2020 was a year to remember, for so many reasons, but there is one reason that might not be obvious: it was the year of the IPO. The crazy corona crisis year didn’t just bring us social distancing and mass mask mandates, it also brought us a huge number of IPOs, with well over 200 companies entering the public realm – that’s 34% more than 2019, and the most since 2014.

And, it was the year of unicorn, too. Unicorns, or billion-dollar start-ups, were more common than usual in the IPO ranks. The aggregate capital raised through initial public offerings in 2020 was north of $76 billion, a 70% increase year-over-year. Simple arithmetic shows that that average funds raised was over $2.5 billion.

Now that doesn’t mean that every company raised that much – but it does mean that IPOs were particularly successful more often than not, despite the ongoing pandemic fears. Even the market recession of February-March couldn’t derail it; rather, the collapse just slowed down the pace and created a backlog of IPO plans that have kept underwriters and investors busy in 2H20.

So which IPO stocks are worth a closer look? We used TipRanks database to pinpoint three new biotech stocks that Wall Street analysts believe have plenty of growth potential ahead and still offer good value for investors.

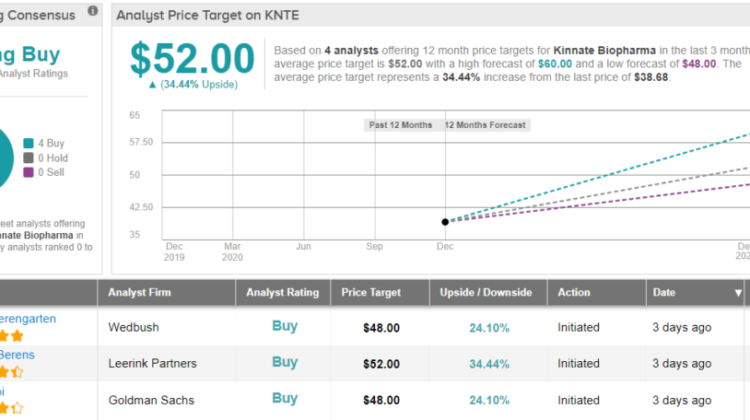

Kinnate Biopharma (KNTE)

First up, Kinnate Biopharma, went public on December 3, making it one of the last companies to do so this year. The stock was offered to the public at $20 per share – and it almost doubled on its first day’s opening. The company now boasts a market cap of $1.7 billion.

What caught investor interest so quickly? Kinnate is a clinical research biopharma focused on developing small molecule kinase inhibitors for the treatment of genomically-defined cancers. These are difficult diseases to treat, and Kinnate aims to expand the range of available therapeutic agents. The theoretical base of the company’s approach is to develop kinase inhibitors that target the oncogenic kinases behind metastatic cancers – in other words, hit spreading cancers at their source, through genetically-specific targeted drugs. If successful, this research will expand the treatments available for patients with metastatic tumors.

Kinnate’s pipeline includes four agents in pre-clinical stages. The IPO was intended to raise funding for further research into this promising pathway.

Leerink analyst Andrew Berens is bullish on KNTE’s experimental course. The analyst rates the stock an Outperform (i.e. Buy) along with a $52 price target. This figure implies a 35% upside from current levels. (To watch Berens’ track record, click here)

“We believe that the Kinnate Discovery Engine platform is a significant driver of fundamental and strategic value. We believe that evolving treatment paradigms and disease knowledge will continue to present opportunities for companies that have an expertise in developing targeted agents. KNTE’s approach, which leverages structure-based drug discovery and translational expertise to address resistant mechanisms, is well-positioned in this arena… We think KNTE will be able to deliver meaningful catalysts over the next 6 -18 months,” Berens wrote.

Out of the gate, Wall Street agrees that Kinnate is worth buying. The stock has 4 recent reviews, and all are to Buy, making the Strong Buy consensus rating unanimous. The stock is selling for $38.98 and the average price target of $52 suggests it has room for 33% growth in the year ahead. (See KNTE stock analysis on TipRanks)

