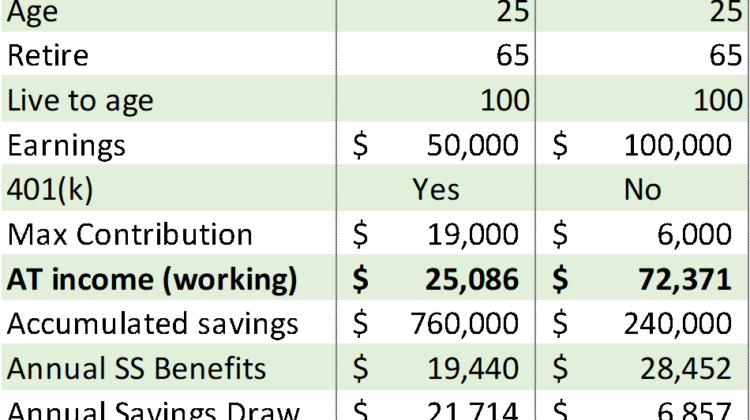

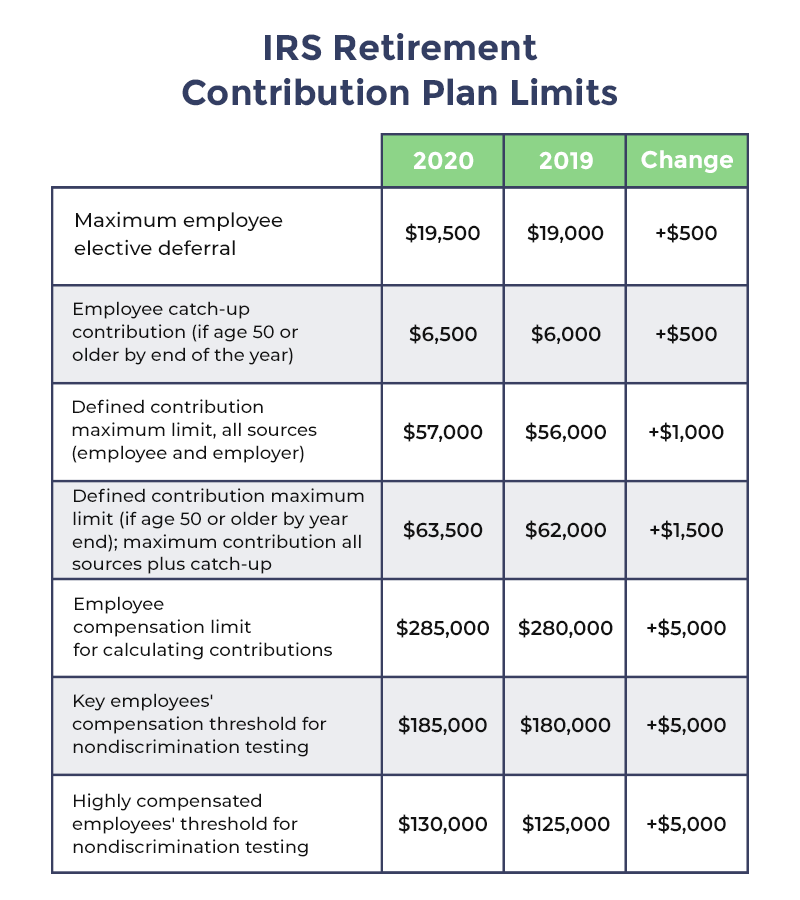

The maximum salary deferral amount you can contribute in 2019 to a 401 (k) is the less than 100% of salary or $ 19,000. However, some 401 (k) plans may limit your contributions to a lower amount, and in such cases, IRS rules may limit the contribution for highly paid employees.

What does the IRS consider a highly compensated employee?

For the previous year, he received more than $ 125,000 from the business (if the previous year is 2019, 130,000 if the previous year is 2020 or 2021, and $ 135,000 if the previous year is 2022), and , if the employer so desires, was in the wealthiest 20% of employees when ranked by salary.

What is considered a highly paid employee? An employee will be a pay-based HCE if the employee’s annual pay in the reporting year was $ 135,000 or more (if the previous year is 2021). The plan may limit the number of HCEs based on pay by choosing in the plan document to use the “highest paid group elections” as explained below.

What is considered a highly compensated employee for 2022?

For the plan year 2022, an employee who earned more than $ 135,000 in 2021 is an HCE.

Who is a highly compensated employee in 2022?

