I’ve been fighting through internet connection issues for two days. Operating from a hotspot doesn’t lend well to trading.

Let’s take a look at three charts shaping up as potential plays next week.

GoPro (GPRO) is the most bullish of the three names I have in front of me. The stock has been on fire for the past two weeks, moving from $6.50 to $8.30. Even with that move, we’re still not in overbought territory in terms of the Moving Average Convergence Divergence (MACD) or the Full Stochastics indicators. The W-shaped price pattern has the potential to reach $9.75 from here.

I wouldn’t be surprised to see the stock consolidate for a bit between $8 and $8.50, creating a cup and handle pattern, before extending another leg higher. I’d only be concerned with a close under the $7.25 level in terms of a stop and walk away from the stock.

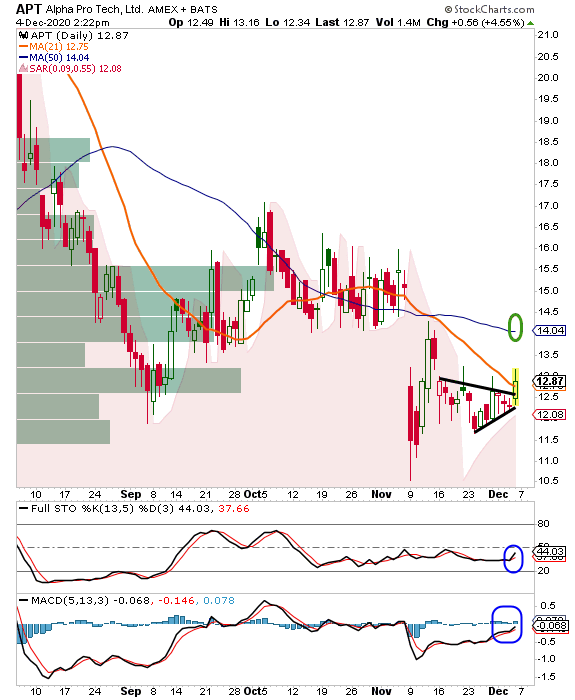

Alpha Pro Tech (APT) has been a PPE play. The stock has been cut in half as significant progress continues on a deployable vaccination. Remember, though, that hospitals will still require PPE and the company has exposure to the housing market, which has been strong.

The shares were showing some signs of life Friday with the stock pushing higher from a recent wedge. It has the potential to close above the 21-day simple moving average (SMA) with a simultaneous bullish crossover in the Full Stochastics indicator. Our MACD and parabolic stop-and-reverse are already in bullish territory.

I’m looking for a test of the 50-day simple moving average (SMA) over the next two weeks.

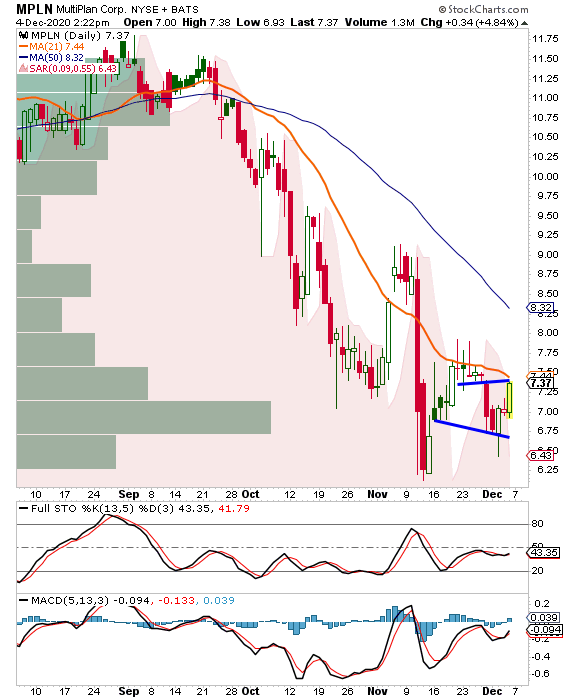

Lastly, is my seemingly never-ending waiting for MultiPlan (MPLN) to come back to life. The shares are pushing back toward the important $7.50 level. This is the closing area of the initial bounces after the company was targeted by a short-seller report. We have the Full Stochastics, PSAR, and MACD that were all setup for a bullish crossover Friday.

As the stock closed above $7.50, this one also looks poised to test the 50-day simple moving average next week with a possible longer move back towards $9.50.

These are three I’m watching for breakout confirmation to play on the long side early next week.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.