Take a deep breath, get ready, the New Year is just around the corner, and while we’re all ready to celebrate – just on principle, because getting out of 2020 is reason enough for joy – let’s also take stock of where we are and where we’re headed.

There’s a growing sense of optimism, engendered by the availability of COVID vaccines and the potential they give for a return to normal on Main Streets around the country. Finally, a chance that the lockdown and social distancing regimes truly are going to end, and in the near-term. There is a real chance that, by the end of a 2021, John Q. Public may be getting back on his feet.

Combine that with Wall Street’s current ebullience, as stock markets trade at or near their all-time high levels, and we are looking at the prospect of a banner year. A return to grass roots normalcy will be great – but we also have the prospect of an overall rising market.

Writing from JPMorgan, chief US equity strategist Dubravko Lakos-Bujas writes, “Equities are facing one of the best backdrops in years. Risks relating to global trade tensions, political uncertainty, and the pandemic, will be going away. At the same time, liquidity conditions remain extremely supportive, and there’s an extremely favorable interest-rate environment. That’s a Goldilocks environment for risky assets.”

Lakos-Bujas doesn’t shy away from quantifying his optimism. He is predicting as much as 19% gains for the S&P 500, saying that the index will hit 4,000 in the early part of 2021 and reach as high as 4,400 in the later part of the year.

Turning Lakos-Bujas’ outlook into concrete recommendations, JPM’s cadre of stock analysts are pounding the table on three stocks that look especially compelling. We ran the trio through TipRanks database to see what other Wall Street’s analysts have to say about.

Sotera Health (SHC)

Sotera Health occupies a unique niche in the healthcare industry, offering, through its subsidiaries, a range of safety-oriented support businesses for healthcare providers. These services include sterilization procedures, lab testing, and advisory services – and their importance is immediately clear. Sotera boasts over 5,800 healthcare provider customers in more than 50 countries around the world.

While not a new company – two of its branches have been in business since the 1930s and 40s – Sotera is new to the stock markets, having held its IPO just this past November. The initial offering was considered successful, raising $1.2 billion on a sale of 53.6 million shares.

Earlier this month, Sotera announced that it used much of the IPO capital to pay down $1.1 billion in existing debt. This included $341 million in a first lien term loan, plus the $770 million in aggregated principal on an issue of senior secured notes. The move allowed Sotera to increase its revolving credit facility to $347.5 million. That facility is currently undrawn.

Among the bulls is JPM analyst Tycho Peterson who rates SHC an Overweight (i.e. Buy) along with a one-year price target of $35. This figure suggests a 31% upside from current levels. (To watch Peterson’s track record, click here)

“SHC is uniquely positioned to benefit from healthy end-market growth and favorable pricing dynamics,” Peterson noted. “Given a diversified operating platform, sticky multi-year contracts, an efficient pricing strategy, significant barriers to entry and high regulatory oversight, we project ~9% sales growth, with higher utilization driving continued expansion [and] robust FCF supports ongoing de-leveraging, leaving us positive on both the near- and longer-term outlook.”

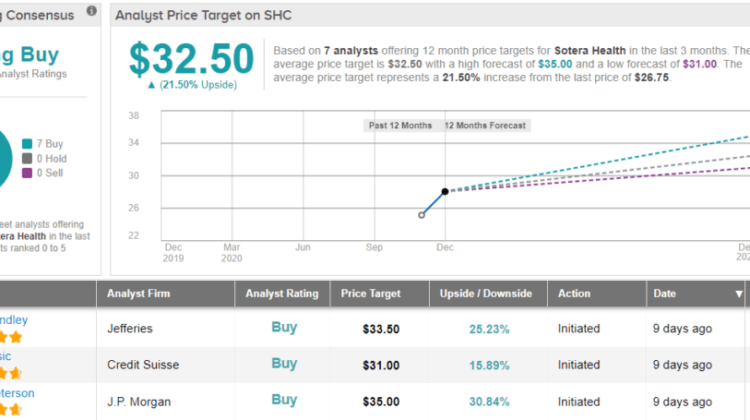

The Wall Street analyst corps is firmly behind Peterson on this one – in fact, the 7 recent reviews are unanimous Buys, making the analyst consensus a Strong Buy. SHC is currently trading for $26.75, and its $32.50 average price target implies an upside of 21.5% by the end of 2021. (See SHC stock analysis on TipRanks)

Myovant Sciences (MYOV)

Let’s stick with the health care industry, and look at Myovant Sciences. This clinical research biopharma company focuses on major issues of reproductive system disease in both men and women. Specifically, Myovant is working to develop treatments for uterine fibroids, endometriosis, and prostate cancer.