4 For the plan year 2022, an employee earning more than $ 130,000 in 2021 is an HCE. For the plan year 2023, an employee earning more than $ 135,000 in 2022 is an HCE.

How is 2022 HCE calculated?

An employee is an HCE if they are an employee during the initial plan year and their pay during the 12-month period immediately preceding the plan year (base year) exceeded the dollar limit in Section 414 (q ) (1) of the IRC) for the reference year.

What is considered a highly compensated employee for 2021?

The IRS defines a highly paid employee as someone who meets one of the following two criteria: A worker who has received $ 130,000 or more in compensation from the employer sponsoring their 401 (k) plan in 2021. For 2022, this threshold rises to $ 135,000.

What is the IRS HCE limit for 2021?

| Other | 2022 | 2021 |

|---|---|---|

| HCE threshold | 135,000 | 130,000 |

| Benefit limits defined | 245,000 | 230,000 |

| Key employee | 200,000 | 185,000 |

| 457 Elective postponements | 20,500 | 19,500 |

How much can a highly compensated employee contribute to 401k in 2021?

401 (k) Contribution Limits for HCEs The 401 (k) contribution limits for 2021 are $ 19,500 (or $ 20,500 in 2022) or $ 26,000 (or $ 27,000 in 2022) if you are 50 or older. HCEs may or may not be able to contribute up to these limits, depending on how much the company’s non-HCEs contribute to their accounts.

What happens if my 401k contributions exceed the limit?

What happens if you exceed the contribution limit of 401k? If you exceed the contribution limit of 401k, you will have to pay a 10% penalty for the early withdrawal, as you have to remove the funds. The funds will be counted as income and those extra contributions will cost you at tax time.

Will my 401k automatically stop at the limit? If your employer is making matching contributions, their payments will stop automatically when yours does. So, if you hit your $ 18,500 before your last paycheck of the year, your employer’s top-up payments will cease before the end of the year and you may not get the full amount.

What do I do if I contributed too much to my 401k?

Get a new W-2 and pay your taxes. The excess contribution returned will be added to the total taxable salary for the previous year, then a modified W-2 will be issued. Your tax will increase (or your refund will decrease) from the excess contribution amount of 401 (k). Manage excess earnings.

What happens if you max out 401k before end of year?

Maximizing your 401k at the start of the year can cost you a lot of money if you have an employer match. Without the match, front loading of your 401k is worth considering. It is a common financial advice to reach the maximum of 401k. Putting as much as possible into a tax relief account is just smart financial planning.

What happens when you reach your 401k contribution limit?

The bad news. You will end up paying taxes twice on the amount over the limit if the 401 (k) excess contribution is not repaid to you by April 15th. You’ll be taxed first in the year you overpayed and again in the year the correction occurs, Appleby says.

How much can an employer contribute to a 401k in 2022?

2022 401 (k) Employer Contribution Limit The overall contribution limit to 401 (k) plans, including employer and employee deposits, is 100% of the participant’s compensation or $ 61,000 , whichever is lower.

How much can a highly paid employee contribute to 401k 2022? 401 (k) Contribution Limits for Highly Paid Employees For 2021, a single 401 (k) participant can contribute up to $ 19,500. For 2022, a single 401 (k) participant can earn up to $ 20,500 in contributions.

What are the 401k contribution limits for 2022?

401 (k) plans The annual 401 (k) plan employee elective deferral limit increased to $ 20,500 in 2022. Employees aged 50 and over can contribute up to an additional $ 6,500 for a total of $ 27,000.

What is the catch-up contribution for 2022?

The 401 (k) contribution limit for 2022 is $ 20,500 and the payback grant allows workers to add an additional $ 6,500 â for a grand total of $ 27,000 each year.

What is 2022 401k max with catch-up?

Workers under the age of 50 can contribute up to $ 20,500 to a 401 (k) in 2022. That’s a $ 1,000 increase from the $ 19,500 limit in 2021. If you’re 50 and older, you can add $ 6,500 extra per year in “payback” contributions, bringing your 401 (k) total contributions for 2022 to $ 27,000.

What is the maximum 401k contribution by employer?

The employer’s 401 (k) maximum contribution limit is much more liberal. Overall, the maximum contribution that can be contributed to your 401 (k) plan between you and your employer is $ 61,000 in 2022, compared to $ 58,000 in 2021. also provide an additional $ 6,500 recovery fee.)

What is the maximum 401,000 employer contribution for 2020? The 401 (k) contribution limit increases to $ 19,500 for 2020; recovery limit rises to $ 6,500 | Revenue Agency.

Sources :