Does 401k Contribution stop at limit?

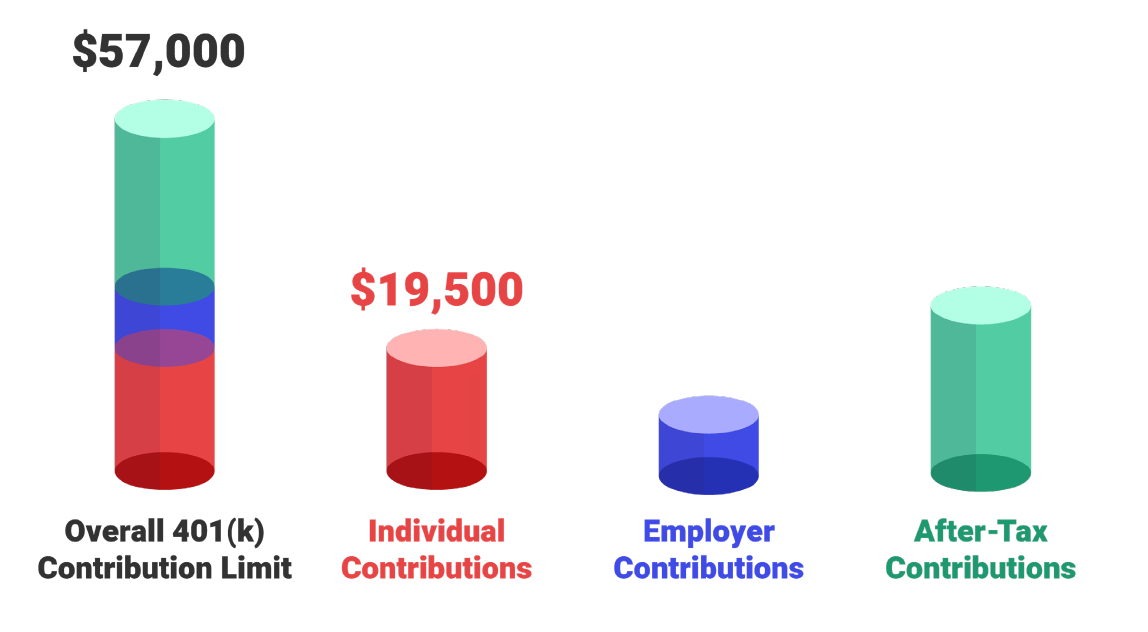

For 2021, the maximum allowable 401(k) contribution is $19,500 per year (rising to $20,500 in 2022). If you’ve contributed too much to your 401(k) plan—that is, you’ve contributed more than the annual maximum set by the IRS—you should notify your employer or plan administrator immediately.

Do 401k contributions automatically stop when you hit the limit? If your employer makes matching contributions, their payments will automatically stop when you do so. So if you reach your $18,500 before your last paycheck of the year, your employer’s payments will stop before the end of the year and you may not get your full amount.

What happens after you max out 401k for the year?

Try to max out your 401(k) every year and take advantage of any match your employer offers. Contributions are tax-deductible in the year you make them, which can leave you with more money to save or invest. Once you’ve maxed out your 401(k), consider putting your remaining money into an IRA, HSA, annuity, or taxable account.

When should you stop maxing out 401k?

Some personal finance experts suggest saving at least 15% of your annual income for retirement during your working career. 2 Chances are you could comfortably use the $20,500 limit if you earn at least $130,000 in 2022 and manage your current finances well.

What happens if you max out 401k before end of year?

Maxing out your 401k at the beginning of the year can cost you a lot of money if you agree with your employer. Without a match, it’s worth considering front-loading your 401k. Common financial advice is to max out your 401k. Putting as much as possible into a tax-advantaged account is just smart financial planning.

What happens when you max out your 401k?

If you’ve maxed out your 401(k) or 403(b), take a look at an Individual Retirement Account (IRA) next time. Wherever you are in life, an IRA can help supplement your workplace plan.

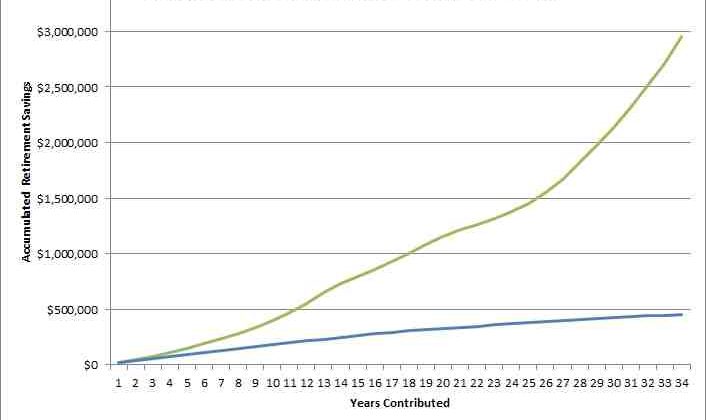

How much money should be in my 401k at age 30?

Ages 25 to 34 By age 30, Fidelity recommends stashing away the equivalent of a year’s salary in your workplace retirement plan. So if you earn $50,000, your 401(k) balance should be $50,000 by the time you reach 30.

How much should I have in my 401k by 50?

By age 50, you should aim to have at least six times your salary saved for retirement to put you on track to retire at age 67, according to calculations by retirement plan provider Fidelity. If you earn $50,000 a year, you should aim to put away $300,000 by 50.

What happens if you max out 401k before end of year?

Maxing out your 401k at the beginning of the year can cost you a lot of money if you agree with your employer. Without a match, it’s worth considering front-loading your 401k. Common financial advice is to max out your 401k. Putting as much as possible into a tax-advantaged account is just smart financial planning.

