When unexpected expenses pile up and the emergency fund has been drained, where can you turn for money? For many people their biggest stash of savings is hidden away in tax-advantaged retirement accounts. © JGI/Jamie Grill/Getty Images 8 ways to take penalty-free withdrawals from your IRA or 401(k) Unfortunately, the government imposes a 10 percent penalty on any … [Read more...] about 8 ways to take penalty-free withdrawals from your IRA or 401(k)

Roth IRA

Will you owe taxes on interest from savings accounts?

Since the IRS considers interest as taxable income, you will likely owe taxes on interest from your savings account. (iStock) Your savings account is an essential part of your overall savings plan. For one, your savings is an investment — each time you deposit money into your savings account, you're actively investing in your financial security and well-being. Your savings are … [Read more...] about Will you owe taxes on interest from savings accounts?

Ask the Hammer: Should I Withdraw Money from My Roth IRA or Traditional IRA to Pay Taxes?

I am 61 years young and in 2020 I made an uneducated movement from my traditional IRA into my Roth IRA. Now I am facing more or less $40,000 in taxes. I do not have a job at the moment. I am divorced and do not receive any pension or alimony. So, the only way I can pay those taxes is by retrieving the amount from either my traditional IRA or the Roth IRA. From which one is … [Read more...] about Ask the Hammer: Should I Withdraw Money from My Roth IRA or Traditional IRA to Pay Taxes?

In-Plan Roth Conversion: Do’s and Don’ts

Does your employer offer both a traditional and Roth 401(k) and does your employer allow you the opportunity to do what’s called an in-plan Roth conversion? That’s a tactic whereby you would convert some or all the money in your traditional 401(k) into your Roth 401(k). If so, it’s important to know the do’s and don’ts?It’s worth noting that employer-sponsored retirement plans … [Read more...] about In-Plan Roth Conversion: Do’s and Don’ts

The IRS is watching: Are you saving too much for retirement?

This article is reprinted by permission from NerdWallet. Many Americans don’t save enough for retirement, but it’s entirely possible to save too much — at least according to the IRS. Tax laws limit how much you’re allowed to contribute to retirement accounts, and excess contributions can be penalized. Uncle Sam doesn’t want you to leave the money in the account too long, … [Read more...] about The IRS is watching: Are you saving too much for retirement?

Roth 401(k) vs. 401(k): Which one is better for you? | News

The 401(k) plan comes in two varieties — the Roth 401(k) and the traditional 401(k). Each offers a different type of tax advantage, and choosing the right plan is one of the biggest questions workers have about their 401(k). It can be a surprisingly complicated choice, but many experts prefer the Roth 401(k) because you’ll never pay taxes again on withdrawals.However, the … [Read more...] about Roth 401(k) vs. 401(k): Which one is better for you? | News

How to know if you should open a Roth IRA

Saving for retirement independently is essential. Without savings, you might really struggle to pay your bills as a senior if Social Security is your only income source -- especially since the average recipient today only collects around $18,500 a year, and that's not a lot of money to live on.But where should you house the money you save? There are different retirement plans … [Read more...] about How to know if you should open a Roth IRA

Teen Savings Vehicle – Your Child Could Retire a Multi-Millionaire

By Christopher CarosaHere’s the deal. For all the talk of fancy and complicated ways to help your child save, there’s one simple vehicle that everyone seems to ignore. That’s too bad because by exercising a conscious discipline for only a few short years, your teenager can retire with a $2.5 million head start.Christopher CarosaIn fact, it’s so easy, a child can do it. … [Read more...] about Teen Savings Vehicle – Your Child Could Retire a Multi-Millionaire

I currently attend community college and am planning to go to law school. Should I continue to save for retirement?

Stock image Dear Dave, I’m 19 and I’m about to finish up my first year of community college. I have enough money through scholarships and help from my family to get a bachelor’s degree. After that, I plan on going to law school and cash flowing that part of my education. I’ve already started a Roth IRA with money I’ve made working, but I’m wondering if I should continue … [Read more...] about I currently attend community college and am planning to go to law school. Should I continue to save for retirement?

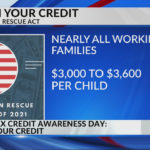

Tax experts provide advice for families that qualify for Child Tax Credit

MEMPHIS, Tenn. — Starting next month, about 36 million American families will start receiving monthly checks from the IRS. What to know about child tax credits ahead of July 15th It’s part of the expanded Child Tax Credit. WREG-TV talked with several tax experts about how you should spend the money, and why it could create headaches for some families. If … [Read more...] about Tax experts provide advice for families that qualify for Child Tax Credit