Can I contribute to a Roth IRA if I have maxed out my 401k?

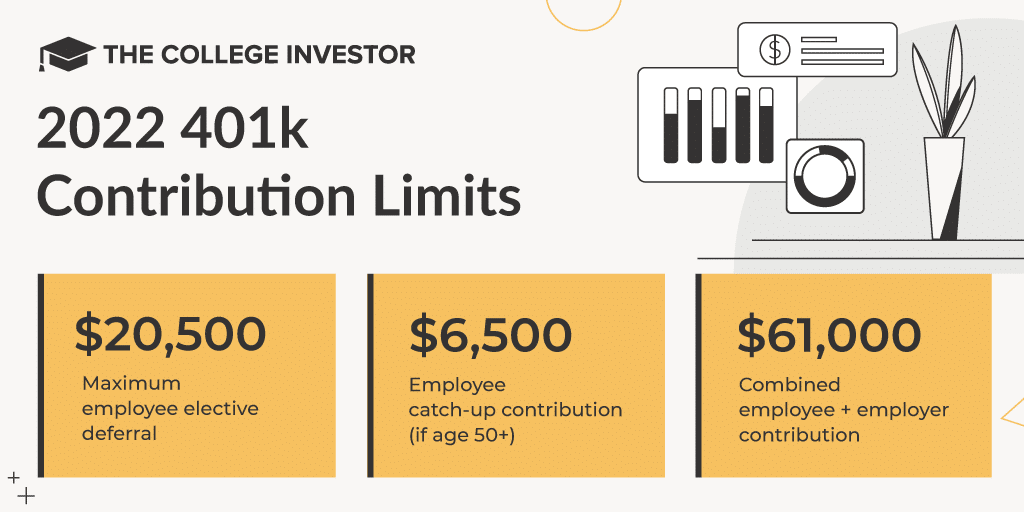

Contribution Limits For example, if you max out your 401(k) plan, including employer contributions, you can still contribute the full amount to a Roth IRA without worrying about overcontribution penalties.

Can I contribute to a Roth IRA if I reach the limit on my Roth 401k? Yes. You can contribute to both plans in the same year up to the allowed limits. However, you cannot max out your Roth and traditional individual retirement accounts (IRAs) in the same year.

Can I max out 401k and IRA in same year?

Non-cumulative limits The limits for 401(k) plan contributions and IRA contributions do not overlap. As a result, you can fully contribute to both types of plans in the same year as long as you meet the different eligibility requirements.

How much can I contribute to my 401k and IRA in 2021?

16 For 2021, the combined 401(k) contribution limits between you and employer matching funds are as follows: $58,000 if you are under age 50 (increasing to $61,000 in 2022) $64,500 if you are age 50 or older (increasing to $67,500 in 2022) 100% of your salary if it is below the dollar limits.

Can you contribute to a 401k and a Roth IRA in the same year?

You can have a 401(k) and a Roth IRA at the same time. Contributing to both is not only allowed, but can be an effective retirement savings strategy. However, there are some income and contribution limits that determine your eligibility to contribute to both types of accounts.

Should I max out my 401k before contributing to Roth IRA?

Key Points Financial planners recommend contributing as much as you can, at least 15% of your pre-tax income. The general rule of thumb for retirement savings is that you must first meet your employer’s matching contribution to your 401(k), then max out a Roth 401(k) or Roth IRA, then return to your 401(k).

Should you max out 401k before other investments?

Which should I max out first, my 401(k) or IRA? You should prioritize maxing out your 401(k), at least until you’ve maxed out the matching contributions your employer offers. You can turn your attention more aggressively toward IRA contributions after you’ve done so.

Should you max out your Roth IRA at the beginning of the year?

In fact, by maxing out your IRA in January (or at least during the first few months of the year) instead of waiting until the next year’s tax filing deadline to make a contribution from the previous year, you’re actually giving up that money. . to an additional 15 months to achieve tax-deferred compound growth.

How much can you contribute to a Roth 401k and a Roth IRA in the same year?

To see what the definition of MAGI is, see IRS Publication 590. This means that a married couple with less than $181,000 MAGI can each contribute up to $17,500 to a Roth 401(k) and up to $5,500 to a Roth IRA.

Can I contribute to a Roth IRA and a Roth 401k in same year?