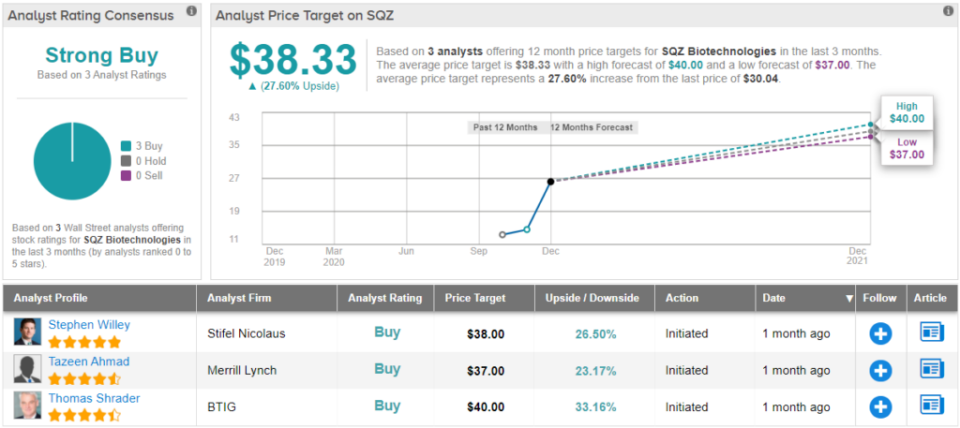

SQZ Biotechnologies (SQZ)

SQZ Biotechnologies derives its ticker from its proprietary technology, dubbed ‘cell squeeze,’ which is a method of temporarily opening cell membranes to allow insertion of target cargoes – which can include a variety of therapeutic agents.

SQZ’s cell manipulation technology allows the development of targeted treatments for a variety of conditions, including cancers and infectious diseases, using selected treated cells as biological delivery systems. The company’s pipeline includes three platforms, SQZ APC, SQZ AAC, and SQZ TAC, with applications to oncology, infectious disease, and immune tolerance. Each platform adapts the underlying technology to particular cells that carry therapeutic agents along different treatment vectors. Most of the research is still in pre-clinical stages, but SQZ APC is in Phase 1 traial as a treatment for HPV+ solid tumors.

SQZ went public at the end of October. The company put 4.4 million common shares on the market at $16 each, and raised $71 million in the opening.

Among the bulls is BTIG analyst Thomas Shrader, who sees SQZ’s approach to drug delivery as the company’s main selling point, and looks forward to early results from clinical studies.

“The fundamental advance that drives SQZ is the ability to use hydrodynamic sheer to “squeeze payloads” into the cytoplasm of cells – most any payload (proteins, peptides, mRNAs and ASOs) into most any cell. This probably doesn’t sound exotic, but it’s transformational […] The SQZ approach results in rapid therapeutic production that may eventually be performed in hospitals. Early programs are oncology-focused and designed to load APCs with tumor antigens to generate powerful anti-tumor responses. Data are expected from HPV-driven tumors throughout 2021,” Shrader opined.

It’s not surprising, then, why Shrader gives SQZ stock a Buy rating. His $21 price target indicates confidence in a 38% one-year upside. (To watch Shrader’s track record, click here)

Overall, all three of SQZ’s recent reviews were positive, showing that Wall Street is in line behind Shrader on this stock – and making for a unanimous Strong Buy analyst consensus. The stock sells for $29, and its average price target, $38.33, suggests ~27% one-year upside from that level. (See SQZ stock analysis on TipRanks)

Olema Pharmaceuticals (OLMA)

Last but not least is Olema, a company working on cancers that specifically impact women. The company is developing treatments for estrogen-receptive cancers, and its lead development candidate, OP-1250, has shown promise as a complete estrogen receptor antagonist and as a selective estrogen receptor degrader. The drug is being evaluated for entry into Phase 1 human clinical trials, targeting estrogen receptor-positive cancers.

Olema is currently following several pipeline pathways for OP-1250, testing its efficacy as an agent against causal mechanisms of several female-specific cancers, including metastatic breast cancer, endometrial cancer, and gynecologic malignancies.

OLMA shares hit the market in mid-November. Their initial price was set at $19, but the stock opened at $45. The pipeline, and its novel approach, attracted investors’ attention, and the stock closed its first day at $49. In just its second month of trading, OLMA has reached a market cap of $1.97 billion, and a deep pocket to back the company’s research activities. The IPO raised over $240 million of that total.

Analyst Arlinda Lee, with Canaccord Genuity, is optimistic about the Olema’s research pathway, writing, “With clinical studies underway, setting the stage for rich dataflow in 2021 and beyond, we are optimistic that Olema’s collective expertise in endocrine cancers and OP-1250’s differentiated properties can translate into clinically meaningful benefit for patients and become a cornerstone of ER-driven cancer therapy.”

To this end, Lee rates OLMA a Buy and her $60 price target suggests a 20% upside in 2021. (To watch Lee’s track record, click here)

Once again, we’re looking at a stock with 4 recent Buy reviews and a unanimous Strong Buy consensus rating. OLMA shares carry an average price target of $60.67, giving a 21% one-year upside from the current trading price of $50. (See OLMA stock analysis on TipRanks)

To find good ideas for IPO stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.