Myovant’s pipeline currently features Relugolix as a treatment for fibroids and endometriosis. The drug is in Phase 3 trial for the latter, and has had its NDA submitted for the former. Also in the pipeline, and related to reproductive health, is MVT-602, a new drug designed to enhance egg maturation and aid in vitro fertilization.

In addition, Myovant has announced this month that Relugolix has been FDA approved – under the brand name Orgovyx – as a treatment for advanced prostate cancer. The drug is the first, and currently only, Oral Gonadotropin-Releasing Hormone (GnRH) Receptor Antagonist for the disease. Orgovyx is expected to enter the market in January 2021.

Analyst Eric Joseph, in his note on this stock for JPM, describes how he is impressed by Relugolix “based on the clinical and commercial potential of lead asset relugolix for the treatment of endometriosis and uterine fibroids, as well as in men for the treatment of advanced prostate cancer.”

The analyst added, “In women’s health, we believe the totality of phase 3 data to date de-risks the likelihood of relugolix approval in the US for uterine fibroids and endometriosis – commercial opportunities that are underreflected at current levels. Further, we see an attractive commercial setup for relugolix in the treatment of advanced prostate cancer as an oral LHRH alternative with a differentiated CV risk profile.”

These comments support Joseph’s Overweight (i.e. Buy) rating on MYOV, and his $30 price target implies a 31% upside for the next 12 months. (To watch Joseph’s track record, click here)

Overall, the Strong Buy analyst consensus rating on Myovant comes from 5 reviews, and the breakdown is clearly for the bulls: 4 to 1 in favor Buy versus Hold. The stock’s $22.80 share price and $36.40 average price target give a robust upside potential of ~59%. (See MYOV stock analysis on TipRanks)

Metropolitan Bank Holding (MCB)

For the third stock, we’ll change lanes from health care to finance, where Metropolitan Bank Holding operates – through its subsidiary, Metropolitan Commercial Bank – as a full-service bank for business, entrepreneurial, and personal customers in the mid-market segment. The bank’s services include business lending, cash management, deposits, electronic banking, personal checking, and prepaid cards.

In a year that has been difficult for most of us, MCB has managed to post steadily increasing revenues and solid earnings. The bank’s top line has increased from $33 million in Q1 to $36 million in Q3. EPS was stronger, at $1.27 per share, up 30% year-over-year. The gains come as the bank gives forward guidance of $153.9 million in total revenues for next year, which – if met – will reflect a 22% gain over 2020.

While MCB’s financial performance has shown steady gains, the share appreciation has not followed suit. The stock has only partially recouped losses taken last winter at the height of the corona crisis, and is currently down 26% this year.

Watching the New York banking scene from JPM, analyst Steven Alexopoulos notes general difficulties in the commercial real estate loan sector – an important part of MCB’s portfolio – due to the ongoing pandemic issues. In this environment, he sees Metropolitan Bank as the right choice.

“We’re not as bearish as most on the outlook for New York real estate. Having witnessed many cycles in NYC, the time to buy has been when the herd is running in the other direction. In past cycles, MCB has been an outperformer on credit metrics in regards to its loan portfolio relative to our coverage group,” Alexopoulos noted.

Alexopoulos goes on to explain another key strength in MCB’s loan portfolio: “In a low interest rate environment, MCB stands better positioned than peers to withstand NIM headwinds with 59% of MCB’s loans being fixed rate and 67% of the remaining floating rate loans have floors to protect from lower short-term rates…”

To this end, Alexopoulos rates MCB an Overweight (i.e. Buy) along with a $50 price target. Should the target be met, investors could pocket gains of 43% over the next year. (To watch Alexopoulos’ track record, click here)

Some stocks fly under the radar, and MCB is one of those. Alexopoulos’ is the only recent analyst review of this company, and it is decidedly positive. (See MCB stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.