August 5, 2021 6 min read This story originally appeared on MarketBeat In September 2000, the Employee Benefit Research Institute (EBRI) with the Retirement Security Research Center (RSRC) surveyed 2,000 individuals, aged 62 to 75. Of these individuals, 97% reported being retired (80% … [Read more...] about Retirees Wish They’d Saved More. Will You Be in the Same Boat?

Roth IRA

Research Scientist in Bay Area, CA — Money Diary

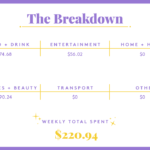

Occupation: Research ScientistIndustry: BiotechAge: 30Location: Bay Area, CASalary: $99,000Net Worth: ~$85,000 ($45,000 savings + $30,000 Roth IRA + $19,000 Roth 401k + $4,000 brokerage account - debt) I don't know the value of my car so that's not included. I also have stock options but none have vested.Debt: ~$13,000 (car loan)Paycheck Amount (2x/month): $2,068.33 (after … [Read more...] about Research Scientist in Bay Area, CA — Money Diary

I Inherited an IRA. Now What?

Woman with laptop working in home office. Getty Images You’ve inherited an individual retirement account, or IRA. Now what?Unfortunately, you cannot leave the money in the original IRA opened by the deceased person. There are several ways you can receive the funds after inheriting either a traditional or Roth IRA, but your options will be narrowed by a few factors. Failure to … [Read more...] about I Inherited an IRA. Now What?

What Gen Z and Millennials Need to Know About How Retirement Planning Has Changed

retirement-mythsGetty Images According to a recent survey by Credit Karma, social media has a tight grip on financial literacy education in 2021—with 56 percent of Gen Z and millennials saying that they intentionally use online resources such as Instagram, Facebook, Snapchat and Tik Tok to source personal finance advice. "When it comes to the parts of our financial lives that … [Read more...] about What Gen Z and Millennials Need to Know About How Retirement Planning Has Changed

LIZ WESTON: 4 cash-raising pitfalls (and better options) [Column] | Business

If you've got more bills than money, the usual advice is to trim expenses and find additional income. But some ways of raising cash can be a lot more expensive than others. Here are four that should be avoided, if possible, and what to consider instead.BEWARE RAIDING A RETIREMENT PLANA big chunk of the money contributed to retirement plans leaks out as hardship withdrawals, … [Read more...] about LIZ WESTON: 4 cash-raising pitfalls (and better options) [Column] | Business

Are Higher Taxes On The Way? Having A Strategy Is Essential

By Reid Johnson The current administration has already spent $1.9 trillion on COVID relief and has plans to spend trillions more on infrastructure projects, Medicaid expansion, education, and climate investments. In order to fund these projects, the administration has proposed several tax-increasing measures on corporations and wealthy individuals. Under his plans, the … [Read more...] about Are Higher Taxes On The Way? Having A Strategy Is Essential

A Week In Bay Area, CA, On A $99,000 Salary

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.Today: a research scientist who makes $99,000 per year and spends some of her money this week on Persepolis by Marjane Satrapi.Occupation: Research ScientistIndustry: … [Read more...] about A Week In Bay Area, CA, On A $99,000 Salary

I Used $23,000 From Renters Insurance to Pay Off My Student Loans

When you buy through our links, Insider may earn an affiliate commission. Learn more.In May 2018, I graduated with my bachelor's degree from the University at Albany (SUNY) and was ready to find a job. My first thought, once the high of completing undergrad had passed, was, "How will I pay off my student loans?" as I'm sure is the case for many recent grads.When I started off … [Read more...] about I Used $23,000 From Renters Insurance to Pay Off My Student Loans

Seniors Are Losing Millions to Taxes on Social Security

The Social Security system has proven to be one of the most popular government programs in the United States. By sending out a monthly cash payment to retired Americans, the program has served as a reliable source of income for seniors who were not able to save for themselves during their careers. Recent polls have suggested that four in five Americans continue to support the … [Read more...] about Seniors Are Losing Millions to Taxes on Social Security

Four cash-raising pitfalls (and better options) | Business

NerdWalletIf you’ve got more bills than money, the usual advice is to trim expenses and find additional income. But some ways of raising cash can be a lot more expensive than others. Here are four that should be avoided, if possible, and what to consider instead.BEWARE RAIDING A RETIREMENT PLANA big chunk of the money contributed to retirement plans leaks out as hardship … [Read more...] about Four cash-raising pitfalls (and better options) | Business