected a “slow multiyear recovery” for the Aviation unit.

Also read: GE’s stock sinks, as CEO Culp can’t call a bottom in the Aviation business.

GE’s aviation business has been pummeled this year, first as a result of the grounding of Boeing Co.’s

BA,

737 MAX planes, of which GE makes engines for, and then by the unprecedented impact of the COVID-19 pandemic on the commercial airline industry.

Before that, the company had big problems with its power business, given weakness in the energy sector, and its legacy insurance business, which masked large losses in its long-term care portfolio.

Read more: Ousted CEO John Flannery pays the price for taking out GE’s trash.

But since closing at a 29-year low of $5.49 on May 15, the stock has now nearly doubled, as results have recovered faster than expected. GE reported in late October a surprise adjusted profit and positive free cash flow in the latest earnings report.

GE’s stock has soared 44.3% this month, while SPDR Industrial Select Sector exchange-traded fund

XLI,

has advanced 18.4% and the S&P 500 has gained 10.7%.

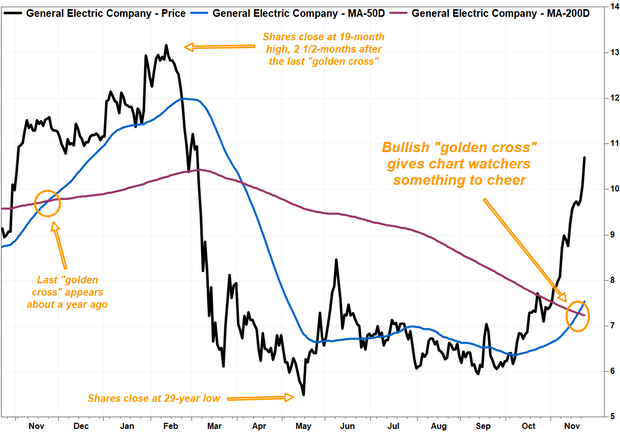

GE’s ‘golden cross’

The rally this month has lifted GE’s stock above the widely watched 200-day moving average (200-DMA), which acted as tough resistance in late October, and produced a bullish chart pattern known as a “golden cross.”

FactSet, MarketWatch

On Monday, the 50-day moving average (50-DMA), viewed by many on Wall Street as a guide to the medium-term trend, crossed above the 200-DMA, which is seen as a dividing line between longer-term uptrends and downtrends. That crossover is believed by many to mark the spot a medium-term decline transitions to a longer-term uptrend.

The last time the 50-DMA was above the 200-DMA was April 2. The last “golden cross” appeared on Nov. 25, 2019; the stock rallied another 14% before peaking at a 19-month high closing high of $13.16 on Feb. 12.