Can you contribute to a 401(k) and a Roth individual retirement account (Roth IRA) in the same year? Yes. You can contribute to both plans in the same year up to the allowed limits. However, you cannot max out your Roth and traditional individual retirement accounts (IRAs) in the same year.

How much can you contribute to a 401k and a Roth IRA in the same year?

You can contribute up to $20,500 in 2022 to a 401(k) plan. If you are age 50 or older, the maximum annual contribution increases to $27,000. You can also contribute up to $6,000 to a Roth IRA in 2022. That increases to $7,000 if you’re age 50 or older.

Can you contribute $6000 to both Roth and traditional IRA?

The Bottom Line As long as you meet the eligibility requirements, like having income from work, you can contribute to both a Roth and a traditional IRA. How much you contribute to each is up to you, as long as you don’t exceed the combined annual contribution limit of $6,000 or $7,000 if you’re age 50 or older.

Can you contribute to both an IRA and a Roth IRA in the same year? Can you contribute to both a Roth IRA and a traditional IRA in the same year? Yes, you can contribute to as many types of IRAs as you like. However, opening multiple accounts does not mean you can contribute more overall: the contribution limit applies to all accounts.

Can I contribute 6k to each IRA?

IRA contribution limits increase every few years to keep up with inflation. For 2021 and 2022, people can set aside up to $6,000 per year (people over 50 can save an additional $1,000).

Can I contribute $6000 to multiple IRAs?

The contribution limit for 2021 is $6,000 for people under 50, so if you have two IRAs, you could contribute $3,000 to each. Although you won’t be able to increase your overall contributions by opening more than one IRA, there are some benefits to having multiple accounts.

Can I contribute to multiple IRAs?

There is no limit to the number of traditional individual retirement accounts, or IRAs, you can establish. However, if you establish multiple IRA accounts, you cannot contribute more than the contribution limits on all of your accounts in any given year.

Can I contribute to multiple Roth IRAs?

How many Roth IRA accounts? There is no limit to the number of IRAs you can have. You can even own multiple of the same type of IRA, which means you can have multiple Roth IRAs, SEP IRAs, and traditional IRAs. That said, increasing your number of IRA accounts doesn’t necessarily increase the amount you can contribute annually.

Can I contribute 7000 to my Roth and traditional IRA?

More in Retirement Plans For 2022, 2021, 2020, and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $6,000 ($7,000 if you’re age 50 or older), or . If less, your taxable compensation for the year.

How much can you contribute to an IRA and Roth IRA in the same year?

The combined annual contribution limit for traditional and Roth IRAs is $6,000 or $7,000 if you are age 50 or older for tax years 2021 and 2022. You can only contribute to an IRA if your contribution comes from what is considered household income. worked.

Should I contribute to both Roth and traditional IRA?

Flexibility should also be considered: a Roth IRA allows you to withdraw your contributions at any time, without paying taxes or penalties. It may make sense to contribute to both types of IRAs if you’re eligible, so you have tax-free and taxable options when you withdraw money in retirement.

How much can I contribute to my 401k and IRA in 2021?

16 For 2021, the combined 401(k) contribution limits between you and employer matching funds are as follows: $58,000 if you are under age 50 (increasing to $61,000 in 2022) $64,500 if you are age 50 or older (increasing to $67,500 in 2022) 100% of your salary if it is below the dollar limits.

What is the maximum traditional 401k contribution for 2021? Employee 401(k) contributions for the 2021 plan year will return to $19,500 with an additional $6,500 catch-up contribution allowed for those age 50 and older. But the maximum contributions from all sources (employer and employee combined) will increase by $1,000.

Can I have both IRA and 401k?

Yes, you can have both accounts and many people do. Traditional Individual Retirement Accounts (IRAs) and 401(k)s provide the benefit of tax-deferred savings for retirement. Depending on your tax situation, you may also receive a tax deduction for the amount you contribute to a 401(k) and IRA each tax year.

Can I contribute to both a 401 K and a Roth IRA?

You can have a 401(k) and a Roth IRA at the same time. Contributing to both is not only allowed, but can be an effective retirement savings strategy. However, there are some income and contribution limits that determine your eligibility to contribute to both types of accounts.

Can you contribute to a 401k and a traditional IRA in the same year?

Short answer: Yes, you can contribute to both a 401(k) and an IRA, but if your income exceeds IRS limits, you could lose one of the traditional IRA tax benefits. How it works: One of the benefits of a traditional IRA is that you can get a tax deduction for your contributions each year.

