Editor’s Note: This article is a part of a series on investing advice for recent college graduates, drawing on expertise from financial professionals, university faculty and of course, InvestorPlace’s very own analysts and writers. Read more “Money Moves for Recent Grads” here and check out Top Grad Stocks 2021 for our best stocks to buy for new graduates. Source: … [Read more...] about Retirement Funds for Rookies: Everything New Grads Need To Know

Roth IRA

Life Insurance vs IRA • What’s the Difference? • Benzinga

Choosing between investing money into a retirement account or a life insurance policy can be a tough decision. Our guide to life insurance vs. IRA retirement savings will help you decide where you should put your money. What is Life Insurance? Life insurance is an agreement between a policy holder and an insurance company to provide a death benefit to a designated … [Read more...] about Life Insurance vs IRA • What’s the Difference? • Benzinga

Should I Use a Roth IRA to Pay for College?

Families spent an average of $30,017 on college during the 2019-2020 academic year, according to the Sallie Mae report How America Pays for College. More than one-third of families used a college savings account such as a 529, which is up from 21% in 2018-2019. If you look closer at the report, you'll also see a list of other ways parents and students pay for college. A … [Read more...] about Should I Use a Roth IRA to Pay for College?

Saving For College And On Your Taxes: Understanding 529 Plans

Any adult may open a 529 Plan for any named beneficiary—you do not have to be the parent or ... [+] grandparent of the person named. getty May 29 is National 529 College Savings Plan Day! Do you know what a 529 plan is? Do you know how to use it? Let me explain. What is it? 529 College Plans were initially created to help families save money for higher … [Read more...] about Saving For College And On Your Taxes: Understanding 529 Plans

The Retiree's Dividend Portfolio – Jane's April Update: Monthly Roth IRA Dividends Reach All-Time High – Seeking Alpha

The Retiree's Dividend Portfolio - Jane's April Update: Monthly Roth IRA Dividends Reach All-Time High Seeking Alpha … [Read more...] about The Retiree's Dividend Portfolio – Jane's April Update: Monthly Roth IRA Dividends Reach All-Time High – Seeking Alpha

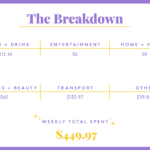

A Week In Denver, CO, On A $119,400 Joint Income

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.Today: a middle school teacher who has a joint income of $119,400 and spends some of her money this week on wind chimes.Occupation: Middle School TeacherIndustry: … [Read more...] about A Week In Denver, CO, On A $119,400 Joint Income

What Is a SEP IRA?

If you own a business and want to save for retirement, consider setting up a simplified employee pension individual retirement account. A SEP IRA can help both you and your employees set aside funds for the future. However, make sure your company and your long-term goals are a good match for this type of account.There are several factors you'll want to consider before opening a … [Read more...] about What Is a SEP IRA?

Should You Choose A 529 Or A Roth Child IRA?

getty For several decades, parents have had the option of saving for college through 529 plans. Although Section 529 of the Internal Revenue Code didn’t appear until 1996, the first such plan is generally recognized as the Michigan Education Trust, which began in 1986. While based in part on Federal tax law, each state must sponsor its own 529 plan. Making decisions … [Read more...] about Should You Choose A 529 Or A Roth Child IRA?

When Not to Rollover Your 401(k)

By Danielle Harrison, CFPAfter leaving an employer, you will be faced with the decision of what to do with the money saved in your employer-sponsored retirement plan such as a 401(k) or 403(b). Your first instinct is likely to roll the funds into an IRA, but it is important to take a step back and look at the available options and your particular situation before making any … [Read more...] about When Not to Rollover Your 401(k)

5 Ways I’m Preparing for the Stock Market Bubble to Burst

Stock market crashes are expected, yet totally unpredictable. Historically, a stock market correction (a drop of 10% or more) happens about once every 1.8 years. While we know that another crash is coming, we also have no idea when it will happen. Fortunately, there are plenty of moves you can make to prepare. Here are five ways I'm safeguarding my finances for when the bubble … [Read more...] about 5 Ways I’m Preparing for the Stock Market Bubble to Burst