What happens to your employer if you max out your 401k? Because once you max out your 401k plan, you have to stop contributing. And when you stop contributing, your employer has no matching contributions.

What happens if I max out my 401k early in the year?

It’s never too early to set up a 401(k), but there’s no real benefit to maxing out your contributions as quickly as possible when your 401(k) has an employer match. By maxing out your annual 401(k) contribution at the beginning of the year, you’d miss out on the total employer match.

Can you max out 401k all at once?

According to the IRS, you can contribute up to $20,500 to your 401(k) for 2022. By comparison, the contribution limit for 2021 was $19,500. This number only counts the amount you defer from your paycheck — your employer’s contributions don’t count toward this limit.

Is it a good idea to max out 401k early in the year?

There is no real benefit to maxing out your 401(k) early in the year. If your company offers an employer match, then you may not want to max out your 401(k) at the beginning of the year, because if your contributions stop due to maxing out, then the match stops as well.

Can you max out 401k in a year?

Total 401(k) plan contributions from both the employee and the employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Contributions for employees age 50 or older increase the 2021 maximum to $64,500, or a total of $67,500 in total contributions . cannot exceed 100% of the employee’s annual compensation.

How much can you max out 401k per month?

Maxing out your 401k retirement account is no easy feat. While people’s incomes and financial responsibilities vary, saving $20,500 a year translates to about $1,708 a month. That’s $854 per paycheck, if you’re paid twice a month.

Can I contribute 100% of my salary to my 401k?

The maximum amount of salary deferral you can contribute in 2019 to a 401(k) is the lesser of 100% of salary or $19,000. However, some 401(k) plans may limit your contributions to a lower amount, and in such cases, IRS rules may limit contributions for highly compensated employees.

Can I put all of my bonus in my 401 K to avoid taxes?

How can I avoid paying tax on my bonus? Your bonus will be taxed, but you can reduce the amount of your taxable income by putting some or all of it into a tax-deferred account like a 401k or IRA. However, this does not mean that you will avoid paying taxes entirely.

Should I exchange my 401k contribution for a bonus? Increase Your 401(k) Contribution You should already be contributing to your employer’s 401(k) retirement account and take full advantage of any available company matching program if available — but if you get a bonus, it’s a great opportunity to increase that contribution.

Can I contribute my entire bonus to 401k?

The short answer is yes. It may be wise to put some or all of your bonus into your 401k, depending on how much you’ve already contributed to your account at work. You want to make sure you don’t exceed the 401k contribution limit.

Should bonuses be included in 401k contributions?

401(k) contributions must be withheld from the participant’s bonus compensation, unless otherwise specified in the plan document.

Can you put entire bonus into 401k?

You can add your bonus to your 401(k) to defer paying income taxes until you withdraw the money. Depending on the size of the bonus and how much you contributed to the 401(k), you can put some or all of the bonus into the 401(k) to maximize its value.

How much of your bonus should you put in 401k?

In the example above, 10% is the sweet spot in terms of 401(k) contribution percentage, where (depending on your salary) you don’t exceed the annual IRS contribution limit before the end of the calendar year, which will also allow you to get a full employee match as well .

What percentage of your bonus should you save?

Enter: Your bonus. Smart use of your year-end bonus can include spending some on yourself, some on bills and other financial obligations, and some on savings or paying down debt, Weliver says. For starters, “It’s a good idea to take between 10 and 25 percent and use it for yourself,” he says.

How much should I contribute to my 401k from my bonus?

The IRS suggests a flat rate of 22% withholding on bonuses, and many employers follow that method. (Remember that withholdings are meant to be an estimate of how much you’ll owe at the end of the year, not the actual tax itself.)

How can I avoid paying tax on my bonus?

Bonus tax strategies

- Make a pension contribution. …

- Contribute to a Health Savings Account (HSA) …

- Delay compensation. …

- Donate to charity. …

- Pay for medical expenses. …

- Claim a non-financial bonus. …

- Additional salary vs.

Are bonuses taxed at 40 %?

A bonus is always a welcome increase in salary, but it is taxed differently than regular income. Instead of adding them to your ordinary income and taxing them at your top marginal tax rate, the IRS treats bonuses as extra wages and charges a flat 22 percent withholding rate.

Can I make my bonus tax exempt?

It is no longer possible to claim exemption from withholding on bonus income.

Should you change your 401k contribution for bonus?

Increase Your 401(k) Contribution You should already be contributing to your employer’s 401(k) retirement account and take full advantage of any available company matching program if available — but if you get a bonus, it’s a great opportunity to top it up contribution.

How much of my 401k should I contribute to my bonus? The IRS suggests a flat rate of 22% withholding on bonuses, and many employers follow that method. (Remember that arrears should be an estimate of how much you’ll owe at the end of the year, not the actual tax itself.)

Do bonuses go into 401k?

Annual bonuses are taxed as ordinary income, meaning they are subject to your normal tax bracket – they can also put you in a higher tax bracket. Also, since bonuses are distributed through your paycheck, your deductions for 401k, Medicare, and Employee Stock Purchase Plans, for example, still come out.

Can I rollover my current 401k to an IRA?

You can roll your traditional 401(k) assets into a new or existing traditional IRA. To initiate the rollover, complete the forms required by the IRA provider you choose and your 401(k) plan administrator. Money is transferred directly, either electronically or by check.

What age withdraw from 401k without penalty?

The IRS mandates that you can withdraw funds from your 401(k) without penalty only after you turn 59½, become permanently disabled, or are otherwise unable to work.

Sources :