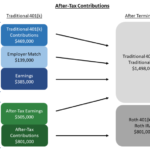

If your employer makes matching contributions, their payments will automatically stop when yours do. So, if you reach your $18,500 before the last paycheck of the year, your employer matching payments will stop before the end of the year and you may not get your full match. Which retirement account should I use first? Key Takeaways Managing cash flows and withdrawals in … [Read more...] about Is it better to max out 401k or Roth IRA?

Roth 401k

What is the main difference between a 401k and a Roth 401k?

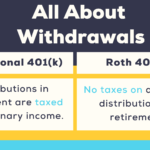

Can I withdraw Roth 401k anytime? Early withdrawals. If you've owned a Roth IRA for at least five years, you can withdraw contributions tax-free before age 59½ (but not earnings, in most cases you'll pay a 10% tax penalty). Can I withdraw my contributions from a Roth 401 K without penalty? Contributions to a Roth IRA can be withdrawn at any time, and after the account … [Read more...] about What is the main difference between a 401k and a Roth 401k?

Is Roth 401k better than 401k?

A Roth IRA is good for taxpayers who expect to be in a higher tax bracket during retirement. You can pay taxes today when your tax rate is low, then enjoy tax-free withdrawals when your tax rate is high in retirement. Should I split my 401k contribution between Roth and traditional? In most cases, your tax situation should dictate which type of 401(k) you should choose. … [Read more...] about Is Roth 401k better than 401k?

Roth 401k

What should you do with your 401k when you retire? In general, retirees with a 401(k) have the following options – leave your money in the plan until you reach the required minimum distribution (RMD) age, convert the account to an Individual Retirement Account (IRA), or start payouts through lump sum distributions, installment payments, or. .. What does the average person … [Read more...] about Roth 401k