How do you pay taxes on a Roth conversion? The conversion will place $20,000 of ordinary income on line 4b of your 2022 Form 1040. If you hold 15%, $17,000 goes to your Roth IRA account and $3,000 goes to Uncle Sam. Instead you can choose not to withhold taxes and pay $3,000 directly to the Treasury from a taxable (non-retirement) account. How do I avoid taxes on a Roth … [Read more...] about Should I convert my 401k to Roth 401k?

Roth 401k

Is 40 too old to start a Roth IRA?

What happens if I max out my Roth IRA? By increasing your contributions each year and paying tax at your current tax rate, you eliminate the possibility of paying an even higher rate when you start withdrawing funds. Just as you diversify your investments, this move diversifies your future tax exposure. Is it a good idea to max out your Roth IRA? Maxing out your Roth IRA … [Read more...] about Is 40 too old to start a Roth IRA?

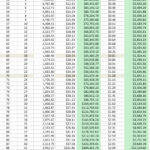

How much does a Roth IRA grow in 10 years?

How much do I need in a Roth IRA to retire? As a rough guide, for every $100 you withdraw each month, you need $30,000 in your IRA. If you withdraw $1,000, for example, this is 10 times 100, so you need 10 times $30,000, or $300,000 in the IRA. At what age does a Roth IRA not make sense? Unlike traditional IRAs, where contributions aren't allowed after age 70 ½, you're … [Read more...] about How much does a Roth IRA grow in 10 years?

At what age does a Roth IRA not make sense?

Is a Roth IRA enough to retire on? So, if you start early and save carefully, your Roth IRA will be enough to afford a modest retirement, but if you start saving late or get used to a higher standard of living before you retire, you need to think about saving more money through additional Investment accounts. Can I withdraw at 50 with a Roth IRA? But even if you're … [Read more...] about At what age does a Roth IRA not make sense?

What is the downside of a Roth 401k?

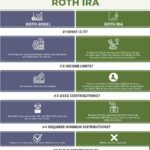

Why shouldn't I do a Roth? One important disadvantage: Roth IRA contributions are made on an after-tax basis, meaning no taxes are deducted in the year of the contribution. Another drawback is not paying the account income until at least five years have passed since the first contribution. Why bother with a Roth IRA? Contributing to a Roth IRA is more tax efficient than … [Read more...] about What is the downside of a Roth 401k?

Can you withdraw Roth 401k without penalty?

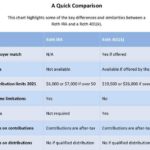

Is it better to do a Roth 401k or traditional? If you expect to be in a lower tax bracket in retirement, a traditional 401(k) may make more sense than a Roth account. But if you're in a low-tax bracket now and think you'll be in a higher tax bracket when you retire, a Roth 401(k) might be a better option. Should I switch from a traditional to a Roth 401k? “The main … [Read more...] about Can you withdraw Roth 401k without penalty?

What is the 5 year rule for Roth 401k?

Does spouse automatically inherit 401k? If you're married, federal law says your spouse* is automatically a beneficiary of your 401k or other retirement plan, period. You should still fill out the beneficiary form with your spouse's name, for the record. If you want to name a beneficiary other than your spouse, your spouse must sign a waiver. . Can you withdraw early … [Read more...] about What is the 5 year rule for Roth 401k?

Do you pay taxes on Roth 401k?

What happens to my Roth 401k when I quit? Key Street Shops. If you leave your job, you can still keep your Roth 401(k) account with your old employer. In some cases, you can transfer your Roth 401(k) to a new one with your new employer. You can also choose to roll your Roth 401(k) into a Roth IRA. Can I withdraw Roth 401k contributions at any time? Another difference is … [Read more...] about Do you pay taxes on Roth 401k?

How do I cash out my Roth 401k?

If you are fired, you lose your right to any unvested funds (employee contributions) in your 401(k). You are fully vested in your contributions and cannot lose this portion of your 401(k). Should I max out my Roth 401k? Invest as much as you can—at least 15% of your pretax income—financial planners recommend. The rule of thumb for retirement savings is that you should … [Read more...] about How do I cash out my Roth 401k?

Can I use my Roth 401k to buy a house?

Can I take money out of my IRA to buy investment property? The IRS offers an exception that allows you to withdraw funds from your IRA to fund a home purchase. You can withdraw up to $10,000 to buy, build, or rebuild your first home. These withdrawals will not incur a 10% penalty, but depending on the type of IRA you have, they may be subject to income tax. What are the … [Read more...] about Can I use my Roth 401k to buy a house?