Can you contribute to a 401k and a traditional IRA in the same year?

Short answer: Yes, you can contribute to both a 401(k) and an IRA, but if your income exceeds IRS limits, you could lose one of the traditional IRA tax benefits. How it works: One of the benefits of a traditional IRA is that you can get a tax deduction for your contributions each year.

How much can I contribute to a traditional IRA if I have a 401K?

If you participate in an employer’s retirement plan, such as a 401(k), and your adjusted gross income (AGI) is equal to or less than the number in the first column for your filing status, you can make and deduct a traditional IRA contribution up to a maximum of $6,000, or $7,000 if you are age 50 or older, in…

Can I max out 401K and IRA in same year?

Non-cumulative limits The limits for 401(k) plan contributions and IRA contributions do not overlap. As a result, you can fully contribute to both types of plans in the same year as long as you meet the different eligibility requirements.

How much can I contribute to an IRA if I also have a 401k?

If you participate in an employer’s retirement plan, such as a 401(k), and your adjusted gross income (AGI) is equal to or less than the number in the first column for your filing status, you can make and deduct a traditional IRA contribution up to a maximum of $6,000, or $7,000 if you are age 50 or older, in…

Can I contribute to a 401k and an IRA at the same time?

The quick answer is yes, you can have a 401(k) and an individual retirement account (IRA) at the same time.

Can you max out both a IRA and a 401k in the same year?

The limits for 401(k) plan contributions and IRA contributions do not overlap. As a result, you can fully contribute to both types of plans in the same year as long as you meet the different eligibility requirements.

How much can a married couple contribute to an IRA in 2022?

For example, in 2022, a married couple, both age 50 and older, can contribute a total of $14,000 ($7,000 each, if there is enough earned income to support this level of contribution).

How much can a married couple contribute to a Roth IRA in 2022? If you are married filing jointly, your joint MAGI must be less than $214,000. Roth IRA annual contribution limits in 2022 are the same as traditional IRAs: $6,000 for people under age 50. $7,000 for people age 50 and older.

How much can I contribute to my IRA in 2022 over 50?

Note: For contribution limits for other retirement plans, see Retirement Topics â Contribution Limits. For 2022, 2021, 2020, and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $6,000 ($7,000 if you’re age 50 or older), or.

What is the max IRA contribution for 2022?

Highlights of Changes for 2022 The contribution limit for employees participating in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $20,500. Contribution limits to traditional and Roth IRAs remain unchanged at $6,000.

How much can a married couple contribute to an IRA in 2022?

These are the IRA limits for 2022: The IRA contribution limit is $6,000. The IRA catch-up contribution limit will continue to be $1,000 for individuals age 50 and older. 401(k) participants with income less than $78,000 ($129,000 for couples) are also eligible to make contributions to a traditional IRA.

What are the IRA contribution limits for 2022?

Highlights of Changes for 2022 The contribution limit for employees participating in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $20,500. Contribution limits to traditional and Roth IRAs remain unchanged at $6,000.

How much can I contribute to my 401k and IRA in 2022?

A 401(k) plan has a higher contribution limit than a traditional or Roth IRA: $20,500 vs. $6,000 in 2022. You can contribute more if you’re age 50 or older, and there are special rules if you participate in both types of retirement. plans

How much can I contribute to my IRA in 2022?

The maximum amount you can contribute to a traditional IRA for 2022 is $6,000 if you are under age 50. Workers age 50 and older can add an additional $1,000 per year as a “catch-up” contribution, bringing the maximum IRA contribution to $7,000.

What is the max IRA contribution for a married couple?

You and your spouse can each contribute up to $6,000 annually (for 2019) or 100% of your earned income, whichever is less, into an IRA. In 2019, married couples filing jointly can generally contribute a total of $11,000 ($5,500 per spouse), even if only one spouse had income.

How much can husband and wife contribute to IRA?

Spousal IRAs have the same annual contribution limits as any other IRA: $6,000 per person in 2021 and 2022, or $7,000 for people age 50 and older.

Can a married couple have 2 IRAs?

Like single filers, married couples can have multiple IRAs, although jointly owned retirement accounts are not allowed. You can each contribute to your own IRA, or a spouse can contribute to both accounts.

Sources :